2016 saw growth in revenues, as well as a further increase in client numbers and assets under advice and administration (AUA), both positive indicators for future performance. However, accelerated investment aimed at further enhancing IFG’s ability to serve clients and deliver further sustainable growth was a drag on earnings in addition to the well-flagged negative impact of reduced interest rates. A platform repricing initiative to be phased in will ameliorate the ongoing impact from low rates in the current year. Investment in improving the customer proposition should better position Ifg Group (LON:IFP) to benefit from an ageing population and pension freedom, while balance sheet strength supports organic and inorganic growth opportunities.

Full year results

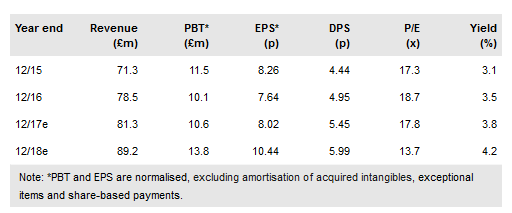

Revenue growth of 10% would have been more than 12% but for an anticipated £1.6m negative impact from lower rates. Low interest rates and accelerated investment spending at James Hay Partnership (JHP), which further stepped up in Q3, reduced adjusted operating profit by 14% with adjusted EPS more resilient (-7%). The dividend increased 11%. SIPP numbers at JHP stayed relatively flat (+1%) with slightly increased attrition offsetting organic growth. AUA grew 13%. Saunderson House (SH) grew clients (+8%) and revenues (+13%) and slightly increased operating margin (22.8%).

To read the entire report Please click on the pdf File Below