17.1%.

If you pay attention to only one number this earnings season, this should be it.

It’s the first-quarter profit gain the suits at FactSet have S&P 500 companies pegged for. And if that’s where the final number lands, it’ll be the biggest profit bonanza in 7 years!

Better yet, the S&P 500 trades at around 16.5 times its next 12 months of forecast earnings. That’s way down from 18.5 in January.

The upshot?

Ignore the terrifying headlines battling for your attention day in and day out. This market is ripe for buying. And dividend-growth stocks should top your list—as should the 7.4%-paying fund I’ll show you shortly.

Bigger Gains, Fatter Dividends

Soaring profits are driving dividend stocks’ payout ratios (or the percentage of earnings headed into your pocket as dividends) down, leaving them tons of room to drive their dividend payouts up.

Take financials, with a forecast 19.1% Q1 profit jump from a year ago, the third-biggest gain of any sector.

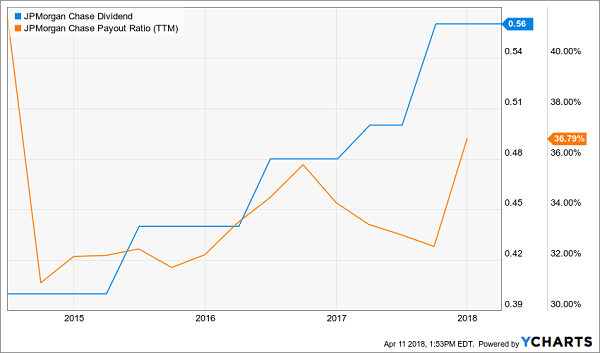

With profit growth like that, it’s no wonder many big banks are boasting low payout ratios (the percentage of earnings headed out the door as dividends) these days, like JPMorgan Chase & Co. (NYSE:JPM), whose ratio (orange line below) sits at an ultra-safe 36.8% as I write, even as management has cranked up the dividend by 40% in just the past 4 years (blue line):

An Accelerating Cash Payout

Predictably, that dividend growth has lured more folks into Morgan’s shares, driving a gain that’s demolished the S&P 500’s rise.

JPM Stock: On a Dividend High

And with rising interest rates driving up the income Morgan is pulling in on loans, there’s a lot more dividend growth to come here.

There’s one problem, though: the big banks’ rate-driven profit growth is hardly a secret. The herd has been following this story since at least December 2015, when the Fed started this rising-rate cycle, so bargains are thin on the ground today.

JPM, for example, sports a P/E ratio of 17.7, much higher than the 13.8 in April 2014. That makes another 94%+ gain in the next 4 years less likely.

Don’t worry, though. You haven’t missed out here.

The fund I’m about to show you lets you grab JPM and America’s other big banks at a discount. Plus you’ll get most of your profits in cash, rather than “paper” gains that are here today and gone tomorrow.

It’s the perfect antidote to today’s schizophrenic, tweet-driven market!

Preferred Shares: Stocks With Benefits

Before we go further, I should tell you that this under-the-radar income play (technically a closed-end fund) doesn’t hold “regular” shares of companies like JP Morgan, Bank of America (NYSE:BAC) or Citigroup (C).

Instead, it owns “preferred” shares of those companies.

Plenty of folks are confused by preferreds, but they’re really pretty simple: think of them stock/bond hybrids that can trade on an exchange, like a stock, but do so around a par value and dole out a fixed regular payment, like a bond.

Their biggest appeal is their outsized payouts. Take the JPMorgan Series Y preferred share, which yields 6.1% as I write, more than triple the current payout on JPM’s common stock!

But before you buy, let me make one thing clear: preferreds can be more sensitive to interest rates than “regular” stocks and long-term bonds, so you’re best to leave your preferred-buying to a pro.

And I’ve got just the ticket—that fund I mentioned earlier, which is throwing off a gaudy 7.4% dividend now, trades at a nice discount (more on that below) and has delivered a stellar return with much less volatility than common stocks.

Seasoned Pros, Big Profits

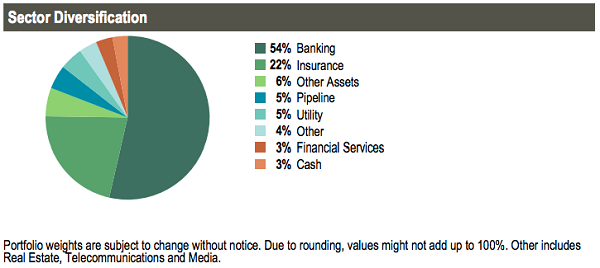

I’m talking about the Cohen & Steers Limited Duration Preferred & Income Fund (NYSE:LDP), holder of 154 different preferred shares. Financial companies and insurers are the main issuers of preferreds, as you can see in LDP’s portfolio:

Source: Cohen & Steers

Here’s where the human factor comes in: Cohen & Steers executive VP William Scapell and senior VP Elaine Zaharis-Nikas run LDP, and this duo has 47 years of experience between them.

They’ve put that expertise to good use, capping the fund’s rate risk by targeting preferreds with shorter durations and focusing on floating-rate securities, whose payouts reset higher as rates climb. The pair also uses a tightly controlled amount of leverage (around 29% of the portfolio today) to juice returns further.

The results speak for themselves. As you can see below, LDP has delivered a total return far bigger than the 2 main preferred-stock ETFs since its launch in July 2012, and its returns have accelerated since December 2015:

Rates Rise, LDP Pops

Which brings me to valuation.

This fund now trades at a 4.2% discount to net asset value (NAV, or the market value of its portfolio holdings). That’s wider than the 3.8% it’s averaged in the last 12 months. And this fund traded at a premium in the past, too.

That means we’re set for some nice downside insurance and upside here. And we’ll collect LDP’s 7.4% payout while we wait.

Revealed: How to Collect $3,333 in CASH a Month—Every Month

LDP is just one of an elite group of investments that pays dividends every month instead of making you wait a full quarter for your next payout.

If you’re not counting on your portfolio to pay your bills, monthly payouts like these are a godsend, because you can reinvest your dividends faster, giving your returns a nice boost over the long haul.

If you are leaning on your portfolio for income, so much the better! Thanks to monthly payouts like the one LDP throws off, your monthly income and your bills will precisely align, saving you a lot of time and hassle.

And LDP is just the start of the stout monthly payers I have for you today. Because I recently released my “8% Monthly Payer Portfolio,” which I’ve painstakingly crafted to let you live on dividends alone—without selling a single stock to generate extra cash—on a nest egg of $500,000.

In fact, the 19 cash machines in this portfolio (12 of which pay dividends monthly) will hand you $40,000 a year, giving you up to $3,333 every single month on a nest egg of that size.

Plus, thanks to these picks’ ridiculously low valuations, we’re looking at easy double-digit upside in the coming year, too!

I think you’ll agree that this is easily enough for many folks to retire on.

The whole incredible story is waiting for you now. Click here and I’ll GIVE you everything I have on these stocks, including their names, tickers, buy-under prices and more.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."