We are in the midst of one of the most difficult investment environments of the past 60 years. It may not seem like it, given how the market has charged upwards over the past few months, but enormous macroeconomic issues still linger in the background.

In one regard, I am a classical value investor. I seek out companies with strong fundamentals that are trading at discounts to their intrinsic values. This has proven to be an extremely effective long-term wealth creation strategy, but I’m also very cognizant that there are assumptions underlying value investment. When one of those assumptions gets undermined, what once looked like “value” can suddenly become very expensive.

There are numerous political currents that could undermine value in the next few years, including the ongoing troubles in the eurozone, Japan’s attempts to weaken its currency, and China’s fixed asset bubble. However, the one being most ignored by mainstream investors right now is the Patient Protection and Affordable Care Act, more commonly known as “Obamacare.”

The Affordable Care Act could have a destructive impact on employment, price levels, consumer spending, and overall economic growth in the United States in the upcoming years. At the very least, it will probably result in a decline in GDP growth, and at worst, could even push the US economy into outright recession in 2014.

The Affordable Care Act

There are several issues created by the ACA that I believe could have a significantly negative impact on the economy in 2014 and beyond:

(1) Imposition of higher direct taxes,

(2) Imposition of stealth (hidden) taxes,

(3) Restrictions on employment,

(4) Restrictions on high-deductible insurance plans, and

(5) Higher costs imposed on low-skilled laborers

In this article, I will focus largely on direct taxes. In Part II, I will focus on stealth taxes and the Obamacare cost-spiral. In Part III, I’ll look at impacts on employment, certain industries, and offsetting currents, such as government spending and monetary policy.

Imposition of Higher Direct Taxes

One of the more obvious ways that Obamacare could drag down economic growth is through direct taxes. This is particularly noteworthy because we’re already seeing signs that the expiration of the payroll tax cut, as part of the “fiscal cliff” deal, might be harming consumer spending. Wal-Mart (WMT) is reporting abnormally slow February sales, which have come on top of an unusually slow January. Certainly other retailers are struggling as well. If a 2% tax on middle income earners is having such a significant impact on consumer spending, imagine how the ACA, which imposes several direct and stealth taxes, could impact the economy?

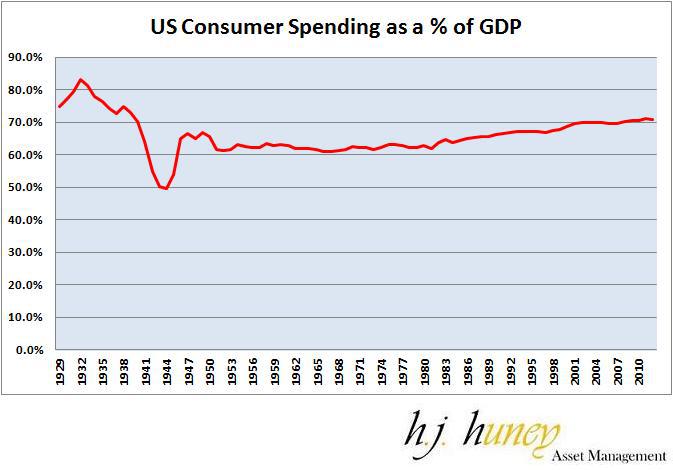

Consumer spending currently constitutes about 71% of US GDP. This means even a minor drop in spending could have huge implications. Even if spending flatlines (rather than outright declining), that could result in a sub-1% GDP growth rate.

Since 1939, there has only been one instance of declining US consumer spending. That came in 2009, at the height of our current economic malaise. I’ll restate that in another way: from 1945 – 2007, every recession in the United States was caused by a fall in private domestic investment and/or trade. If consumer spending were to decline or stay flat, it would mean that private investment would need to jump considerably to stave off recession.

The fiscal cliff tax increases are important because Obamacare is packed with similar tax increases. The ACA levies a 0.9% Medicare tax on families with incomes over $200,000, as well as a 3.8% tax on “unearned income” from high-income taxpayers. Even ignoring the other aspects of the bill, the 3.8% “unearned income” tax should almost certainly result in reduced private direct investment ["PDI"], another key component of GDP. Historically, there’s a high correlation between tax increases and drops in PDI. During the Great Depression, we saw two instances of this.

Great Depression Tax Increases

Herbert Hoover signed the Revenue Act of 1932, which implemented arguably the largest peacetime tax increase in American history. It’s often noted that it raised the top rate from 25% to 63%, but more broadly, it raised taxes significantly on every single American, even doubling the rates for many middle income individuals. It also introduced several new excise taxes, which are often overlooked by modern observers. To make matters worse, these taxes were implemented immediately for the 1932 tax year, rather than being phased in gradually during future years.

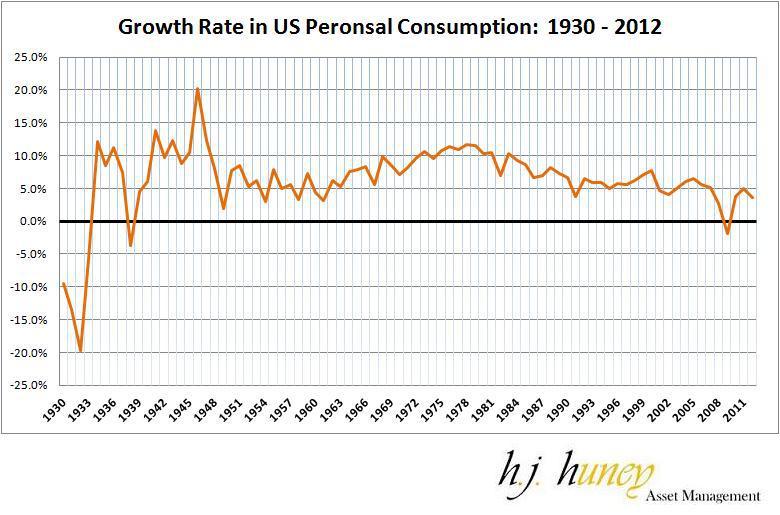

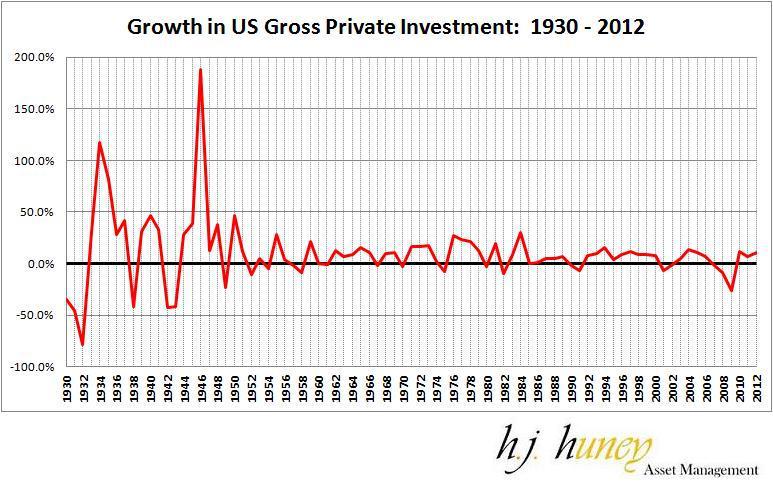

The result was that gross private domestic investment fell 78% in one year; the single largest decline in the data series, which dates back to 1929. Moreover, consumer spending fell 20%; also the largest decline in the series. For comparative purposes, in 2009, PDI fell 26% and consumer spending fell a mere 1.9%.

In spite of the disastrous results of the 1932 tax increases, Roosevelt implemented several more tax increases between 1935 and 1938, with more of an eye on “soaking the rich.” While not quite as dramatic as the Hoover tax increases, the Roosevelt taxes led to consumer spending falling 3.7%. This might not be as huge as the 20% fall in 1932, but it’s still one of the largest declines in the data series. More ominously, PDI fell 34% in one year and was the primary driver pushing the US back into recession.

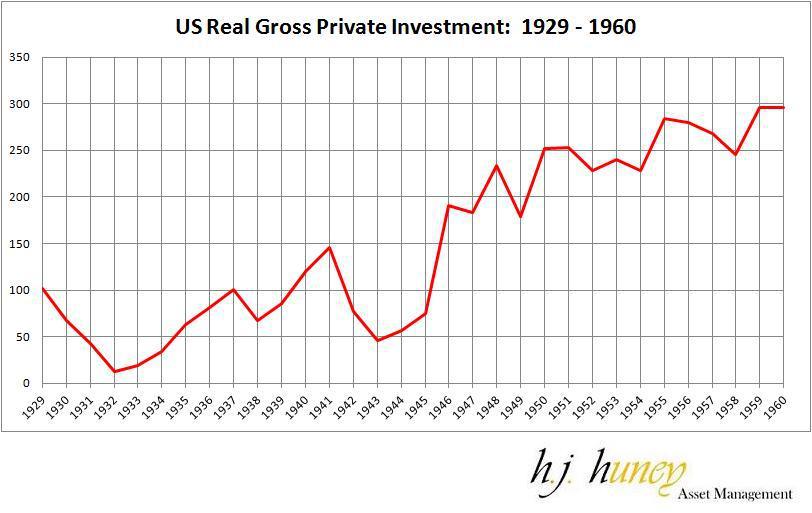

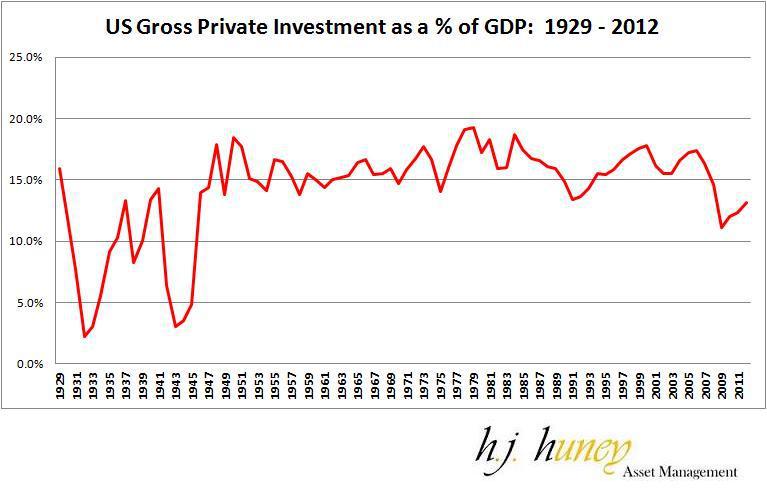

If the chart above is ugly, the charts below are even uglier. In real terms, PDI did not hit its 1929 levels again until World War II, and even that was fleeting. It took till 1946 till PDI sustainably stayed above the 1929 mark. In essence, we had something close to a 17-year black hole for investment. No wonder unemployment was so astronomically high in the Great Depression.

Also, it’s interesting to take a look at PDI as a percentage of GDP. From 1946 to 2008, we saw a “normal” range of private investment take form at 14% – 20% of GDP. After Hoover’s 1932 tax increases, PDI fell all the way to 2.2% of GDP. It steadily rose for a few years, before plunging again in 1938 to 8.2%.

All this is to say, be wary of tax increases that could negatively impact private investment and consumer spending. They could have a larger effect on the economy than people are anticipating.

Etcetra

Other direct taxes in the ACA include an annual fee on health insurance providers, an excise tax on so-called “luxury” plans, fees on manufacturers of branded drugs, and the increasingly controversial 2.3% excise tax on medical device makers. Overall, there are a lot of new taxes being implemented within the next 12 months. If the Great Depression should have taught us anything, it’s that these higher taxes could adversely impact economic growth more than we expect.

Conclusions

If the fiscal cliff tax increases are already putting a dent in consumer spending, it stands to reason that the tax increases embedded in the Affordable Care Act could also create an additional hit to the economy.

The Federal Reserve is forecasting 3.0% – 3.5% GDP growth for 2014. The CBO is even more unrealistic, forecasting 3.4% real GDP growth in 2014, and 3.6% average real GDP growth from 2015 – 2018. These estimates seem extremely unlikely to be met.

While I can’t say for certain how much the ACA’s tax increases will harm the economy, I’d wager to guess we’ll see sub-2% GDP growth in 2014, if not outright recession. For this reason, it makes sense for investors to proceed with caution.

In my upcoming articles, I will examine an even larger issue with the Affordable Care Act: stealth taxes. I’ll also look at a probable cost-spiral, the ACA’s impacts on particular sectors of the economy, and offsetting factors, such as government spending and monetary policy. Finally, I’ll look at the investment implications and how the ACA ties in with my own investment theses.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How Obamacare Could Harm Economic Growth

Published 03/04/2013, 01:37 AM

Updated 07/09/2023, 06:31 AM

How Obamacare Could Harm Economic Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.