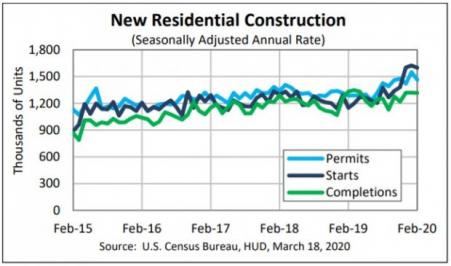

The U.S. housing starts took a step back in February after surging for trailing four months, thanks to sharp decline in the construction of multifamily housing units. Building permits also tumbled from 13-year high numbers reported in January. Nonetheless, both the metrics came ahead of analysts’ expectation by 6.3% and 1.5%, respectively.

Let’s delve into the numbers to get a clear picture of the current market condition.

Key Takeaways

On Feb 18, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly reported that housing starts fell 1.5% to a seasonally adjusted annual rate of 1.599 million units in February from the previous month’s revised 1.624 million units. A 6.7% rise in single-family housing starts was overshadowed by a drop of 17% in the multi-family homebuilding units.

In February, privately-owned housing starts fell 41.4% and 18.2% from January levels in Northeast and West, respectively. However, the metric increased in the Midwest and South regions, by 16.7% and 15.2%, respectively.

Building permits for the said month also dropped 5.5% to 1.464 million units from January’s revised 1.550 million units. Single-family authorizations inched up 1.7%, which was more than offset by 18.3% decline in multi-family segment.

Both the metrics rallied 39.2% and 13.8% from year-ago period’s figure, respectively.

U.S. Housing Trends to Struggle Despite Solid Fundamentals

Post torrid 2018 market conditions, the U.S. homebuilding industry strengthened in 2019 on low mortgage/interest rates, strong job market and wage growth along with fairly unseasonably warm weather. Record low existing homes for sale and sturdy underlying market demand have boosted the performance in the overall industry. In fact, homebuilders’ sentiments were strongest in December 2019 at 76 since June 1999.

However, the pandemic started gnawing the world economy after the first case, which was reported in Wuhan city of China. So far, almost 9,000 people have died due to this contagious respiratory disease throughout the world.

Importantly, February’s drop in building permits depicts builders’ inability to ramp up construction even though borrowing costs have been declining steeply after hitting 3.36% in Mar 12 week from year-ago period’s levels. Notably, new weekly mortgage rate for the week ending Mar 19 is yet to get released today. Moreover, confidence level among single-family builders also fell two points in March from February’s reading of 74. (Read more: Builders Sentiments Slip in March as Coronavirus Fears Rise)

In spite of lower rates, mortgage applications declined 8.4% in the week ending Mar 18 from a week earlier (on a seasonally-adjusted basis), according to a Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey.

Joel Kan, MBA's associate vice president of Economic and Industry Forecasting, stated, "The ongoing situation around the coronavirus led to further stress in the financial markets late last week, with unprecedented volatility and widening spreads.”

Although the recent starts data does not conclusively reflects on the mounting economic effects of the pandemic, but market pundits are anticipating a U.S. recession by the second quarter of this year.

However, in the wake of escalating Covid-19 crisis, the U.S. Federal Reserve or Fed took the most dramatic step since the 2008 financial crisis and announced that it will cut its target interest rate near zero. This will take the target range for the federal funds rate down from the 1-1.25% range to the 0-0.25% range.

Although solid demand and supply shortages create market opportunities for single-family builders, the coronavirus outbreak is a pressing concern for the entire industry. Shares of notable single-family builders like Meritage Homes Corporation (NYSE:MTH) , Toll Brothers, Inc. (NYSE:TOL) , KB Home (NYSE:KBH) , Taylor Morrison Home Corporation (NYSE:TMHC) and M/I Homes, Inc. (NYSE:MHO) have declined 55.3%, 62%, 67.7%, 67.7% and 75.3%, respectively, in the year-to-date period.

The Zacks Building Products - Home Builders industry declined 43.4% so far this year along with the Zacks Construction sector and S&P 500 composite’s 36% and 21.4% fall, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Toll Brothers Inc. (TOL): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Meritage Homes Corporation (MTH): Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC): Free Stock Analysis Report

M/I Homes, Inc. (MHO): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Housing Starts Drop In February, Coronavirus A Potent Threat

Published 03/19/2020, 08:25 AM

Updated 07/09/2023, 06:31 AM

Housing Starts Drop In February, Coronavirus A Potent Threat

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.