Banks have had several extended hot-and-cold periods over the past 10 years. Since 2007, they have been much cooler than hotter. For the past couple of months, they have been much hotter than the broad market.

Are banks about to turn cold again or become much much hotter? Below looks at the Financial Select Sector SPDR (NYSE:XLF) vs. the S&P 500.

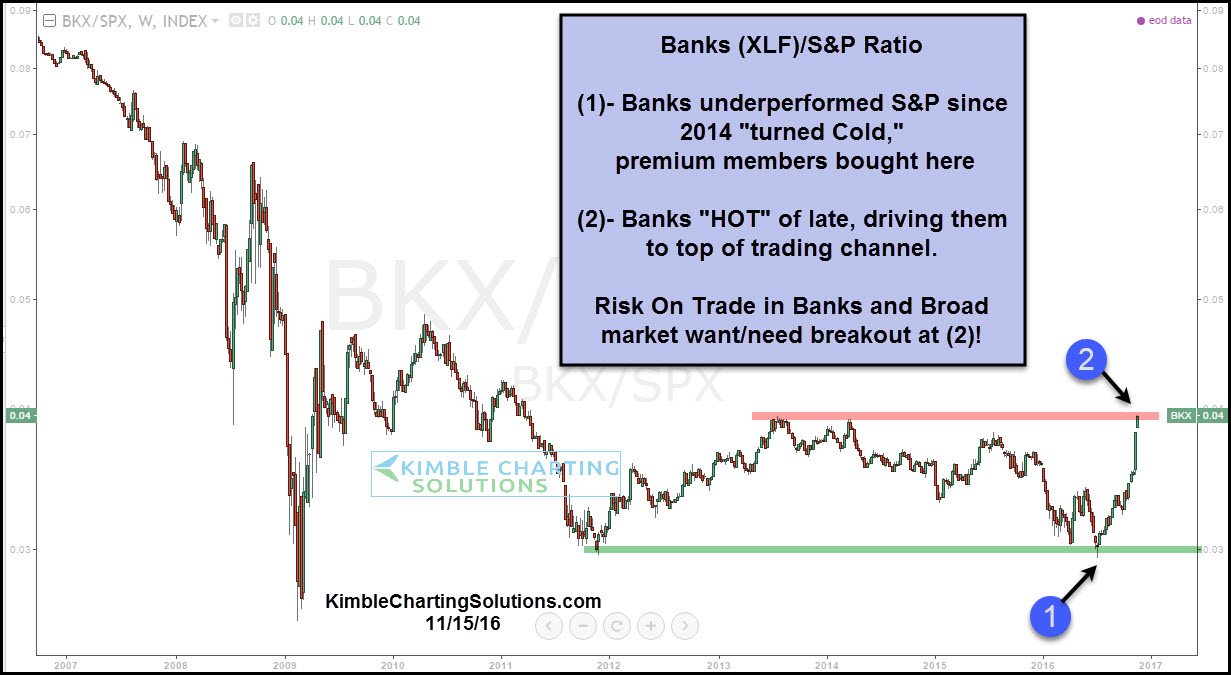

Banks have been much hotter than the S&P 500 since hitting support at (1). Premium members went long banks right after support was hit for the second time in a few months. We noticed that the ratio was near the 2009 financial-crisis lows and was at the same prices as the lows back in 2011. Both times, banks had strong rallies.

While many say banks have rallied since the election, they actually started pushing higher more than 100 days ago.

In 2014 the ratio hit highs and banks proceeded to underperform the broad market for nearly two years. Now the ratio is testing horizontal resistance at (2). The risk-on trade in banks and the broad market wants/needs the banks to remain hot and breakout at (2), which has been the most important risk-on test for banks over the past 24 months.