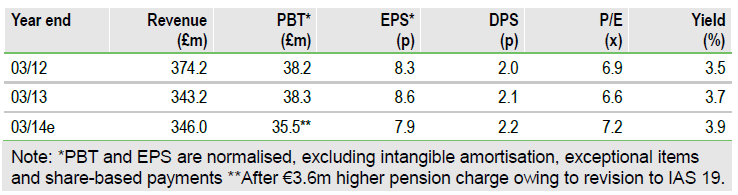

Hogg Robinson (HRG.LSE) hit the spot in FY13 with impressive margin gain comfortably offsetting market pressures on revenue. In the current year we expect more of the same, if less marked, driven by continued cost control and a strengthening of HRG’s technology offering, which is enhancing an already resilient model. The cut in PBT forecast from £40.5m to £35.5m is due mainly to IAS 19 revision and is arguably cautious on trading grounds.

H2 margin spur

An 11% trading profit gain in H2 on 7% lower revenue (both constant currency) is further proof of the effectiveness of HRG’s fee-based model as well as improved productivity (revenue/employee +1%). The H2 trading margin (15.0% vs 12.7%) was boosted by cost control, technology sales and online self-booking, exceeding even our bold assumptions. For the year, HRG secured net new business wins, importantly across multiple sectors, and held its longstanding high client retention rate. The sharp rise in period-end net debt was expected and entirely a function of the planned exit from the active working capital programme, while the IAS 19 pension cost was up only £1.2m despite the £14m increase in deficit to £159m.

Holding steady

Despite maintained revenue assumptions (constant currency -2%) for FY14, we are now looking for a smaller improvement in trading margin, ie up from 14.2% to 14.4%, not 14.6%, attributable to continued difficult conditions and management’s newly-stated KPI range of 13-14.5%. Thus, forecast trading profit is stable before the c £1m currency boost. However, last year’s striking margin success suggests this may be pessimistic. Longer-term action to reduce costs (locations, back-office functions etc) in the light of structural changes, notably self-booking, will involve a likely £6.5m exceptional charge in the current period. But net debt is still expected to decline to £80m by March 2014, ie 1.3x EBITDA, which is well within covenants. Management has advised that the revision to IAS 19 would have depressed FY13 PBT by £3.4m (comparatives will be restated), as opposed to £3.6m charged in the current year, as shown above.

Valuation: Stubbornly cautious

HRG’s FY14 P/E rating is low (7x) compared with that of the All-Share Support Services sector (c 16x). Such a discount appears excessive, despite investor caution about corporate travel service earnings (repeatedly proven to be overdone), the company’s pension deficit (further action being taken) and the concentration of top shareholdings. HRG is securely financed, cash generative and committed to a generous dividend policy (the yield has strong cover of 3.5x).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Hogg Robinson: H2 Margin Spur

Published 05/30/2013, 07:02 AM

Updated 07/09/2023, 06:31 AM

Hogg Robinson: H2 Margin Spur

Margin gains confirmed

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.