Looking for defensive dividend paying stocks? It makes sense – May is turning out to be one of the worst months in quite some time, with the S&P 500 down over 6%, the DOW down nearly 6%, and the NASDAQ and RUSSELL 2000 Small Caps both down over 7%.

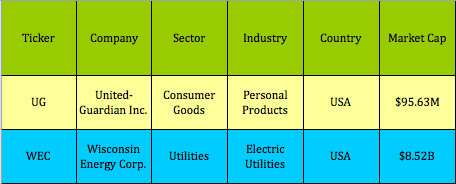

Here are two dividend stocks from our High Dividend Stocks By Sector Tables that have outperformed the market since the start of the spring pullback in April. United-Guardian, (UG), is a NY-based microcap, and Wisconsin Energy, (WEC), is a large cap electric utility:

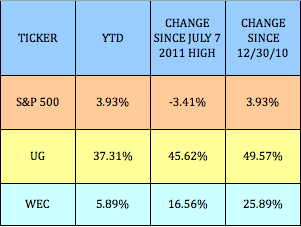

Performance: Both UG and WEC have beaten the market quite handily in these time periods…

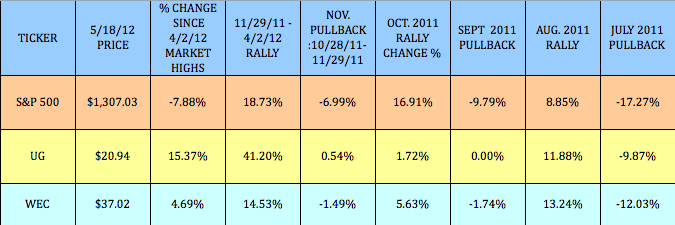

But things get really interesting, when you look at their performance during rallies and pullbacks over the past 11 months.

Both stocks have beaten the S&P in pullbacks, and have participated in rallies:

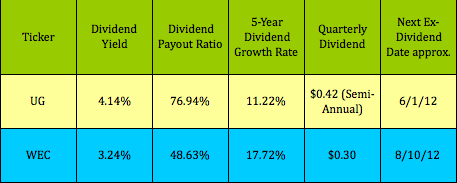

Dividends: UG pays a semi-annual dividend, which it just raised by 17%. The ex-dividend date is coming up on June 1st. WEC also increased its dividend, by 15%, to $.30, from $.26/share, in the first quarter of 2012. Both stocks have an attractive dividend yield and dividend growth rate:

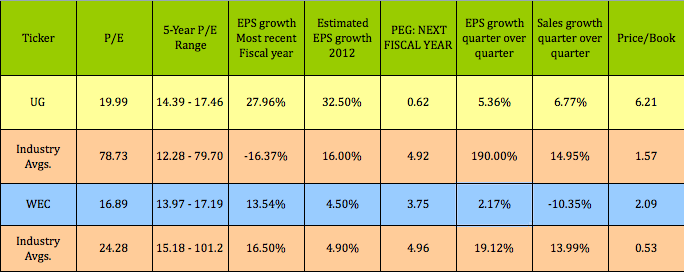

Earnings & Valuations: Given the run that these 2 stocks have had, you can’t say that they’re oversold, but, UG still looks like it’s undervalued, on a PEG basis, (P/E/Earnings Growth). WEC, being a utility, isn’t a stock you’d buy for growth, but it still has had some EPS growth in 2011, and its most recent quarter, plus it’s projected to have growth in 2012 that’s in line with industry averages:

Options: There are no options available for UG. We researched selling covered calls and Cash Secured Puts for WEC, but there’s insufficient option volume and bids at present.

If you’re interested in creating extra income via selling Covered Calls, you’ll find over 30 high yield options trades in our Covered Calls Table.

Likewise, we also list over 30 high yield Cash Secured Puts trades in our Cash Secured Puts Table.

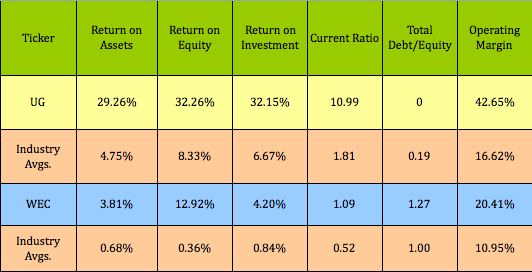

Financials: Both firms have Mgt. Efficiency and Debt ratios, and margins, that outshine their peers:

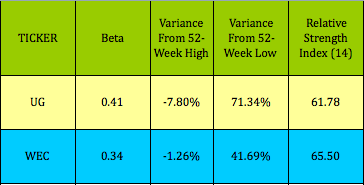

Technical Data: These are both low-beta stocks, due to their lack of correlation to the market, which makes them some of the best stocks to buy for defense against downward market swings:

Disclosure: Author had no positions in any of the above stocks at the time of this writing.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

High Dividend Stocks Outperforming The Market Pullback

Published 05/20/2012, 02:04 AM

Updated 07/09/2023, 06:31 AM

High Dividend Stocks Outperforming The Market Pullback

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.