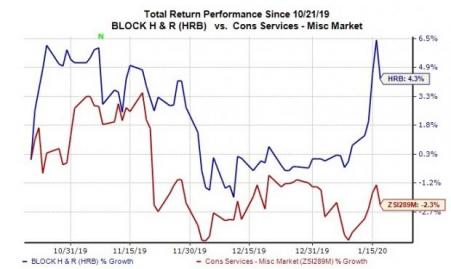

H&R Block, Inc.’s (NYSE:HRB) stock has performed well in the past three months and has the potential to sustain momentum in the near term. Shares have gained 4.3% in the said time frame against 2.3% decline of the industry it belongs to. So, we believe it’s time you add the stock to your portfolio.

Let’s take a look at the factors that make the stock an attractive pick.

Solid Rank & VGM Score: The stock currently has a Zacks Rank #1 (Strong Buy) and a VGM Score of B. Our research shows that stocks with a VGM Score of A or B when combined with a Zacks Rank #1 or 2 (Buy) offer the best investment opportunities. Thus, the company appears to be a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: Five estimates for fiscal 2020 moved north over the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for fiscal 2020 climbed 21.9%.

Positive Earnings Surprise History: H&R Block has an impressive earnings surprise history. The company outpaced the consensus mark in three of the trailing four quarters, delivering a beat of 1.88%, on average.

Solid Prospects: The Zacks Consensus Estimate for fiscal 2020 earnings is pegged at $2.45, indicating year-over-year growth of 14%. Earnings for fiscal 2021 are expected to grow 4%. The company’s long-term expected earnings growth rate is 10%.

Growth Factors: Betterment in the tax business, along with contribution from the acquisition of Wave Financial, is expected to help the company grow its top line. The Wave Acquisition has expanded H&R Block's product and client portfolio, and strengthened its position in the large and expanding small business market.

Additionally, cost reductions are expected to offset operating losses from Wave acquisition, thus positively impacting margin. Expansion of digital offerings in new areas is helping the company to attract and retain new clients, thereby boosting earnings growth.

Other Stocks to Consider

Some other top-ranked stocks in the broader Zacks Business Services sector are S&P Global (NYSE:SPGI) , Accenture (NYSE:ACN) and Booz Allen Hamilton (NYSE:BAH) , each carrying a Zacks Rank #2.

The long-term expected EPS (three to five years) growth rate for S&P Global, Accenture and Booz Allen is 10%, 10.3% and 13%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

S&P Global Inc. (SPGI): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH): Free Stock Analysis Report

H&R Block, Inc. (HRB): Free Stock Analysis Report

Original post