Waste Management, Inc. (NYSE:WM) has an impressive Growth Score of B. This style score condenses all the essential metrics from the company’s financial statements to get a true sense of the quality and sustainability of growth.

With expected long-term earnings per share growth rate of 8.5% and a market cap of $38.6 billion, Waste Management seems to be a stock that investors should retain in their portfolio for now.

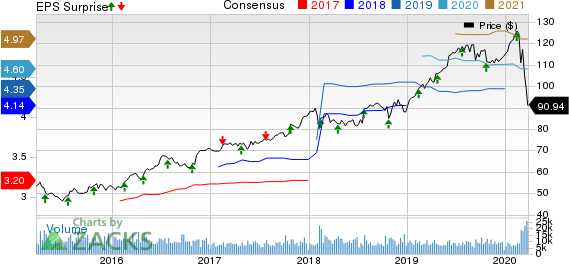

The Zacks Consensus Estimate for 2020 earnings is pegged at $4.6, which indicates year-over-year growth of 4.5%. Moreover, earnings are expected to register 8.14% growth in 2021.

Factors Boding Well

Waste Management continues to execute core operating initiatives targeting focused differentiation and continuous improvement, and instill price and cost discipline to achieve better margins. Focused differentiation through capitalization of extensive assets ensures profitable growth and competitive advantages. Successful cost-reduction initiatives are helping the company achieve consistent EBITDA growth. Waste Management’s fourth-quarter 2019 adjusted operating EBITDA increased 2.6% year over year. Adjusted operating EBITDA margin improved 70 basis points year over year.

Strength across the traditional solid waste business continues to boost the company’s cash and earnings. Waste Management expects yield momentum to continue in the solid waste lines of business.

Moreover, Waste Management has a consistent record of boosting shareholders’ value in the form of dividend and share repurchases. These initiatives not only instil investors’ confidence but also positively impact earnings per share. In 2019, 2018 and 2017, the company had repurchased shares worth $248 million, $1.004 billion and $750 million, respectively. It had paid $876 million, $802 million and $750 million in dividends during 2019, 2018 and 2017, respectively.

Risks

Waste Management’s balance sheet is highly leveraged. As of Dec 31, 2019, its long-term debt was $13.28 billion, while cash and cash equivalents were $3.56 billion. Such a cash position implies that the company needs to generate adequate amount of operating cash flow to pay debt. Moreover, high debt may limit future expansion and worsen its risk profile.

Zacks Rank and Stocks to Consider

Waste Management currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Charles River Associates (NASDAQ:CRAI) , Genpact Limited (NYSE:G) and Blucora, Inc. (NASDAQ:BCOR) . All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Long-term expected EPS (three to five years) growth rate for Charles River, Genpact and Blucora is 13%, 14% and 20%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Charles River Associates (CRAI): Free Stock Analysis Report

Waste Management, Inc. (WM): Free Stock Analysis Report

Genpact Limited (G): Free Stock Analysis Report

Blucora, Inc. (BCOR): Free Stock Analysis Report

Original post

Zacks Investment Research