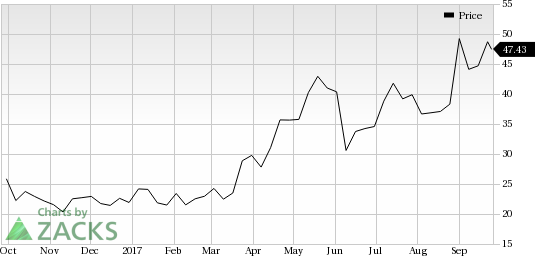

Shares of Mazor Robotics Ltd. (NASDAQ:MZOR) have moved 67.1% up over the last six months, ahead of the S&P 500’s 6.9% gain and the broader industry’s rally of 8.9%. The stock has a market cap of $1.15 billion.

With solid prospects, this Zacks Rank #2 (Buy) stock is an attractive pick at present. The company has delivered a positive average earnings surprise of 13% in the last four quarters.

Let’s find out whether this positive trend is a sustainable one.

The company’s estimate revisions have been encouraging. In the past 60 days, two estimates moved north, with no movement in the opposite direction for the current year. Accordingly, the Zacks Consensus Estimate has narrowed to a loss of 86 cents per share from a loss of 92 cents.

The market is upbeat about the company’s recent CE Mark approval for its Mazor X Surgical Assurance platform. The approval will allow Mazor Robotics and its partner Medtronic (NYSE:MDT) to commercialize, co-promote and market the Mazor X platformin countries that recognize CE Mark.

Mazor Robotics’ solid performance in the last reported second quarter has instilled confidence in investors. Notably, revenues marked an 87% increase on a year-over-year basis. The company is also expanding globally to capitalize on untapped markets. In this regard, we note that Mazor Robotics ended the second quarter with 170 installed systems worldwide.

Other Key Picks

Other top-ranked medical stocks are BioTelemetry, Inc. (NASDAQ:BEAT) , IDEXX Laboratories, Inc. (NASDAQ:IDXX) and Amedisys, Inc. (NASDAQ:AMED) . BioTelemetry, IDEXX Laboratories and Amedisys carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BioTelemetry has a long-term expected earnings growth rate of 19.2%. The stock has rallied roughly 11.2% over the last six months.

IDEXX Laboratories has a long-term expected earnings growth rate of 19.8%. The stock has gained around 36.4% over the last year.

Amedisys has a long-term expected earnings growth rate of 18.2%. The stock has gained around 10.3% over the last year.

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax (NYSE:EFX) announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Mazor Robotics Ltd. (MZOR): Free Stock Analysis Report

BioTelemetry, Inc. (BEAT): Free Stock Analysis Report

Amedisys Inc (AMED): Free Stock Analysis Report

Original post

Zacks Investment Research