Dover Corporation (NYSE:DOV) looks promising at the moment, backed by an upbeat outlook, stellar earnings prospects, improved performance by the Engineered Systems and Fluids segments, strong bookings and backlog, cost-reduction initiatives and restructuring programs.

Dover currently has a Zacks Rank #2 (Buy) and a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities for investors.

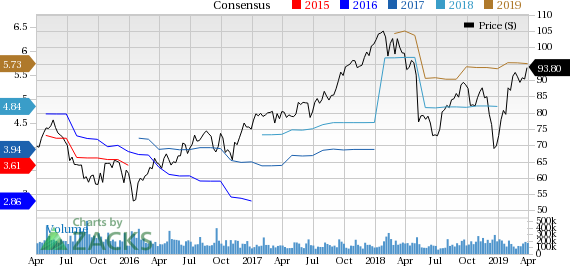

The trend in earnings estimate revisions also indicates a solid earnings outlook for Dover.

Let's delve deeper into the factors that make Dover stock a compelling investment option at the moment.

Upbeat Guidance

For 2019, Dover expects to generate adjusted earnings per share in the range of $5.65-$5.85. The company guided full-year revenue growth of 2-3%, comprising organic growth of 2-4% and a 1% impact from the Belanger acquisition, partly offset by an expected 2% unfavorable impact from foreign-currency exchange. On Jan 25, Dover completed the Belanger acquisition, which is expected to prove accretive to margins and adjusted earnings in 2019.

Positive Earnings Surprise History

Dover outpaced the Zacks Consensus Estimate over the trailing four quarters, average positive earnings surprise being 6.59%.

Price Performance

The stock has gained around 32.2% year to date, outperforming the industry’s growth of 19.1%.

Strong Earnings Growth Prospect

The Zacks Consensus Estimate for Dover’s 2019 earnings is currently pegged at $5.73, reflecting expected year-over-year growth of 15.29%. The same for 2020 stands at $6.17, indicating a year-over-year rise of 7.59%. The stock also has a long-term expected earnings per share growth rate of roughly 12%.

Growth Drivers in Place

Dover’s first-quarter 2019 results are likely to improve on robust bookings growth, solid order backlog, margin improvement and rightsizing programs. Through the year, impressive performance by the Engineered Systems and Fluids segments with strong organic growth, benefits from cost-containment actions, as well as footprint optimization projects and retail refrigeration will negate the impact of weak demand in the Refrigeration & Food Equipment segment.

Dover anticipates to benefit from its targeted cost-reduction initiatives in 2019. The company has executed restructuring programs to better align costs and operations with the current market conditions through targeted facility consolidations, headcount reduction and other measures. The company expects annualized run-rate savings of $18 million in the ongoing year.

Dover is progressing well with its efforts to simplify the portfolio and focus on markets with growth prospects. In sync with this, it successfully completed the spin-off of its upstream energy businesses — Apergy — last May. Following the spin-off, the company no longer owns the Energy segment and has three reportable segments. Thus, the divestment will enable Dover to focus on less volatile core platforms by delivering innovative equipment and components, specialty systems, consumable supplies, software and digital solutions, and support services.

Dover Corporation Price and Consensus

Other Stocks to Consider

Some other top-ranked stocks in the Industrial Products sector are Mueller Industries, Inc (NYSE:MLI) , Lawson Products, Inc. (NASDAQ:LAWS) and Albany International Corp. (NYSE:AIN) , each sporting a Zacks Rank #1, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Mueller Industries has an expected earnings growth rate of 2.2% for 2019. The company’s shares have rallied 23.2%, over the past year.

Lawson Products has an outstanding projected earnings growth rate of 102.5% for the current year. The stock has appreciated 28.8% in a year’s time.

Albany International has an estimated earnings growth rate of 44.7% for the ongoing year. The company’s shares have gained 15.7%, in the past year.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

Dover Corporation (DOV): Free Stock Analysis Report

Mueller Industries, Inc. (MLI): Free Stock Analysis Report

Lawson Products, Inc. (LAWS): Free Stock Analysis Report

Albany International Corporation (AIN): Free Stock Analysis Report

Original post

Zacks Investment Research