Regal Beloit Corporation (NYSE:RBC) seems to have lost its sheen due to global uncertainties, industrial slowdown in the United States and other prevailing headwinds. Also, weak price performance and lowered earnings estimates indicate bearish sentiments for the stock.

The company, with market capitalization of $3.5 billion, carries a Zacks Rank #4 (Sell) at present. It belongs to the Zacks Manufacturing – Electronics industry, currently at the bottom 31% (with the rank of 176) of more than 250 Zacks industries.

Notably, Regal Beloit’s earnings surpassed estimates by 1.5% in the third quarter of 2019. However, its bottom line declined 13.5% year over year on weak sales performance and a fall in margins. Revenues in the quarter lagged estimates by 6.4%.

In the past six months, the company’s shares have gained 9.3% compared with the industry’s growth of 20.9%.

Factors Affecting Investment Appeal

Top-Line & Bottom-Line Weakness: In third-quarter 2019, Regal Beloit’s earnings surpassed estimates by 1.5%, while sales lagged the same by 6.4%. On a year-over-year basis, earnings declined 13.5% on weak sales performance (down 16.5% from the year-ago quarter’s figure) and a fall in margins.

For 2019, the company believes that industrial slowdown in the United States, a slowdown in Asia, excess channel inventories and uncertainties in global trade will affect its performance.

Adjusted earnings per share are predicted in the range of $5.45-$5.55 per share, down from $5.50-$5.80 stated previously. Organic sales will likely decline in mid-single digits versus a low to mid-single-digit fall mentioned earlier.

Forex Woes: Presence in the United States, Canada, Mexico, Europe and Asia has exposed Regal Beloit to geopolitical issues, macroeconomic challenges and unfavorable movements in foreign currencies. In the third quarter of 2019, forex woes affected the company’s sales by 0.7%.

Persistence of such issues might pose concerns for the company.

Debt Headwinds: A highly-leveraged balance sheet is a headwind, as high debts increase financial obligations. Exiting third-quarter 2019, Regal Beloit’s long-term debts were $1,200.3 million. Interest expenses in the quarter were $13.5 million. For 2019, interest expenses (net) are predicted to be $49 million.

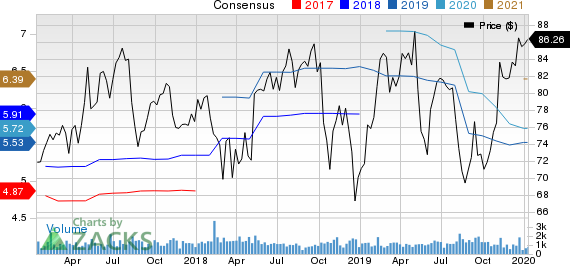

Bottom-Line Estimate Trend: The Zacks Consensus Estimate for Regal Beloit’s earnings has been revised in the past 60 days. The Zacks Consensus Estimate for earnings per share is currently pegged at $1.24 for the fourth quarter of 2019 and $5.72 for 2020, which indicates decline of 0.8% and 1% from the 60-day-ago figures, respectively.

Regal Beloit Corporation Price and Consensus

Cintas Corporation (CTAS): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE): Free Stock Analysis Report

Hickok Inc. (CRAWA): Free Stock Analysis Report

Original post

Zacks Investment Research