Alcoholic beverage companies are generally thought of as safe investments as consumption tends to remain stable even during difficult economic times. This is even more true when it comes to beer brewers, and especially so when speaking about Heineken (OTC:HKHHY) – the largest brewer in Europe.

But the COVID-19 brought an economic crisis unlike any other. People started stockpiling necessities and beer didn’t make the cut. On April 8, Heineken withdrew its 2020 financial guidance due to coronavirus uncertainty. The market was obviously anticipating bad news as the stock lost 34% between Feb. 19 and March 16.

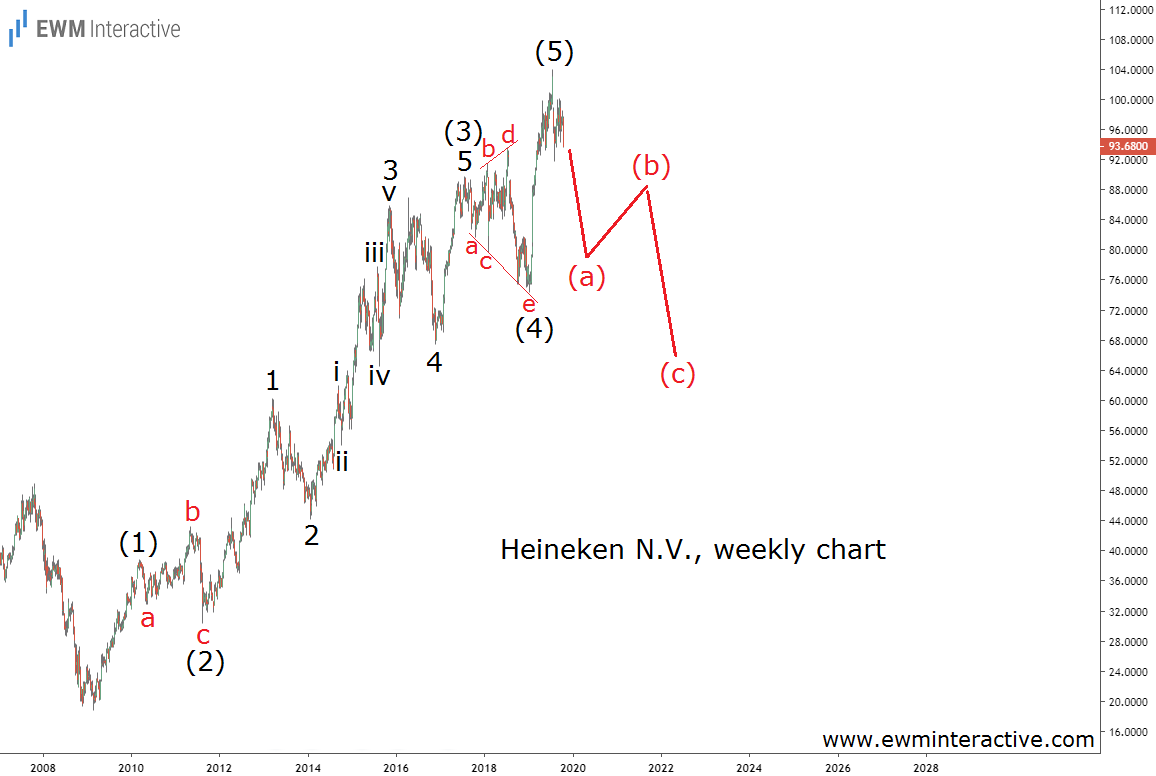

And while hardly anyone could’ve predicted the pandemic, Heineken stock was supposed to drop even without it. Nearly six months ago, its weekly chart revealed a troubling Elliott Wave pattern. We wrote an article about it on Oct. 25, 2019. Take a look.

Heineken’s weekly chart allowed us to examine the structure of the entire uptrend from the bottom at €18.75 in March 2009. It looked like a complete five-wave impulse, labeled (1)-(2)-(3)-(4)-(5). The five sub-waves of wave (3) were also visible.

Elliott Wave Decline Still Unfolding in Heineken Stock

This uptrend multiplied investors’ money by more than five in ten years. Unfortunately, according to the theory, a three-wave correction should be expected. So instead of joining the bulls near €94 a share in October 2019, we thought “a three-wave decline can be expected to drag Heineken down to the support area … near €70.” The updated chart shows how the situation played out.

The bulls managed to lift the price to €105, but eventually their efforts proved to be fruitless. On March 16, Heineken dipped below €69 a share. It took less than a month for the bears to erase three years’ worth of progress.

Now, you might have noticed that the count looks a little different from the one published in late-October. That is because the chart inspires a better idea now. Wave (4) actually ended at €67.47 in November 2016. The rest of the rally looks like an ending diagonal in wave (5).

If this count is correct, last month’s crash to sub-€69 must be the first phase – wave (a) – of a larger correction. This means wave (b) up and (c) down still remain. A recovery to roughly €90 is likely to be followed by another selloff to €60 or less. In our opinion, the bears are not done with Heineken yet. Just regrouping.