HEICO Corporation (NYSE:HEI) reported second-quarter fiscal 2019 earnings of 60 cents per share, surpassing the Zacks Consensus Estimate of 49 cents. The bottom line rose 36.4% from the prior-year quarter’s figure of 44 cents. The year-over-year improvement was driven by higher sales in the reported quarter and a 30% increase in operating income.

Total Sales

Quarterly net sales of $515.6 million outpaced the Zacks Consensus Estimate of $478 million by 7.9%. The top line also increased 19.7% from the year-ago quarter’s $430.6 million. The upside can be primarily attributed to the company’s organic growth and favorable impact from the company’s profitable acquisitions.

Operational Update

HEICO Corp’s total costs and expenses increased 17% year over year to $396.5 million in the reported quarter. The uptick was due to higher cost of sales, and increased selling, general and administrative expenses.

The company’s consolidated operating margin improved to 23.1% in the second quarter of fiscal 2019, up from 21.3% in the second quarter of fiscal 2018.

Segmental Performance

Flight Support Group: Net sales were up 15.1% year over year to $308.3 million, attributable to strong organic growth of 15% along with increased demand and new product offerings within the company’s aftermarket replacement parts and specialty products categories.

Operating income improved 20.7% year over year to $62.2 million, courtesy of net sales growth and improved gross profit margin, mainly reflecting a more favorable product mix within the specialty products category.

Segmental operating margin increased to 20.2% in the second quarter of fiscal 2019, up from 19.2% in the second quarter of fiscal 2018.

Electronic Technologies Group: Net sales rose 27.1% year over year to $214.5 million, majorly owing to increased demand for certain defense, aerospace and space products.

The segment’s operating margin improved to 31.4% in the second quarter of fiscal 2019, up from 28.5% in the second quarter of fiscal 2018.

Operating income increased 39.9% year over year to $67.4 million, largely on account of quarterly net sales growth, improved gross profit margin, and a favorable product mix for certain defense and aerospace products.

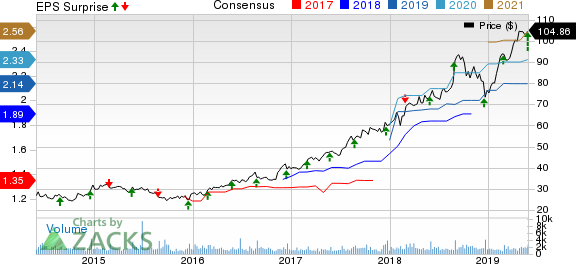

Heico Corporation Price, Consensus and EPS Surprise

The Boeing Company (BA): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Heico Corporation (HEI): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Original post

Zacks Investment Research