The supply demand outlook for nickel remains highly uncertain — banks and analysts at least agree on that

Many believe nickel demand, having slumped this year, to have bottomed and that the metal could post a modest upswing next year

HSBC reports that China posted practically no growth (+14%) in stainless steel production (by far the largest market for nickel) in 2012, but is expected to pick up in 2013''

Stainless steel production was actually down in Europe and the Americas this year, but a lower nickel price encourages the use of nickel-bearing steels and in particular austenitic grades, a trend that has seen the ratio of austenitic to total stainless grades increase from 72.1 percent to 73.3 percent during this year.

Although smaller in total demand, the increase in nickel use from non-stainless applications has increased the most rapidly, by 8 percent this year

Taken as a whole and against the backdrop of slowing global GDP growth, even outright recession in some quarters, nickel demand has held up reasonably well responding to the stainless cycle rather than directly to GDP trends

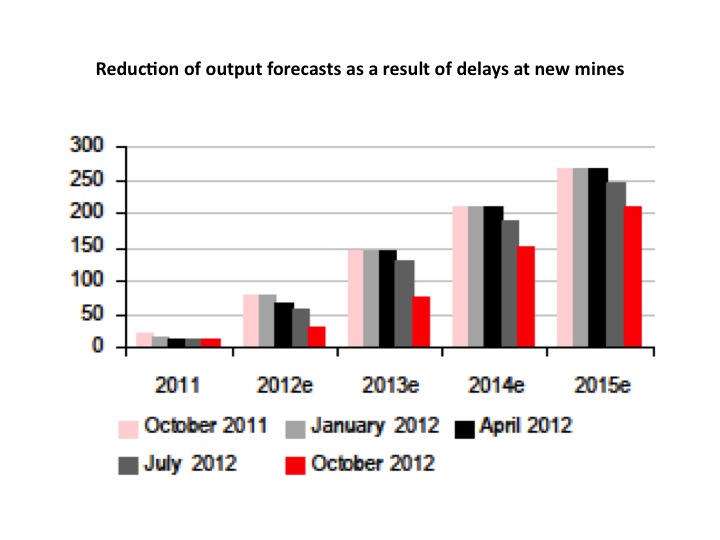

The swing factor has been and will continue to be nickel production New mines have faced a number of challenges, cumulatively reducing the expected contribution they will make leading up to the middle of the decade An interesting graph from HSBC shows how estimates have been progressively reduced over the last 12 months by some 20 percent:

The second major source of nickel supply, Chinese nickel pig iron (NPI) has held relatively steady in spite of an Indonesian ban on exports this year and increased export duties on nickel ore. China has substituted almost the entire quantity imported from the Philippines, although the higher costs of lower grades will likely impact some production in H2 this year and next.

As a result, China may shift to importing more refined nickel than relying to the same extent on NPI next year. HSBC certainly believes increased Chinese demand will help lift prices next year and forecasts prices to rise from an average of $17,920/ton (estimated) this year to $18,740/ton in 2013.

In addition the bank estimates both rising cost pressures on Chinese nickel pig iron and from higher-cost new mines will underpin prices going forward, resulting in prices rising to $20,000/ton in 2014 and $22,000/ton in 2015.

However, most sources agree the market will remain in surplus. The World Bureau of Metal Statistics puts the figure at 77,000 tons for January to August this year, Standard Bank estimates this year as a whole at 48,000 tons and next year at 35,000, but HSBC believes the market is much more in balance, predicting just 7,000 tons this year and 25,000 in 2013.

Interestingly, Standard Bank in a Bloomberg article speculates nickel could be a candidate for similar stock-and-finance plays to aluminum and zinc. The metal’s forward curve is in contango, benefiting from the surplus supply situation.

Presently, physical premiums for cut cathode are low, suggesting Standard Bank’s speculations have not yet caught on. Nevertheless stock-and-finance, if it takes off, remains yet another risk to nickel premiums for buyers to watch out for, as if they didn’t have enough variables already!

By Stuart Burns

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Have Nickel Prices Bottomed?

Published 10/30/2012, 05:17 AM

Updated 07/09/2023, 06:31 AM

Have Nickel Prices Bottomed?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.