Harsco Corporation (NYSE:HSC) , yesterday, announced that it has successfully completed the acquisition of Hatboro, PA-based Clean Earth, Inc. for approximately $625 million. The other party to the transaction was Compass Group (LON:CPG) Diversified Holdings LLC.

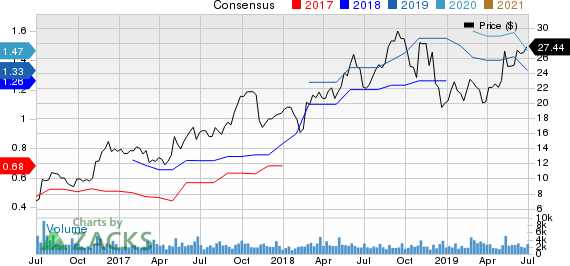

It’s worth mentioning here that the company’s share price gained roughly 0.2% yesterday, closing the trading session at $27.44.

Clean Earth is among the leading specialty waste processing companies in the United States. It provides solutions to tackle contaminated materials, dredged volumes and hazardous wastes to customers in the commercial, infrastructure, industrial and institutional markets. The firm’s revenues and earnings before interest, tax, depreciation and amortization are anticipated to be roughly $300 million and $65 million, respectively, in 2019.

Details of the Buyout

Notably, the company funded the all-cash buyout with funds raised from debt financing and revolving credit facility. Clean Earth, under the leadership of Chris Dods, will work as a separate business segment of Harsco.

The buyout marks the entry of Harsco into the environmental services market (that have high regulatory barriers of entry). This also complements the company’s existing offerings related to environmental solutions and services within the Metals & Minerals segment.

Harsco predicts the buyout to immediately prove accretive to its margins and free cash flow. Also, earnings accretion is anticipated in 2020, while the combined operations of Harsco and Clean Earth are likely to generate $10 million in synergies.

Zacks Rank and Price Performance of Harsco

The company, with approximately $2.2-billion market capitalization, currently carries a Zacks Rank #4 (Sell).

In the past 60 days, earnings estimates for the company have been lowered, indicating bearish sentiment. The Zacks Consensus Estimate for earnings is pegged at $1.33 for 2019 and $1.47 for 2020, suggesting a decline of 6.3% and 6.7% from the respective 60-day-ago figures.

Harsco Corporation Price and Consensus

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Flowserve Corporation (FLS): Free Stock Analysis Report

Chart Industries, Inc. (GTLS): Free Stock Analysis Report

Harsco Corporation (HSC): Free Stock Analysis Report

Original post

Zacks Investment Research