Oil field service provider Halliburton Company (NYSE:HAL) recently announced that the company has been hiring 100 workers every month so far this year to meet the mounting demand for fracking in West Texas.

Halliburton has increased its active fleet by 30%, which required the company to increase employment by more than one-third of its workforce to 2,700 workers in the Permian Basin. The company has around 50,000 workers globally.

Due to such a demand the company has been forced to look for workers outside the region, as the job market in West Texas has reached a saturation point. Moreover, finding workers who can acclimatize to the challenging environment of West Texas is also a tough job per the company. In fact, Halliburton held job fairs in Alabama, Mississippi, and Nevada to recruit skilled workers.

Why the Surge?

Earlier this year, the oil producing companies locked in price for their crude oil while the price increased above $50 per barrel. This led to a rapid increase in the number of rigs and frack-crews in the area as the scenario forecasted more profit from heightened production. This incentivized oil field service providers like Halliburton to increase their services and rate of employment. Improved utilization also helped the companies to raise their price for services thereby increasing profit level and reducing financial burden.

In this regard, we would like to remind investors that Halliburton's revenue from the North America region in the first quarter of 2017 increased 24% sequentially to $2.2 billion. However, it must be added that oil prices have since fallen below the $50 per barrel level again, which can challenge Halliburton’s recruitment spree.

About the Company

Houston, TX-based Halliburton is one of the largest oilfield service providers in the world, offering a variety of equipment, maintenance, and engineering and construction services to the energy, industrial, and government sectors. The company operates in two main segments – Completion and Production, and Drilling and Evaluation.

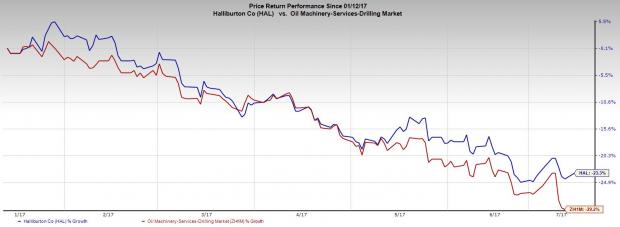

Price Performance

Halliburton belongs to the Zacks categorized Oil and Gas - Field Services industry. In the last six months, the company’s shares fell 23.3%, narrower than the industry’s decrease of 29.2%.

Following opposition from US and European regulators, Halliburton and Baker Hughes called off their $28 billion merger agreement. Accordingly, Halliburton paid Baker Hughes $3.5 billion in termination fees - one of the highest in US corporate history. This has hurt Halliburton's liquidity and stretched its balance sheet.

Zacks Rank and Stocks to Consider

Halliburton presently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the oil and energy sector are Delek US Holdings, Inc. (NYSE:DK) , Crescent Point Energy Corporation (TO:CPG) and Canadian Natural Resources Limited (TO:CNQ) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Delek US Holdings’ sales for 2017 are expected to increase 71.3% year over year. The company delivered an average positive earnings surprise of 60.7% in the last four quarters.

Crescent Point’s sales for the second quarter of 2017 are expected to increase 14% year over year. The partnership delivered an average positive earnings surprise of 354.9% in the last four quarters.

Canadian Natural Resources’ sales for 2017 are expected to increase 49.4% year over year. The company delivered a positive earnings surprise of 30.8% in the first quarter of 2017.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Crescent Point Energy Corporation (CPG): Free Stock Analysis Report

Halliburton Company (HAL): Free Stock Analysis Report

Original post

Zacks Investment Research