We initiate on Gulf Keystone (GKP) at a time when the understanding of its massive Shaikan asset has increased markedly. The convergence of a tighter range of estimates around a higher (13.7bn bbls pMean) oil in place (OIP) demonstrates the better understanding of the Shaikan field gained over recent months and indicates that the next stage, development, is just around the corner. Our core NAV of 216p should grow as the current uncertainties (development details, recovery rates, pipelines and politics) become clearer while further value could be unlocked as exploration and appraisal takes place across its other blocks. In reality, big fields require big developers and we would ultimately expect to see GKP crystallise value for shareholders.

Shaikan enters a new phase

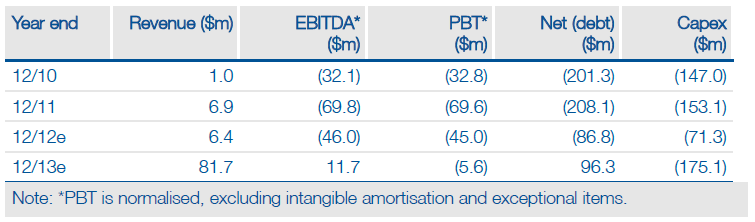

GKP is a Kurdistan-focused E&P. Its key asset is the Shaikan oil field, with an independently-estimated 13.7bnbbls of OIP. Appraisal of Shaikan has now formally reached an end and the company anticipates that development will take gross production to a plateau of at least 400mbbl/d by 2016 (we model 475mmbbls/d for nine years).

The development of Shaikan should bring significant value to GKP, but there are a number of unknowns to consider. Overall recovery rate for the complex reservoir is still uncertain, as is a route to monetise the production; an export pipeline to Turkey is planned, but tensions between Baghdad and Kurdistan means this is not 100% certain, although long term exports via Turkey are likely. Additionally, the company is being sued for 30% of its Kurdistan assets by Excalibur – the trial should start in October 2012.

Valuation: More to come

GKP’s value has increased considerably in the years since Shaikan was discovered and the shares have been a rollercoaster ride for many investors as hopes of a much-rumoured takeover increased and subsequently fell away. Our analysis shows that the core NAV of 216p underpins the value of the shares, while RENAV of 271p provides upside based on current E&A activity. However, GKP is an evolving story and further increases in resources would not be a surprise.

More potential upside is possible in the neighbouring Sheikh Adi block, which the company believes could be linked to Shaikan. A Shaikan superstructure, extending over neighbouring blocks, is a tantalising possibility. Ber Bahr could add further in time, while the company could realise value in the near term with a sale of Akri-Bijeel. An unrisked RENAV for the company (including a decrease in discount factor from 12% to 10%) stands at 575p.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gulf Keystone Petroleum Initiation Of Coverage

Published 08/01/2012, 06:41 AM

Updated 07/09/2023, 06:31 AM

Gulf Keystone Petroleum Initiation Of Coverage

Entering a new phase

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.