Greenlight Capital Re, Ltd (NASDAQ:GLRE) incurred fourth-quarter 2017 loss of $1.02 per share, wider than the Zacks Consensus Estimate of a loss of 55 cents. Also, the bottom line compared unfavorably with $1.31 per share earned in the year-ago period.

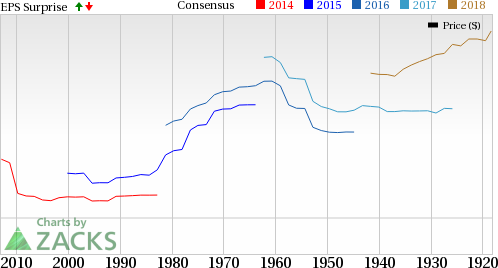

Greenlight Reinsurance, Ltd. Price, Consensus and EPS Surprise

Reserve strengthening, investment loss and losses from the California wildfires weighed on fourth-quarter results.

Shares of the company lost about 6% in the last two trading sessions reflecting its underperformance.

Quarter in Detail

Operating revenues of $125 million missed the Zacks Consensus Estimate by 20.93%. Moreover, the top line declined 33.7% year over year.

Gross written premiums of $139 million decreased 6.6% year over year. Net earned premiums increased 3.3% year over year to $141.1 million.

Net investment loss was $16.2 million, comparing unfavorably with income of $52.9 million in the year-ago quarter.

Underwriting loss of $19.7 million compared unfavorably with underwriting income of $1.4 million in the prior-year quarter, attributable to $4.7 million loss, net of reinstatement premiums, stemming from the California wildfires.

Full-Year Highlights

For 2017, Greenlight Capital reported loss per share of $1.21 versus income of $1.20 earned in 2016.

Revenues of $645.7 million improved 9.7% over 2016 owing to higher premiums earned.

Total expenses of $690.5 million increased 27.6% over 2016 on higher loss and loss adjustment expenses, acquisition costs and general and administrative expenses.

Combined ratio of 108.6% deteriorated 500 basis points year over year.

Financial Update

Cash and cash equivalents were $1.5 billion as of Dec 31, 2017, improved from $1.2 billion as of Dec 31, 2016.

Total assets of $3.4 billion as of Dec 31, 2017 increased from $2.7 billion as of Dec 31, 2016.

Total liabilities of $2.5 billion deteriorated from $1.8 billion at 2016-end.

Shareholders’ equity at 2017-end totaled $831.3 million, lowered from $874.2 million as of Dec 31, 2016.

Adjusted book value per share was $22.22 as of Dec 31, 2017, declining 5% from $23.38 as of Dec 31, 2016.

Zacks Rank

Greenlight Capital carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported fourth-quarter earnings so far, the bottom line of The Progressive Corp. (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Greenlight Reinsurance, Ltd. (GLRE): Free Stock Analysis Report

Original post