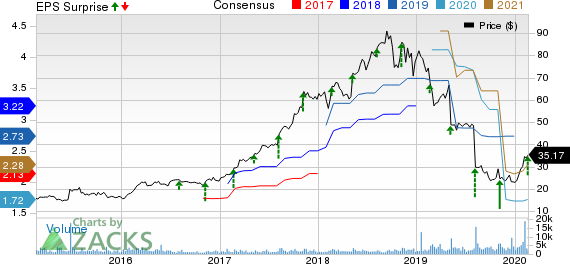

Green Dot Corporation (NYSE:GDOT) reported mixed fourth-quarter 2019 results, with earnings beating the Zacks Consensus Estimate but revenues missing the same.

The stock climbed more than 3% in after-hours trading, in response to the earnings beat.

Adjusted earnings of 14 cents beat the Zacks Consensus Estimate by 27.3% but declined 75% year over year. However, quarterly revenues of $238.4 million missed the consensus mark by 9 cents but slightly improved year over year. The uptick reflected strength in interchange revenues, and processing and settlement segment.

Shares of the company have dipped 47.7% over the past year against 44.6% rally of the industry it belongs to.

Q4 Financials

The Account Services segment’s non-GAAP operating revenues came in at $189.6 million, down 6.3% from the year-ago quarter due to decrease in active accounts (2.7% sequentially) from the company’s consumer business.

The Processing and Settlement Services segment’s non-GAAP operating revenues of $55.5 million grew 32.8% from the year-ago quarter, driven by increased transaction volumes across product lines.

Key Metrics

Gross dollar volume grew 8.4 % year over year to $10.6 billion. Purchase volume also increased 0.2% from the prior-year quarter to $6.3 billion. The company ended the quarter with 5.04 million active accounts (down 5.6%) and 12.08 million cash transfers (up 10.7% year over year). The number of tax refunds processed was 0.07 million, in line with the year-ago quarter.

Operating Results

Adjusted EBITDA of $21.8 million decreased 57.3% on a year-over-year basis. Adjusted EBITDA margin of 9.2% also decreased from 21.6% in the year-ago quarter.

Balance Sheet

Green Dot exited the quarter with cash, cash equivalents and restricted cash balance of $1.06 billion compared with $1.09 billion at the end of the prior quarter. The company had no long-term debt.

First-Quarter Guidance

Green Dot anticipates first-quarter 2020 non-GAAP revenues to be 30-31% and adjusted EBITDA to be 48% of its full-year 2020 guidance at the midpoint.

2020 View

The company expects revenues in the range of $1.08-$1.1 billion. The current Zacks Consensus Estimate is pegged at $1.06 billion, below the midpoint ($1.09) of the guided range.

Adjusted earnings are expected in the range of $1.6-$1.74 per share, whose midpoint ($1.67) is below the Zacks Consensus Estimate of $1.72.

Green Dot anticipates full-year adjusted EBITDA between $175 million and $185 million.

Zacks Rank & Stocks to Consider

Currently, Green Dot carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector include S&P Global (NYSE:SPGI) , NV5 Global, Inc. (NASDAQ:NVEE) and Accenture PLC (NYSE:ACN) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings (three to five years) growth rate for S&P Global, NV5 Global and Accenture is estimated to be 10%, 20% and 10.3%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Accenture PLC (ACN): Free Stock Analysis Report

Green Dot Corporation (GDOT): Free Stock Analysis Report

NV5 Global, Inc. (NVEE): Free Stock Analysis Report

S&P Global Inc. (SPGI): Free Stock Analysis Report

Original post