Shares of W.W. Grainger, Inc. (NYSE:GWW) scaled a fresh 52-week high of $327.76 during trading session on Nov 12, before closing a little lower at $325.44. The company has a market cap of $17.62 billion.

Over the last three months, its average volume of shares traded has been approximately 400.8M. The company has an expected long-term earnings per share growth rate of 11%.

Notably, the stock has gained 8.3% in a year’s time, as against the industry’s loss of 1.8%.

Driving Factors

Recently, Grainger reported third-quarter results, wherein earnings and revenues missed the respective Zacks Consensus Estimate. However, the top- and bottom-line figures, both, improved year over year. Growth in operating earnings and lower average shares outstanding drove the company’s quarterly performance.

Grainger expects current-year earnings per share in the band of $17.10-$18.70, reflecting year-over-year growth of 2-12%. Earnings growth will be driven by solid operating performance and favorable tax rates. In the United States, business investment is likely to remain strong in 2019, supported by expanding global markets, lower capital costs and an improving regulatory environment. Grainger is well positioned to benefit from its efforts to strengthen relationships with customers in the nation. Moreover, the company is poised to deliver its strongest SG&A leverage and continued operating-margin improvement, aided by the incremental margin of 20-25%.

The company is also focused on improving end-to-end customer experience by making investments in e-commerce and digital capabilities, and implementing improvement initiatives within the supply chain. Notably, it intends to continue reducing the cost base. Further, the company expects to drive growth with the endless assortment model on solid MonotaRO and incremental investments in its Zoro businesses.

Grainger’s Canada business is an attractive market and is expected to deliver double-digit operating margin growth over the next five years. The company has been focused on reducing its cost structure in the Canada operations, in a bid to bolster growth. Grainger has been managing inventory efficiently to boost profitability, and is focused on making incremental investments in marketing and merchandising.

Positive Growth Projections

The Zacks Consensus Estimate for Grainger’s current-year earnings per share currently stands at $17.46, indicating 4.5% growth from the year-ago quarter. The same for 2020 is pegged at $318.86, suggesting an increase of 8.01% from the year-ago reported tally.

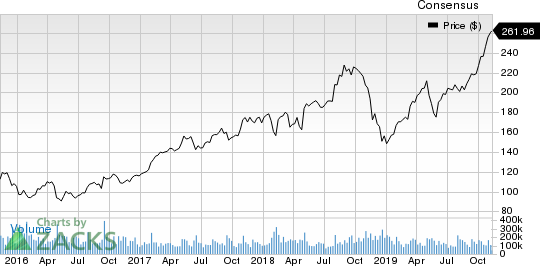

W.W. Grainger, Inc. Price and Consensus

Zacks Rank and Key Picks

Grainger currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Sharps Compliance Corp (NASDAQ:SMED) , Tennant Company (NYSE:TNC) and Casella Waste Systems, Inc. (NASDAQ:CWST) . While Sharps Compliance and Tennant sport a Zacks Rank #1 (Strong Buy), Casella Waste Systems carries a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sharps Compliance has an expected earnings growth rate of a whopping 500% for the current year. The stock has gained 2.8% in a year’s time.

Tennant has a projected earnings growth rate of 29.82% for 2019. The company’s shares have rallied 32.6% over the past year.

Casella Waste Systems has an estimated earnings growth rate of 37.7% for the ongoing year. The company’s shares have gained 28.1% in the past year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Tennant Company (TNC): Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST): Free Stock Analysis Report

Sharps Compliance Corp (SMED): Free Stock Analysis Report

W.W. Grainger, Inc. (GWW): Free Stock Analysis Report

Original post

Zacks Investment Research