Google (GOOG) reported QE December 2012 financial results on January 22.

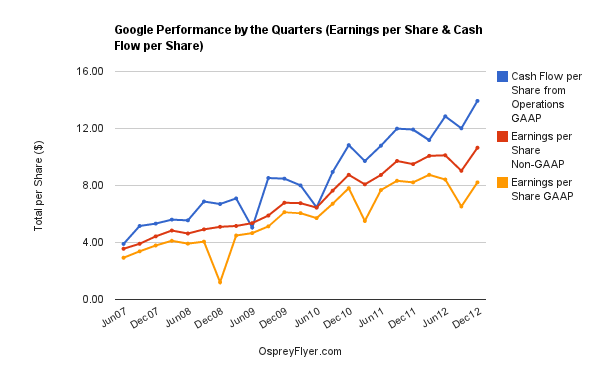

Google earnings showed hopeful signs this quarter, after the fundamentals were negatively impacted in 2012 with the acquisition and merger of Motorola. GAAP earnings per share were $8.22 and matched the prior year QE December 2011, but were short of the QE March 2012 record of $8.75. However, Non-GAAP earnings per share of $10.65 and cash flow per share of $13.94 were all-time highs.

Google sees the world as a global cloud plus a multi-screen environment from the user side. People now have a variety of devices to connect to the Internet and use more than one device per day. These can be a smartphone, tablet, notebook, desktop, etc. Google plans on being on your screen, your window to the Internet and the global cloud, via their products, regardless of device. Google would also like to build your device.

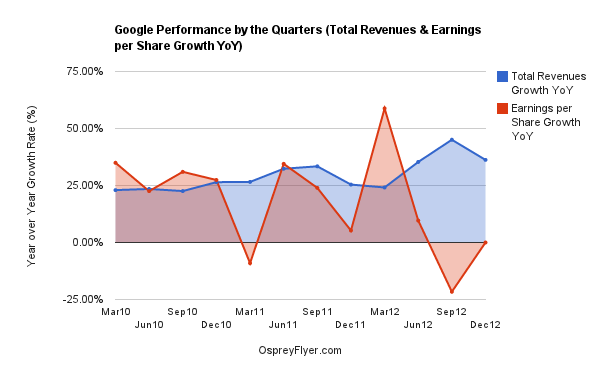

There is still some damage to repair in the earnings per share growth rate. The revenue growth rate continues healthy, but needs an assist from gross margin for the bottom line.

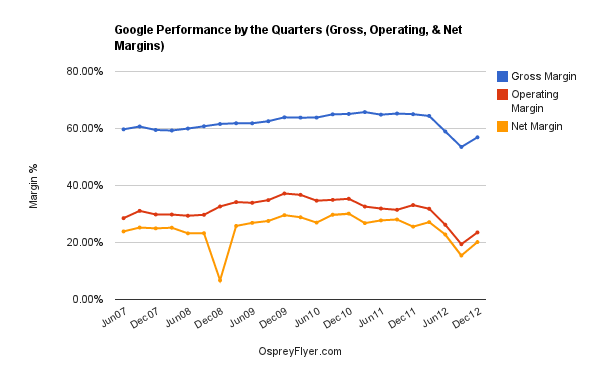

The reversal of the downtrend in gross margin (56.91%) is the most positive metric for this quarter. Operating and net margins responded accordingly. Last quarter, gross margin reached an abysmal and multi-year, if not all-time, low of 53.52%.

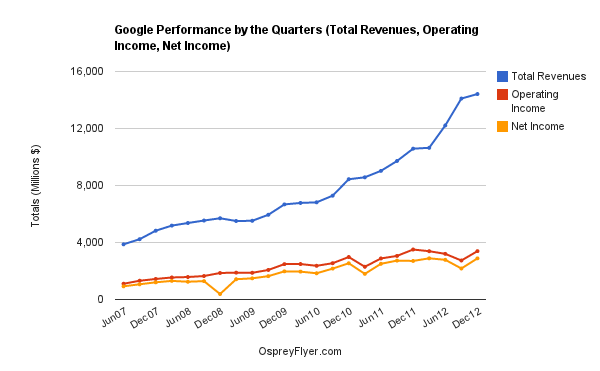

Revenues rose to an all-time high of $14.42 billion, powered by record regional revenues across the board: the United States, the United Kingdom, and Rest of the World. Operating income inched up to an all-time high of $3.39 billion. Net income of $2.886 billion just missed the record high of $2.890 billion in the QE March 2012.

“We ended 2012 with a strong quarter,” said Larry Page, CEO of Google. “Revenues were up 36% year on year, and 8% quarter on quarter. And we hit $50 billion in revenues for the first time last year – not a bad achievement in just a decade and a half. In today’s multi-screen world we face tremendous opportunities as a technology company focused on user benefit. It’s an incredibly exciting time to be at Google.”

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Google Earnings Review: Hopeful Signs In A Multi-Screen World

Published 01/24/2013, 12:18 AM

Updated 07/09/2023, 06:31 AM

Google Earnings Review: Hopeful Signs In A Multi-Screen World

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.