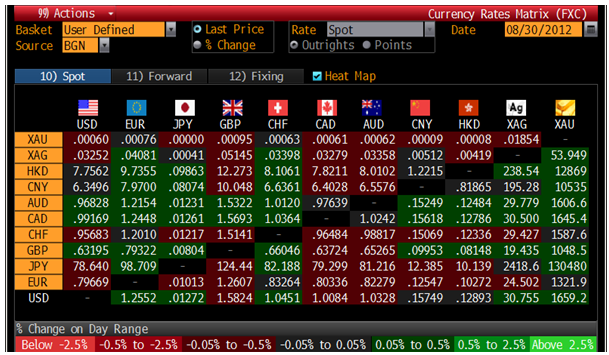

Today’s AM fix was USD 1,657.00, EUR 1,320.21 and GBP 1,046.48 per ounce.

Yesterday’s AM fix was USD 1,664.25, EUR 1,325.04 and GBP 1,051.66 per ounce.

Gold fell $11.10 or 0.67% in New York yesterday and closed at $1,656.10. Silver slipped to a low of $30.55 and rallied back and forth then finished the day with a loss of 0.58%.

Gold is mostly unchanged as investors gear up for the US Fed chairman, Ben Bernanke’s speech tomorrow.

Market participants are focussed again on the short term and the silly “will he, won't he?” debate re Bernanke at the Jackson Hole symposium.

Bernanke may again obfuscate and not give clear guidance regarding monetary policy and further QE.

However the smart money such as PIMCO's Bill Gross, Jim Rogers, John Paulson and others believe that further QE and money printing remain inevitable. We would concur and advise investors to fade out the short term noise emanating from Jackson Hole and from assorted policy makers on both sides of the Atlantic and focus on the reality that further monetary easing and currency debasement will continue for the foreseeable future.

There are continuing hopes that the ECB will deliver concrete plans next week that will help diminish the borrowing costs in Spain and Italy and an interest rate decrease is also being mooted.

The German Constitutional court decision on September 12th may finally put to bed whether Germany will allow the ECB to print euros in order to bailout periphery nations thereby debasing the euro.

The 6.5 billion euro Italian sovereign bond sale went well today but the auction again spotlights the country's massive debt burden and still high and rising borrowing costs.

A new and important bullish indicator for the gold market is that gold calls are at highs not seen since the October 2008 low as option traders go long gold in the belief that it will go higher.

It suggests that option traders believe that U.S. Federal Reserve Chairman Ben Bernanke will hint at or announce additional money printing and monetary easing at the Jackson Hole, Wyoming, symposium.

Alternatively, it suggests that they are bullish on gold due to the risks posed to the dollar and the risk of inflation taking off.

The ratio of outstanding calls to buy the SPDR Gold Trust versus puts to sell jumped to 2.69 to 1 on August 24th and reached 2.76 earlier this month, the highest level since October 2008, according to data compiled by Bloomberg.

Ownership of calls is up 26% since the July 20th options expiry. Ten of the most owned actively owned ETF option contracts are bullish.

Option traders are regarded as savvier and tend to be more sophisticated then the more speculative futures traders.

Gold in October 2008 was trading at below $725/oz (see charts above). In the less than 5 months that followed gold rose 67.8% - from mid October 2008 to the high on February 12th 2009 at $1,215/oz.

A similar move today is quite possible given the long period of consolidation in the last 12 months and the strong fundamentals.

This could see gold rise from below $1,660/oz today to $2,785/oz in the first quarter of 2012 (see chart above).

NEWSWIRE

(Bloomberg) -- U.S. Mint Gold-Coin Sales in August at 32,500 Ounces Top July

The U.S. Mint’s sales of American Eagle gold coins were 32,500 ounces so far in August, according to figures from the Mint’s website. The total for all of July was 30,500 ounces.

(Bloomberg) -- U.S. Mint Silver-Coin Sales in August Exceed July Total

The U.S. Mint’s sales of American Eagle silver coins have reached 2.52 million ounces so far in August, according to figures from the Mint’s website. Sales totaled 2.28 million ounces in July.

(Bloomberg) -- Gold ETP Holdings Rise to Record for Seventh Straight Session

Gold holdings in exchange-traded products backed by the metal rose to a record for the seventh straight session.

The amount increased 3.49 metric tons, or 0.1 percent, to 2,460.46 tons, data tracked by Bloomberg showed.

(Bloomberg) -- Ahmadinejad Says Capitalism Is on ‘Threshold of Collapse’

Iranian President Mahmoud Ahmadinejad urged countries to barter and use their own currencies for trade instead of the U.S. dollar and said capitalism was about to end.

“Domineering capitalism is on the threshold of collapse,” Ahmadinejad said told delegates at a Non-Aligned Movement meeting in Tehran today.

(Philstar) -- Central Bank of Philippines may buy gold abroad

The Bangko Sentral ng Pilipinas (BSP) has warned it may be forced to purchase gold abroad for its reserve requirements should local sales of the metal continue to drop due to taxes levied by the government, a central bank official said.

“If nothing happens, we might be forced to downsize our gold refinery. The effect is that the BSP will not be able to buy gold using pesos,” BSP Deputy Governor Diwa Guinigundo told The STAR in a text message late Monday.

“While gold can be bought from the international market, this will have to be done using (foreign exchange). Foreign exchange reserves will not be increased in the process,” he added.

When asked when the BSP can say that it needs to buy gold abroad, Guinigundo replied: “This is a question of timing policy and therefore not for public consumption.”

Gold is considered as a safe haven in times of foreign exchange volatility, meaning, investors flock to it when currencies around the world are plunging in value to protect their investment. BSP, by law, is supposed to be the sole purchaser of gold from local small-scale miners.

(Bloomberg) -- Platinum May Rally to $1,735 on South African Output Loss: UBS

Platinum may climb to $1,735 an ounce within three months because of production losses in South Africa, which represents almost 75 percent of world mine supply, said Dominic Schnider, head of commodity research at UBS AG’s wealth management unit.

Global supply may drop 4 percent this year, returning the market to balance, Schnider said today at a briefing in Singapore. The surplus was 430,000 ounces in 2011, UBS data show. Spot platinum was at $1,523.25 at 11:39 a.m. local time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Option Traders Most Bullish Since Bottom In October 2008

Published 08/30/2012, 05:07 PM

Updated 07/09/2023, 06:31 AM

Gold Option Traders Most Bullish Since Bottom In October 2008

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.