The final corner at Italy’s Autodromo Nazionale Monza, (aka “The Cathedral of Speed”), is its famed Curva Parabolica, whose profile was mathematically derived similar to that for computing Gold’s parabolic curves which we judiciously present relative to the weekly Gold bars. As does the Parabolica “guide” a Formula One car as its races through that ever-accelerative curve, so do Gold’s parabolic dots guide price, and in the case of the new Long trend, to the upside.

However, just two “laps” into the new Long trend per the welcomed blue dots below at lower right…

…Gold, in attempting to ascend, is dealing with an aerodynamic issue of which we’re now learning per the following radio transmission from Gold to its chief engineer in the pits:

Gold: “There’s too much oversteer and it keeps turning back on itself into the 1380s…”

Engineer: “It’s ok, Gold, we see it on the telemetry. Box this lap, box, box…”

(Which is the F1 lingo used to request the driver to bring the car into the pits). And indeed, courtesy of modern technology, Gold’s engineers and mechanics already have sussed out the problem: too much downforce on the front end has kept Gold suppressed in these early stages of its new parabolic Long trend. Indeed for the past four weeks, Gold has closed respectively at: 1386, 1388, 1384 and now yesterday (Friday) at 1391. ‘Tis a finishing range of just seven points within an overall four-week trading span of 87 points (from as low as 1336 to as high as 1423).

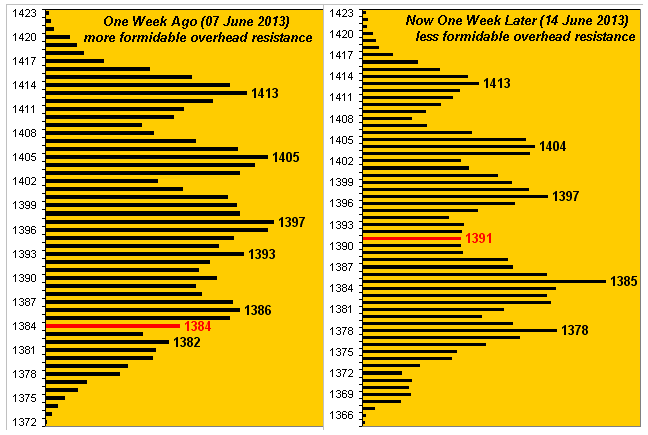

What’s brilliant about it all is that, via their telemetry, the engineers can see Gold’s trading profile on the left as it stood one week ago, such thicket of overhead resistance having kept price from moving up more freely, and thus necessitating a “wing adjustment”. Therefore by having the mechanics “take a little wing off”, the engineers now can see Gold’s trading profile on the right as it currently stands, Friday’s 1391 closing level as shown in red:

Looks comparatively less upside resistive now than was the case a week ago, non? Note as well the supportive apex at 1378, reminiscent of Base Camp 1377 at which the Gold Troops were able to consolidate following their uncharted voyage down along the Golden Archipelago to as low as 1322 in mid-April. The beauty of a trading profile is that ‘tis a living, breathing thing, as the oldest price/volume data in the study is regularly replaced with the latest. Which to an extent supports the fact the traders oft have short-term memories. (Were they long-term, support and resistance might forever contain markets in a box, ex-external forces). The point is: in tandem with the underlying guidance of Gold’s new parabolic Long trend, the now evident eroding of this overhead resistance ought more enable the freedom for Gold to accelerate higher.

Shocking the Shorts

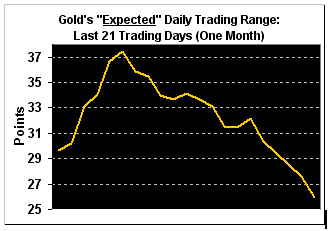

For the Gold Shorts, (a bad stance in which to be), their digestive acids must be in full refluxive churn through here, especially should they get a glimpse of the side-by-side profiles just displayed. The Shorts’ downside efforts and hopes are fading, if for no other reason than Gold’s “expected” daily trading range is narrowing without price having materially descended. Such range is a weighted-averaged calculation that assists the trader in determining as to where the low and high may arrive for each ensuing session; to wit, this next chart showing us what Gold’s “expected” daily trading range has been over the last 21 days:

As an example for using such data, with Gold currently at 1391 and its “expected” daily trading range at 26, were Monday to be a down day, Gold might move from no higher than 1397 to as low as 1371, or if instead an up day, from no lower than 1384 to as high as 1410.

Obviously one must work a myriad of other factors into determining specific price points, (such as taking into account profile apexes, trend measurements, inter-market correlations, FedSpeak and so forth). However, ‘tis good to at least have a sense of potential range, and if you are Short, (notwithstanding the wont of some traders to show they’ve large attachments), you best stay awake ‘round the clock as such narrowing of range elicits consolidation, which in turn with the aforementioned erosion of overhead resistance, suggests to me that Gold (as it emerges from the pits with its wing adjustment) is imminently moving higher.

Preparation for Penetration

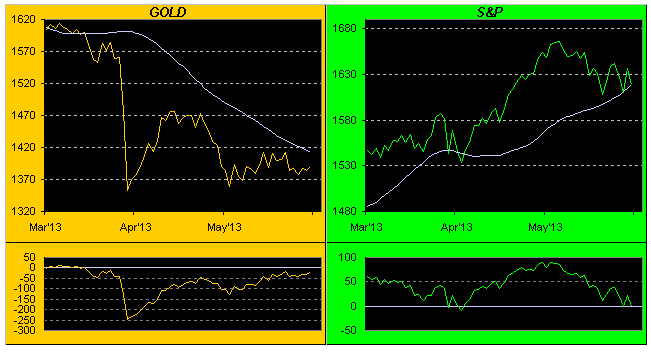

That’s right we’re talking Valuation. And certainly about which ‘tis worth getting excited as we go to this next two-panel chart of both Gold and the S&P 500. For the past three months, here are the daily closes of both markets along with their respective smooth, pearly lines that establish value relative to the price movements in the complex we call BEGOS (Bond/Euro/Gold/Oil/Spoo). Because the smooth lines move more ponderously than does price itself, as you regular readers know, penetration of valuation is the side for which to seek price follow-through. And to that end, Gold looks prepped to pop up through its smooth line whilst the S&P appears poised to plop down through its own:

Indeed the oscillators (price less valuation) at the foot of both panels are trending for Gold to move higher and the S&P lower. Moreover, these indications have already been advanced per the activity in the Baby Blues for both markets as shown below, again over the past three months:

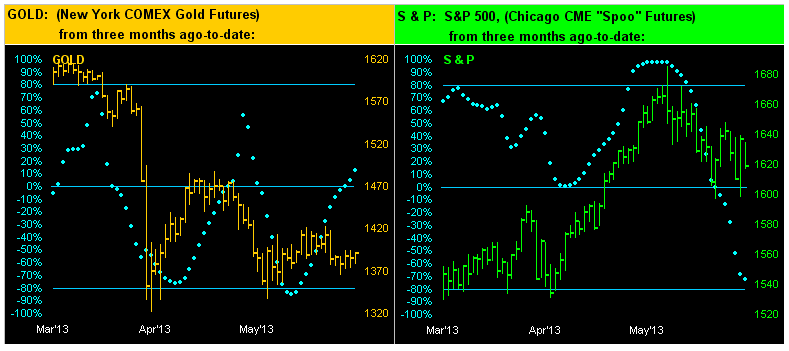

As you’ve come to understand in these missives, the baby blue dots represent the ~consistency~ of both markets’ 21-day linear regression trends. Such trend consistency falters, if price not outright reversing course, upon the Baby Blues moving toward the 0% axis after having been above 80% or below -80%. To be sure, Gold’s Baby Blues on the left still have a way to climb before declaring an uptrend to be firmly in place above 80%; however for the S&P on the right, knocking on the door of -80% is all but confirming that the stock market ought continue lower. In fact, as do ships in the night, wouldn’t it be lovely to see these two markets pass by one another at 1500?

“So, mmb, even though there are those analysts and people in media saying the stock market is cheap, you think lower still, huh?”

Oh do come along, Squire, you know me better than that. Here at 1627, the S&P remains terribly over-extended by my measures both technically and fundamentally. In fact, within this past week’s e-mail traffic, I remarked as I do on occasion, (tongue-in-cheek at times), to a valued reader that I’m sitting on the S&P futures bid to buy at 880. The response to that notion was sufficiently alarming that I wrote back, with the following explanation, and share it with you verbatim as follows:

~~~ “I’m sittin’ on da bid at 880” has become sort of an mmb tagline, although I wouldn’t be surprised a wit if we traded down to there. I’d originally selected 980 back around 2010/2011 when the S&P was in the 1100-1200 area, (and then was heartened shortly thereafter by Merrill Lynch in a call to clients saying by their own accord that was a reasonable downside target). But then I revised 980 to 880 because I felt that at 980, all the complacency would come back into the market on the notion that the worst was over, thus leading to a “scare” down to 880, (furthering fear of a move back to 666 which would not actually happen).

Given the “live” p/e of the S&P at this instant is 25.8x, proportionally from 1619 to 880 would put the p/e at 14.0x, which is a much more reasonably priced Index, (although still not “cheap” by business school rule of thumb).

‘Course, then there still is that 666 crowd lurking out there… ~~~

My point here to you great and good stock market types is not to dismiss the three-digit era of the S&P as a distant, never-to-be-revisited memory, which given directional negative correlation would be bring much higher prices for Gold. And ‘tis more than just about the worry of the Fed potentially tapering or even yanking out the stimulus plug, (of which I remain non-expectant, given the now downside trending of our Economic Barometer). ‘Tis the demand for dough that ‘twill make it go, (i.e. down), especially given the “need” to maintain a lifestyle and cover expenses, made even more daunting by the inadequate levels of retirement nest eggs. (Don’t worry, you’re not alone out there: I, too, shall likely have to write and trade until the night I fade).

Yet even with such reality of so many having to work ‘til they knee-jerk, I read this week that more Americans are quitting their jobs, thinking they can just go out and get one if needed. “It woiked boss! I convinced Harry to quit! Cha-Ching fer us!” I certainly hope the quitters know what they’re doing out there, for as stated in the fine print, hiring fell in March, April’s level was below that of February, and in totaling the data, the number of available jobs fell three percent to a seasonally adjusted 3.75 million. And that’s in a country with some 200+ million folks who are eligible to work, (which for you WestPalmBeachers down there is less than 2 jobs available for every 100 people).

Now as knowledgeable Gold followers, we all understand that with the demand for more dough comes the bending of governments to print more that is faux. Which in furtherance is naturally why we hold and stay Long Gold. Certainly the fundamentals to foster more debasive froth remain intact. For example, from the “Department of Redundancy Department”, we’ve just learned that Italy’s industrial production declined in April and that the country’s economy shrank more than was initially reported in the first quarter as the recession deepened. As a fellow over at Sunrise Brokers in London put it: “The data was actually quite bad.” Perhaps they ought more aptly rename their firm to Sunset Brokers.

Counter-intuitively to that, the Bank of Japan actually held the line on announcing further ¥en debasing measures to those already in place, (and a tip of the cap to Prime Minister Abe for suggesting some degree of lower taxes and deregulation – such moves have been known to work economic wonders). But here’s The But: no new stimulus from the BOJ creamed the Japanese market, and so too in sympathy, other bourses ‘round the world. You see, they know ’tis a bubble, the stock market. Take away stimulus, instead value markets against economic reality, and ‘tis suddenly gonna be “Uh-Oh…”, (or worse).

Also, as was penned in the FinTimes: “EuroZone banks have cut cross-border holdings of government and corporate bonds to such an extent they have wiped out all the progress towards the integration of the bloc’s debt markets achieved after the €uro’s launch.” Well that’s cute. And then add to it: “Banks may also have come under political pressure to help national governments – and have been encouraged to do so by supplies of cheap liquidity from the ECB.” Nice. Where’s that coming from? (Remember Cyprus?)

Finally there’s this from the blossoming UK: living standards are now reported as being at the lowest levels in a decade. (You’ll recall a just week ago how ‘twas all coming up roses on the British economic front, but now they’ve this. Seems a bit manic-depressive really, kind of like France). Nonetheless there’ll always be an England, (I mean there really will always be an England, won’t there? Oh-boy…)

Let’s wrap it here with the Gold Stack:

Gold’s All-Time High: 1923 (06 September 2011)

The Gateway to 2000: 1900+

The Final Frontier: 1800-1900

The Northern Front: 1750-1800

The 300-day Moving Average: 1616

The Floor: 1579-1466

Structural Resistance: 1463 / 1478 / 1527-to-1535 / 1554 / 1626 / 1675

Trading Resistance: 1397 / 1404 / 1413

10-Session “volume-weighted” average price: 1392, (range: 1423-to-1365 = 58 points or 4%)

Gold Currently: 1391, (weighted-average trading range per day: 26 points)

Trading Support: 1385 / 1378 / (Base Camp 1377)

The Weekly Parabolic: 1324

Structural Support: 1267 / 1228

Having made the wing adjustment, as Gold is now released from the pits back onto the track -- and in consideration of the Gold Positives above which have been discussed -- please be wary of all the clowns out there in their bogus S&P-powered Gold-Wanna-Be-Mobiles…

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Hits The Pits For A Wing Adjustment

Published 06/17/2013, 04:13 AM

Updated 07/09/2023, 06:31 AM

Gold Hits The Pits For A Wing Adjustment

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.