The September round of manufacturing PMI data brought some really interesting insights. I'll be talking through them in more depth later in the week, but I wanted to highlight 2 charts I thought particularly interesting and salient to the key global macro currents:

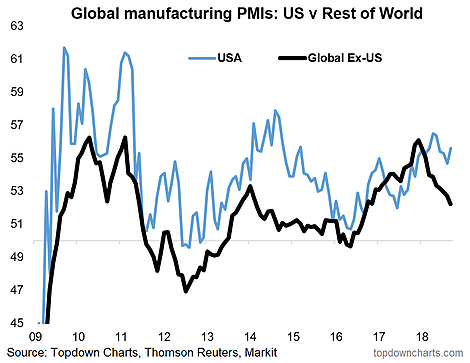

1. USA vs Global Ex-US Manufacturing PMI: This one shows how stark the divergence or decoupling has been between America and the rest of the world. Call it America first, or Trump triumph, for this brief moment it seems "Trumpnomics" (or Trumponomics?) is working... *

*There are of course a lot of moving parts, and we can talk about what's driving the divergence, but it's there and plain for all to see, and it reinforces the divergence and relative performance trends we've been seeing in asset markets. To me this chart says expect more strong USD, expect more US equities outperforming global, and watch out for potentially more casualties...

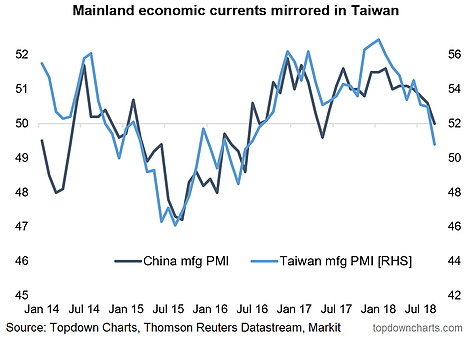

2. China Slowdown - China and Taiwan Manufacturing PMIs: This is something I've been talking about for a while - the combination of tariffs, previous policy tightening, softer EM, and a tapering out in property and export activity has cemented a Chinese economic slowdown. This has clear and pressing downside risks for commodities and EM as a whole... to a point.

You see, the thing with China macro is that a minor slowdown is a concern, but a major slowdown is a buying opportunity because you know the policymakers there have a low pain tolerance threshold for weaker economic growth. Hence at least in recent history it has paid to never get too bearish on China - in fact it's when China looks the worst which usually produces the best buying opportunities in China-linked and China-sensitive assets.

So watch this space... these are two charts and two major themes investors need to be on top of.