Gibraltar Industries, Inc.’s (NASDAQ:ROCK) shares gained more than 4% on Feb 28, after it reported fourth-quarter 2019 results. The company’s earnings and sales not only topped analysts’ expectations but also rose year over year on solid contribution from the Renewable Energy and Conservation segment.

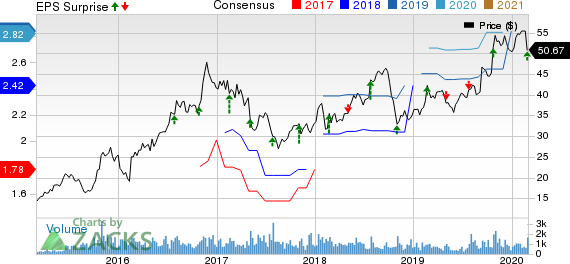

The company’s adjusted earnings of 62 cents per share beat the Zacks Consensus Estimate of 59 cents by 5.1%. The bottom line also increased 31.9% year over year on higher organic growth in Renewable Energy & Conservation, lower interest expense, and benefits from operational excellence initiatives.

Net sales of $258.1 million beat the consensus mark of $256 million by 0.8%. On a year-over-year basis, the top line increased 7.1%, out of which 5.3% was organic, led by the Renewables & Conservation business. Meanwhile, the acquisition of Apeks Supercritical contributed 1.8% to revenue growth.

Markedly, the company’s backlog was $218 million (as of Dec 31, 2019), up 35% year over year, as it increased participation in Renewable Energy and Conservation, as well as Infrastructure and Residential end markets.

Segmental Details

Residential Products: Net sales in the segment declined 1.1% year over year to $101.2 million during the quarter. A modest increase in volumes was partly offset by market price.

Adjusted operating margins contracted 30 basis points (bps) to 13.1%. The downside was mainly caused by unfavorable product mix, which was offset by improved material cost alignment and 80/20 simplification initiatives.

Industrial and Infrastructure Products: Sales in the segment decreased 9.9% year over year to $45.5 million. The drop was due to lower pricing and demand for core Industrial products. Notably, customers delayed purchases to optimize their inventory in a declining steel price environment.

Adjusted operating margins expanded 30 bps to 7%, backed by a more favorable mix of higher margin products and solid execution of 80/20 profit improvement efforts.

Renewable Energy and Conservation: Quarterly net sales in the segment rose 26.4% year over year (21.4% on an organic basis) to $111.4 million. The Apeks Supercritical acquisition contributed 5% to top-line growth. The uptick can be attributed to solid demand for its commercial greenhouse growing solutions, including design, structures system integration, field project management and general contracting services. Meanwhile, segment backlog grew 51% year over year owing to healthy market dynamics.

Adjusted operating margins of 15.2% were up 360 bps on better operating execution, volume leverage, and favorable product and vertical market mix.

Costs and Margins

Selling, general and administrative expenses increased 25.1% year over year to $45.2 million. As a percentage of sales, the metric increased 230 bps year over year. Adjusted operating income grew 25.1% in the quarter and margin of 10.2% expanded 150 bps year over year.

Balance Sheet and Cash Flow

As of Dec 31, 2019, Gibraltar had cash and cash equivalents worth $191.4 million compared with $297 million at the end of 2018.

In 2019, the company provided $129.9 million cash from operating activities compared with $97.5 million in the year-ago period.

2019 Highlights

Adjusted earnings of $2.58 per share advanced 20.6% from $2.14 earned in 2018. Revenues of 1.05 billion grew 4.5% from a year ago, buoyed by higher contribution from the Renewable Energy & Conservation segment. Adjusted operating margin also grew 40 bps to 10.5% in the year.

2020 Guidance

Gibraltar expects consolidated revenues in the range of $1,210-$1,230 million. The company projects adjusted earnings in the range of $2.95-$3.12 per share. Adjusted operating income is expected in the range of $133-$141 million. Adjusted operating margin is expected in the range of 11-11.4%.

Zacks Rank & Other Key Picks

Currently, Gibraltar currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks in the Zacks Building Products – Miscellaneous industry include Arcosa, Inc. (NYSE:ACA) , Armstrong World Industries, Inc. (NYSE:AWI) and Installed Building Products, Inc. (NYSE:IBP) , each carrying a Zacks Rank #2.

Arcosa’s earnings for the current year are expected to rise 12.3%.

Armstrong World Industries’ earnings for 2020 are expected to rise 10.7%.

Installed Building Products has three-five year expected earnings per share growth rate of 16%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Armstrong World Industries, Inc. (AWI): Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK): Free Stock Analysis Report

Installed Building Products, Inc. (IBP): Free Stock Analysis Report

Arcosa, Inc. (ACA): Free Stock Analysis Report

Original post