On Nov 15, we issued an updated research report on Genomic Health Inc (NASDAQ:GHDX) , a global cancer research company with focus on advanced molecular diagnostics.

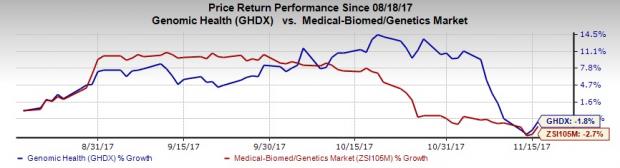

Genomic Health has been trading below the broader industry over the past three months. The stock has lost 2.7%, wider than the broader industry’s 1.8% decline.

Revenues in the third quarter of 2017 lagged the Zacks Consensus Estimate due to disruption from the hurricanes in certain regions of the United States (estimated to have affected domestic test volumes by approximately 3%). The company’s rising operating losses also continue to be a concern. Its sole reliance on profitability of Breast Oncotype DX test is another challenge to cope with. Above all, management’s decision not to issue any guidance has been discouraging too as it failed to provide us with visibility about the company’s upcoming performance.

However, we are encouraged by the year-over-year rise in revenues, driven by solid performances in the United States and internationally. During the third quarter, international test volumes expanded 14%, representing 26% of total test volumes in the quarter. While revenues grew around 7% year over year.

So far, Genomic Health has witnessed a healthy progress with regard to establishing coverage for its Oncotype DX breast cancer test. In 2018, Genomic Health expects several key catalysts to drive strong revenue growth. These catalysts include the anticipated implementation of both PAMA (Protecting Access to Medicare Act) reimbursement at a higher level than the 2016 invasive breast rate and AJCC (American Joint Committee on Cancer) staging criteria that will become effective in January 2018.

Within prostate cancer business, the Oncotype DX Genomic Prostate Score test received a positive Local Coverage Determination to expand Medicare coverage by Palmetto GBA. The company also made some positive developments for its Oncotype DX Breast Recurrence Score tests. In addition, it established private coverage for the test in Germany.

Zacks Rank & Key Picks

Genomic Health carries a Zacks Rank #3 (Hold). A few better-ranked medical stocks are PetMed Express, Inc. (NASDAQ:PETS) , Align Technology, Inc. (NASDAQ:ALGN) and Myriad Genetics, Inc. (NASDAQ:MYGN) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10%. The stock has surged roughly 77.9% over a year.

Align Technology has a long-term expected earnings growth rate of 28.9%. The stock has skyrocketed 156.3% in a year’s time.

Myriad Genetics has a long-term expected earnings growth rate of 15%. The stock has soared 82.1% in a year.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Genomic Health, Inc. (GHDX): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research