Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Meta (NASDAQ:META), Nvidia (NASDAQ:NVDA), and Alphabet (NASDAQ:GOOGL) are the AI pentad for long-term exposure. Yet, some Big Tech players have better prospects than others.

According to a Bloomberg Intelligence report on March 8th, the AI demand is heading for consistent yearly jumps. At a 43% compound annual growth rate (CAGR), the generative AI market is poised to reach $1.3 trillion by 2032.

This includes image generation, semantic image-to-photo translation, fraud detection, financial advice and loan creation, text-to-video generation, and video prediction, and is used in surveillance and self-driving. For stock investors, it is easy to see how such a market would develop.

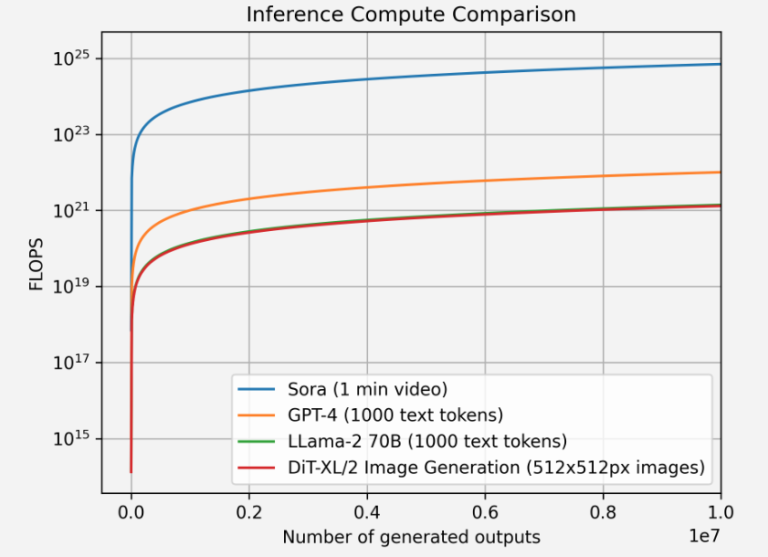

After all, Big Tech has perfected the formula for attracting, funding, and absorbing startups. Even more importantly, scaling up AI generative content requires an extensive infrastructure. Text-to-video generation alone, such as Sora, would take massive computing resources.

Image credit: Matthias Plappert via Factorial Funds

And only large companies can provide this hyperscaling cost-effectively. These five companies have already demonstrated their scaling prowess.

Microsoft

Within the AI deployment arena, Microsoft is alongside Adobe (NASDAQ:ADBE) with practical products. Its AI Copilot has been fully integrated into Microsoft’s legacy software suites, in addition to integrated image generation via Bing.

Furthermore, the company announced AI-powered Surface PCs for businesses, such as Surface Pro 10 and Surface Laptop 6, featuring the latest Neural Processing Units for AI workloads. Most importantly, Microsoft Azure is gaining ground as the go-to cloud service.

In the latest Q2 FY24 earnings, Microsoft’s cloud services revenue increased by 30% year over year. To corner this high-growth market, Microsoft’s Founders Hub provides up to $150,000 in Azure credits for AI-leveraging startups.

Amazon

While Azure has a hefty cloud market share, Amazon Web Services (AWS) is at the top, with a 31% market share as of Q4 2023. Sales increased by 13% YoY to $24.2 billion. Seeing Microsoft’s encroachment, Amazon is deploying a free “AI Ready” program to train 2 million people by 2025.

In March, Amazon announced a collaboration with Nvidia to integrate Nvidia’s Blackwell GPU platform into AWS cloud infrastructure. As for practical use cases, the logistics giant deployed Rufus AI shopping assistant and e-commerce features in which AI agents generate product listings for direct-to-consumer websites. Carrying on the AI theme, AWS Healthcare Customers will have symplrAI and Amazon Bedrock as tools to automate complex workflows.

Meta Platforms

Of the Magnificent Seven, Mark Zuckerberg-led Meta has the highest year-to-date gains, at 46%, excluding NVDA. And for a good reason. Meta has spread its corporate fingers in all the critical pies of all the Big Tech companies. The Oculus Quest lineup dominates the VR headset market as the most affordable solution.

Although Meta’s Reality Labs is yet to make a profit, this is a small development price compared to revenues from Facebook, Instagram, and WhatsApp, totaling $39 billion net income for full-year 2023, a 69% uptick from 2022. In July, Meta is slated to launch its Llama3 LLM.

Whether it will be as bound by “AI safety” as Gemini is yet to be seen; what is for sure is that Meta will have a massive infrastructure of 600,000 GPUs by the end of the year to power the company’s take on AI generative content.

Nvidia

Poised to overtake Apple’s valuation at this rate, Nvidia took over the AI demand reigns. Although Intel and AMD can erode Nvidia’s market share, it is likely that Nvidia’s scaling operation will continue to exert market dominance.

However, from an investing perspective, it is likely that Nvidia is overvalued if long-term pressure from Chinese Huawei is accounted for. Nvidia’s price-to-earnings ratio is estimated to be cut in half in 2025, to 42.41 from the present 80.24. Moreover, Nvidia’s price-to-sales ratio of 19.4x is also higher than its five-year average of 15.8x.

With this in mind, investors should take care to receive NVDA exposure in the next sharp dip.

Alphabet

Although Google’s Gemini launch was a debacle, large language models (LLMs) are tweakable. Of all the Big Tech companies, Alphabet has the greatest pool of data to make it so. With an 82% search engine market share as of January 2024, it is safe to say that Google has plenty of room for blunders.

Meanwhile, Alphabet ended 2023 with $73.8 billion net income, a 23% uptick from the year prior. To advance AI initiatives and training, Alphabet announced the next-gen AI chip, Cloud TPU v5p, purportedly having up to 3x faster performance. If anything, the Gemini fiasco serves as a buying on the weakness opportunity for stock investors.

After all, negative coverage’s staying power has short legs in the age of social media. That said, all four companies are likely to outperform Alphabet if its corporate culture remains intact.

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

***

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.