Following the 21 November 2012 announcement and subsequent EGM, Gemfields (GEM.L) completed the acquisition of Fabergé on 28 January 2013. Management states that by extending control over this high-end luxury goods platform with a global brand and exceptional heritage, Gemfields can position itself as a globally recognised coloured gemstone champion. The market will need to absorb the dilutive effect of a substantial increase in issued capital, which downgrades short-term earnings estimates, and assess the ambitious strategy to rapidly expand the Fabergé business.

Fabergé acquisition

The all-share deal gave Gemfields a 100% interest in Fabergé through the issue of up to 214m Gemfields shares. This values the purchase at c £58m (US$91) at the current share price (27p). Fabergé is currently loss-making, but management targets profitability through expansion and cost efficiencies. We estimate that the acquisition could become cash accretive to Gemfields within four years. The Pallinghurst Group now has a direct plus indirect interest in Gemfields of 49.3% following the unbundling of the Fabergé equity holdings in the Rox consortium.

Background and strategy

The iconic Fabergé brand was originally established in Russia in 1842. In 2007, the Unilever-owned portfolio of brands was acquired by Pallinghurst, which subsequently established the brand’s new business, licences and trademarks. Fabergé currently has six outlets covering Geneva, London, Hong Kong, Ukraine, and New York, and the strategy is to open 20 new stores over the next 10 years, with a long-term target of 71 stores by 2033.

Gemfields’ vision

Gemfields has an enviable status in restructuring and expanding a major ethically sourced premium emerald mining operation and creating a benchmark in grading and marketing rough stones. This will soon be complemented by a ruby operation. Management is confident that Fabergé will help accelerate demand for the company’s finest gems by providing a directly controlled international showcase.

Valuation: NPV per share of 47.7p

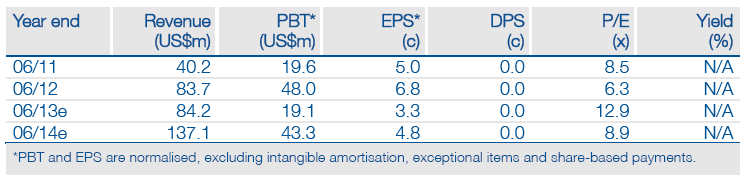

Our model and valuation for the enlarged company is 47.7p a share (previously 57.5p), reflecting the dilutive short-term impact of the merger. The valuation assumes success of the ambitious expansion strategy for the Fabergé business, with an expectation of continued growth in the luxury goods investment sector. There is a longer-term strategy to apply for listing on the LSE main board.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gemfields: Faberge Challenges Ahead

Published 02/09/2013, 10:32 PM

Updated 07/09/2023, 06:31 AM

Gemfields: Faberge Challenges Ahead

Fabergé challenges ahead

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.