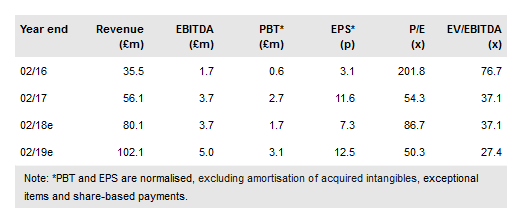

Gear4music Holdings PLC (LON:G4M) finished the year in robust style, with 43% revenue growth. While marginally below our forecast, this represents good momentum going into FY19, where we only forecast 27%. While continued investment in scale means costs remain at planned levels, resulting in a pause in FY18 earnings growth, prospects for further market share gains remain bright and we see the current share price as below fair value.

Strong revenue growth, momentum sustained

G4M has traded strongly throughout FY18, with a 39% increase in active customers and a 3.25% conversion rate. Against an atypical base in FY16, 41.7% revenue growth for September-December 2017 was a very satisfactory result. In January and February 2018, growth has remained consistent at a robust 41.3%, representing acceleration against 38.7% in the previous year. This provides good momentum going into FY19.

To read the entire report Please click on the pdf File Below: