The European debt contagion has been “kicked down the road” as Spanish and Italian short-and-long term bond yields have moderated recently given the ECB “plan” to buy bonds of up to three years in maturity...but only if asked; and only if conditionality is imposed upon those asking. The Fed has also changed its game from “inflation-fighting” to “unemployment fighting” with the new move to QE-4; and with any war -- they will go further and farther than anyone believes in printing money to achieve their ends...regardless of their balance sheet concerns.

STRATEGY: The S&P 500 remains above the 160-wma long-term sup- port level at 1275; and the standard 200-dma support level at 1404. Collectively, with the breakout above the Sept-2012 highs at 1475 has run into major overhead resistance, and shall likely find “rough sledding” at this level given the relative under performance of the NASDAQ 100. We are long of gold; and we are short the Russell 2000.

CAPITAL MARKET COMMENTARY

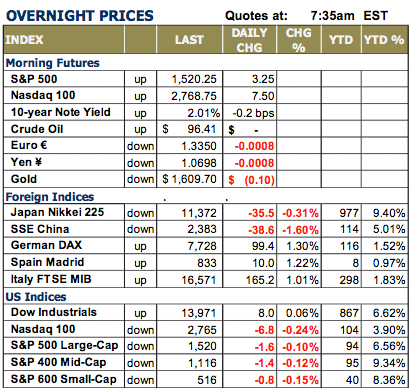

WORLD MARKETS ARE MIXED AMONGT REGIONAL LINES: Asian bourses closed lower on their trading sessions, with China dropping -1.6% and Japan falter- ing modestly by -0.3%. In Europe however, the bourses are sharply higher on news that the German ZEW investor confidence index rose to 48 from 32...the consensus was for a rise to 35. This pushed Germany’s DAX higher by +1.1% and France’s CAC higher by +1.3%, which is actu- ally greater than the rises seen in Spain and Italy of roughly +1.0%. What was lost this morning was the France’s Eco- nomic Minister noting that the French economy was going to grow markedly slower than its target – and – the deficit target was going to be missed as well. Outside of this, we are seeing the U.S. dollar rising once again, with the pre- cious metals rising – and energy mixed.

On the US ECONOMIC FRONT, there is only one report today of mentioning – the NAHB Housing Index for February, which is a homebuilder confidence index. Consensus is for a rise to 48 from 47, of which 47 is the very same number extant during January and December. Thus, it has stagnated just a bit, and we wouldn’t be surprised to see it do so once again. Also of note, it is being reported that President Obama is about to turn up the heat on Republicans over sequestration that will kick-in on March 1...which is next Friday. If we had to venture a viewpoint, we would be- lieve that the Republicans are about to allow the cuts to take place, for they will not be seen caving in to their base a second time. And given the market’s extended nature, then certainly this could cause a very short and sharp correction as we saw during late-December.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Futures Edge: Wednesday, February 18

Published 02/19/2013, 10:06 AM

Updated 07/09/2023, 06:31 AM

FX Futures Edge: Wednesday, February 18

“FORECAST” STOCKS

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.