STOCKS:

The fundadmental backdrop is likely to be volatile: the Italian election is not yet resolved in terms of a sitting government; US “seques- tration” is in place; and China is moving to “dampen” their housing mar- ket. These issues, coupled with the Cyrpiot depositor saga. will dominate the headlines in the short-term, but longer-term -- the euro-zone recession, the likely decline in corporate margins/ profitability and the Fed’s potential tapering of QE will serve as strong headwinds.

STRATEGY: The S&P 500 remains above the 160-wma long-term sup- port level at 1287; and the standard 200-dma support level at 1424. Col- lectively, with the breakout above the Sept-2012 highs at 1475 has run into major long-term overhead resistance, and should find “rough sled- ding” in the weeks ahead as a top is formed. This, coupled with our models in increasingly negative lights puts the risk-reward to the downside.

CAPITAL MARKET COMMENTARY

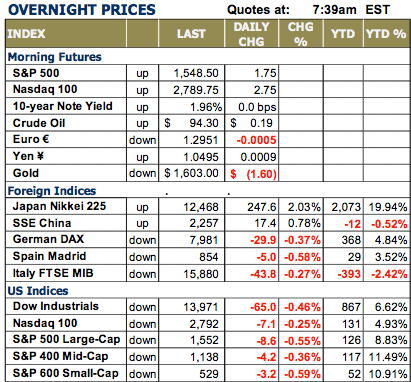

WORLD MARKETS ARE SOMEWHAT CONFUSED THIS MORNING as Asian bourses rose in a rather nice manner with Japan higher by +2.3% and China higher by +0.8%. However, this is where it ends, for European bourse are all trading lower on their sessions, although off their lows and back towards the unchanged line. The news of the day relates to Cyprus, and the Eurozone’s decision that Cyprus must “tax” its depositors to the tune of €5.8 billion in order to receive a €10 billion bailout. The original proposal was for those holding below €100,000 to be taxed 6.75%, while those above would be taxed at 9.9%. But the parliament is deciding whether or not to exempt those making €20,000 or not. The Eurozone authorities say the Cypriots can raise the money in other manners, but it has to be raised. This remains a concern to many; but not to most as contagion isn’t yet a prevalent view. It does in our opinion; show the European authorities still grappling with the deleveraging situation.

U.S. ECONOMIC FRONT: There is very little today as only the Housing Starts and Building Permits have been released – and both were better than the consensus expectations. Hous- ing Starts rose +0.8% month/month from an annual rate of 910k to 917k; consensus was for 915k...so a small beat, but a beat none- theless. Building Permits were higher by +4.6% month/month from 904k to 946k; the the consensus was for 925k; again, a beat and a beat is a beat right now. Also today, the FOMC begins their two-day meeting ending in tomorrow’s statement, economic projections and finally the press conference at 2:30pm ET.