STOCKS:

As 2012 begins, very little has changed from the end of 2011: the European debt contagion remains in place and is growing, China remains on a growth deceleration curve — while the US is showing stable growth, with an increasing probability of a recession. What is clear to us, is that at this point — the US is better positioned than the rest of the world, which simply means that it shall outperform yet again this year.

STRATEGY: Technically speaking, the S&P 500 remains above longterm support at the 45-mema at 1190; which is critical given it delineates bull & bear markets. But thus far, the 2012 rally has seen very little weakness, and appears ready to embark upon another leg higher — a weak leg higher to be sure towards the 1350-to-1370 zone; a correction of some substance, but then perhaps a “moon shot.”

WORLD STOCK MARKETS ARE HIGHER THIS MORNING as the news flow continues out of Asia and Europe…there is very little in the US going on this week in terms of economic reports. First, let’s note that China’s inflation figures were released, and they were “hotter” than anyone expected – showing a rise of +4.5%. The consensus was for something a bit lower at 4.3%. This cast a pall for a short while in Asia that the Chinese authorities wouldn’t have the leeway they thought at first to ease monetary policy. We are record as saying we are not of the opinion of “soft” Chinese landing, for her monetary policy tools are very blunt – and there is very little evidence in economic history of the “soft-landing.” In fact, the term was coined during the “Maestro’s” days at the Fed when at the time he was revered as a monetary savant. Yes, we’re speaking of former Fed Chairman Greenspan.

Moving on, in Europe – Greece and the “troika” have yet to agree to conditions for release of the 2nd bailout tranche, and there reports that it won’t get done until the weekend. Once again, deadline after deadline passes, and there is no agreement. The market has clearly become used to the fact that these are difficult negotiations, and we are coming to the conclusion if they haven’t already that Greece will ultimately default. Perhaps it won’t occur this week, perhaps not in March when the next bond payment comes due – but certainly eventually and probably by the end of this year.

Also of interesting in Europe, the Bank of England (BOE) and the European Central Bank (ECB) have both met and both have allowed their overnight repo rates remain the very same: 0.5% and 1.0% respectively. The consensusmakers were right in this regard, and they were right in the regard that the BOE decided to implement another £50 billion QE campaign to bring the total campaign to a total of £325 billion. However, they did surprise the market by announcing a change in the buckets of gilt bonds they would buy – preferring to buy more at the short-end of the yield curve rather than the long-end. This has strengthened the Pound, and done very little to the S&P futures…which are trading several points around the unchanged level.

TRADING STRATEGY: We have come to admire the resilience of the US stock markets these past few weeks as they have had many fundamental as well as technical reasons to decline, but the fact of the matter is that buyers were found on the dips. However, the short-term has become a bit more worrisome given the extended nature of several technical measures, which argues strongly that any move into our resistance zone at 1350-to-1370, and subsequent “stalling” shall allow for a well-needed correction. We are unsure as to the depth and length of the correction, but we wouldn’t be surprised to see a sideways trading range develop between 1290 and 1370 to work off the current overbought condition.

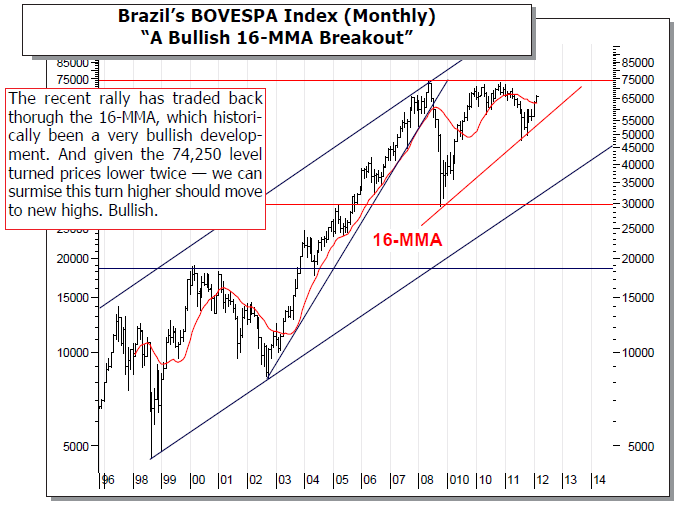

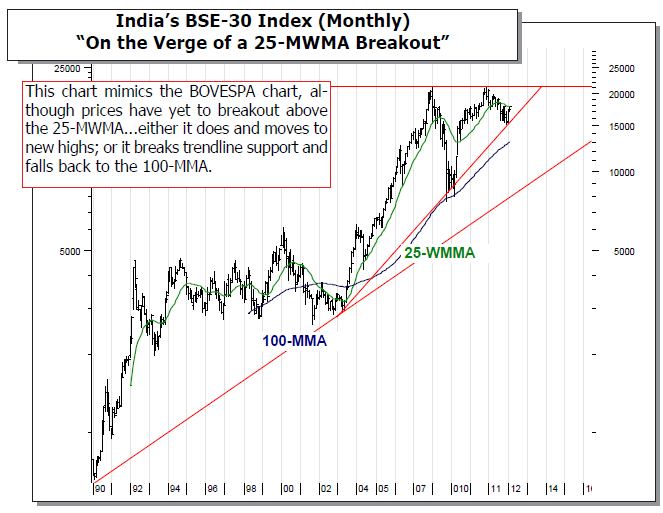

We should also note this morning that two markets considered “emerging” are breaking out and on the verge of breaking out to the upside on a monthly basis. Brazil has broken out, while India is on the precipice of doing so – although only at month’s end will we be entirely sure. We find this rather bullish given the monthly charts are better at determining the primary trend at hand.

As for the US markets, we continue to like “parts” of it, and in particular the energy sector as from a technical perspective, we see variations of bullish pennants or consolidations below their overhead 200-day moving averages. And in the case of coal stocks – our favorite speculative group at present, they are forming bullish declining wedges. The riskreward is favorable for sharp moves higher in this group. However, we do not particularly care for consumer discretionary or technology shares at current levels.

Looking ahead, and given the current overbought condition into the 1350-to-1370 selling zone – we are reticent to add any further long positions unless it is in the energy sector. However, as we trade into “the zone”, we shall look to add a short-term short Russell 2000 position (TWM) to hedge our long positions.

To Read the Entire Report Please Click on the pdf File Below.