STOCKS:

The world economy is muddling through: the US payroll tax increase and “sequestration” are headwinds to the US economy; China is being pressured by Japan, and both the US and China housing market are “weakening”. The Eurozone remains mired in “inaction”, athough showing signs of growth. Quite clearly, we feel risk is being mispriced at current levels given the economic backdrop and developing pressure upon corporate revenues/margins/earnings. At some point, the market will view the central banks will be non-sequitur.

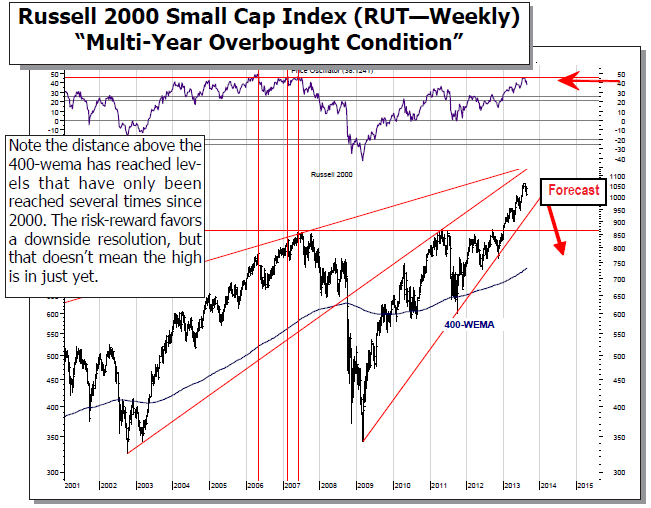

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1363; and the standard 200-dma support level at 1562. But perhaps more importantly, the distance above the 160-wma “falied” at the +23- to +25% zone that is our “bubble-like rally” threshold. Hence, a correction of some proportion is forthcoming — perhaps -15% or more.

WORLD MARKETS ARE MIXED THIS MORNING as pundits attempt to figure out just that US President Obama’s “change of heart” regarding consulting Congress and receiving a vote as to whether the US plans a limited strike against Syria, or whether they do nothing other than trying work this out diplomatically. There is going to be quite a few a ound bites out of all the interested parties in the leadup to Congress returning from summer vacation on September 9th; and then debates within the body itself as to what types of strikes and strategy shall be employed, and the impact upon other geopolitical actors. This will cause confusion in the markets, but for the moment it has resulted in a “positive” trade of higher stock prices, higher bond yields, and a higher US dollar. If anything, these are tenuous gains, and we believe this is simply just a respite before more volatility enters the capital markets

To Read the Entire Report Please Click on the pdf File Below.