Target Healthcare REIT (LON:THRLT) has recently raised an additional £94m in new equity and has extended its debt facilities by £40m, providing the capital resources to pursue an immediate investment pipeline of more than £100m. The strength of the pipeline and flexible debt facilities limit the drag from cash, while the expanded portfolio offers further diversification and scale economies to counter increasing asset prices. The shares have slightly de-rated during the process and offer an attractive 5.8% yield and growing dividend, which we expect to be fully covered on a fully invested basis.

Significant new capital for growth

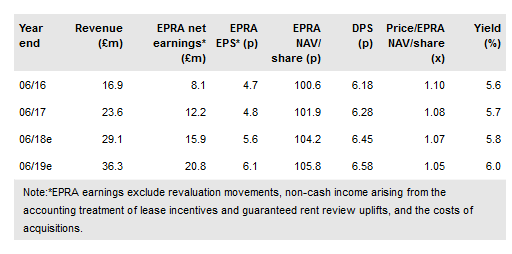

With £94m of additional equity and borrowing facilities increased to £130m, our revised estimates allow for £140m of new committed investment by the end of FY19, with the majority (c £120m) in the current year. Including existing commitments, we believe this would represent full investment, with borrowing facilities fully drawn and a net LTV of c 25%. The equity raising (at 108p) has no material effect on EPRA NAV per share (104.4p at end-2017) despite acquisition costs. Full dividend cover is delayed, but at an assumed 6.25% average yield on investment we expect 102% cover in FY20, as investments made by the end of FY19 make a full contribution to earnings.

To read the entire report Please click on the pdf File Below: