MercadoLibre (NASDAQ:MELI) , which operates the largest online marketplace in Latin America through its e-commerce and payment services, has been witnessing a gloomy second-half 2019.

We note that MercadoLibre is making every effort to bolster its e-commerce business further by promoting branding and loyalty. Further, its strengthening mobile wallet initiatives have been driving total payment volume.

However, increasing warehousing cost of managed network and expenses related to infrastructure transition on public clouds are impacting the company’s profitability. Moreover, costs related to free shipping subsidies and discounts on mPOS devices are weighing on margin expansion.

Additionally, rising inventory cost of the company thanks to increasing sales of mPOS devices remains a headwind. Further, rising branding and marketing initiatives are taking a toll on margins.

Furthermore, mounting interest accrual on convertible bonds and accumulating bad debt in the company’s credit business in Brazil remain major concerns. These are likely to impact the company’s financial performance in the near term.

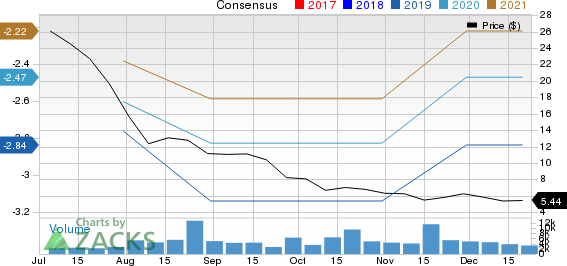

Downward Estimate Revisions

We believe all the above-mentioned factors currently hurting MercadoLibre are expected to persist in the upcoming quarters. Apart from these factors, there are geo-political concerns, which do not bode well for its cross-border initiatives. Further, macro headwinds in Argentina are risks.

Additionally, MercadoLibre is facing tough competition from Amazon (NASDAQ:AMZN) , which dominates the e-commerce market and putting strong efforts to bolster presence in Brazil.

All these negatives are affecting investor sentiments regarding the stock.

Further, the Zacks Consensus Estimate for 2019 has been revised down from earnings of 66 cents per share 60 days ago to a loss of $3.05.

Further, the Zacks Consensus Estimate for 2020 has been revised down from earnings of $2.14 per share 60 days ago to a loss of 97 cents.

Currently, MercadoLibre has a Zacks Rank #5 (Strong Sell).

E-commerce Prospects to Aid These Stocks in 2020

The fast-paced world we inhabit has made e-commerce a part and parcel of our day-to-day lives. The sector continues to grow driven by rapid proliferation of smartphones and Internet globally.

We believe strengthening online retail shopping, bolstering the adoption rate of online payment solutions and growing online travel bookings will continue to drive growth in this particular market.

Further, growing proliferation of m-commerce and infusion of AI and augmented reality into e-commerce services that are becoming mainstream, are major positives.

These factors have helped the Emerging Markets Internet & Ecommerce ETF (EMQQ) growth 33.6% on a year-to-date basis compared with the S&P 500 Composite’s rally of 27.2%.

Per a report from Statista, revenues in the worldwide e-commerce market is expected to hit $2.9 trillion by 2024 by witnessing a CAGR of 9% between 2019 and 2024.

Though MercadoLibre’s prospects may not appear appealing at the moment, there are some e-commerce stocks that offer good investment opportunities in 2020.

Here we pick three stocks that not only benefit from the aforesaid strong fundamentals of the e-commerce space but also carry a Zacks Rank #2 (Buy), making them good investment opportunities. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our Picks

Groupon (NASDAQ:GRPN) based in Chicago, IL operates a website that offers daily discount deals via which it acts as a third-party marketing agent and sells vouchers online known as Groupons.

The company is benefiting from strategic partnerships. Its tie-up with Grubhub enables customers to order food delivery from a wide range of restaurant partners via its own platform. Further, it recently entered into an alliance with DerbySoft, provider of hotel distribution solutions, to enhance the accessibility of Groupon Getaways travel business across notable hotel brands.

Additionally, the company’s introduction of Groupon Select membership program is a positive as it is likely to bolster user engagement and generate repeated purchases owing to extra savings and other perks.

The Zacks Consensus Estimate for 2020 earnings has moved up 3.6% to 29 cents per share over the past 60 days.

Tel Aviv, Israel-based Fiverr International (NYSE:FVRR) operated a platform that connects businesses of all sizes with freelancers offering digital services.

The company’s marketing efficiency and strong focus toward product and technology enhancements remain major positives. Further, launch of four industry stores namely – Gaming, E-commerce, Architecture and Politics will aid the company in expanding catalog and gaining momentum across larger businesses.

Notably, the Zacks Consensus Estimate for 2020 loss has narrowed over the past 60 days from 74 cents per share to 60 cents per share.

Berlin, Germany-based Jumia Technologies (NYSE:JMIA) operates an e-commerce platform offering products, which includes clothing, accessories, health products, beauty products and a range of products for children.

The company’s robust logistics services, expanding seller base and wide range of product offerings remain key catalysts. Further, it offers services like restaurant food delivery, hotel and flight booking, classified advertising and airtime recharge are likely to reinforce its position in the e-commerce market.

Notably, the Zacks Consensus Estimate for 2020 loss has narrowed over the past 60 days from $2.83 per share to $2.47 per share.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 top tickers for the entirety of 2020?

These 10 are painstakingly hand-picked from over 4,000 companies covered by the Zacks Rank. They are our primary picks to buy and hold. Start Your Access to the New Zacks Top 10 Stocks >>.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

MercadoLibre, Inc. (MELI): Free Stock Analysis Report

Groupon, Inc. (GRPN): Free Stock Analysis Report

JUMIA TECH-ADR (JMIA): Free Stock Analysis Report

Fiverr International Lt. (FVRR): Free Stock Analysis Report

Original post

Zacks Investment Research