Small-cap stocks have earned the reputation as the ‘wild card’ of the stock market game. But do these tiny firms deserve the notoriety and can investors mitigate some of the risk?

While definitions may vary, a small-cap stock is often defined as having a market capitalization (outstanding shares multiplied by share price) between $300 million and $2 billion. What other characteristics do we generally associate with this type of stock?

- Illiquid trading

- Over-the-counter exchanges

- Extreme price volatility

- Low quality firms with higher risk of bankruptcy

Investors desiring to buy into these smaller companies often look for the next Microsoft (MSFT) or Apple (AAPL) in its infancy stage. They investigate the company’s story looking for the David that could take out Goliath for a long-term upside gain of 10 or even 100 times their original investment.

Let’s examine these caveats and myths one at a time to see if we can devise a small-cap strategy with less risk and more upside gain than a traditional buy and hold approach.

Volatility Can Be Your Friend

Small-cap volatility is often used in the same sentence as risk and potential loss. While huge gains are made during good markets, you can expect prices to plummet in bad ones. There are many ways to mitigate much of this risk but the first technique will turn the volatility foe into a friend. The process lies in timing the market.

Before we take another step, is market timing really possible? Many analysts say no. They claim that statistical testing has not yet proven the ability to time the market. Others claim that ‘black swans’ or individual days of extreme market moves, cannot be forecast in advance. But is this what market timing is about?

The Truth about Market Timing

For me, market timing is not cherry-picking isolated days of large price advance – quite the opposite actually. I look for broad market trends that may last years. And when analysts claim that the jury is out with quantitative testing, I like to point out the difference between economic and statistical significance. Standard Student t-statistics require market timing models to produce returns three times higher than buy and hold methods. Yet market timing is not synonymous with market outperformance, but it is closely linked to risk reduction. You will achieve identical gains with market timing in a bull market, but reduce your holdings when a bear market is probable.

You are not dealt better cards than other poker players, but you are more adept at knowing when to hold and fold them. If market timing achieved twice the annual gains with half the downside risk of traditional buy and hold investing, most of the current tests would reject this as null. If some stubborn mathematician wants to invest with higher risk until his statistical model delivers three times the gain, I’ll let him do so. I’m sticking with market timing.

There are a variety of market timing approaches that include analyzing company earnings, price trends, fundamental valuations, institutional activity, sentiment indicators and more. By applying a market timing filter to your small-cap strategy you will be investing when the upside is more likely, thus making the volatility work for you instead of against you. And you will be sitting on cash when a downside is most probable – thus lowering your downside risk.

The market timing model I use analyzes broad market earnings trends in conjunction with a secondary confirmation signal on the S&P 500 price chart. When enough companies slash forward earnings estimates for an extended period of time, this signals a soft market and a price drop is likely. I confirm this with a price trigger.

Liquidity and Exchange Risk

Are you worried about the risk of thinly traded stocks on exchanges of ill-repute exacerbating downside volatility? Then don’t buy these illiquid over-the-counter stocks. Limit yourself to companies on major exchanges that have enough liquidity so your $1,000 trade doesn’t make the price double and selling a small amount won’t drop the share price to its knees.

This strategy requires that a minimum of $250,000 worth of shares traded daily – but usually a whole lot more. This will mitigate some of the volatility risk associated with illiquid stocks.

Low Quality Firms with High Bankruptcy Risk?

While there may be some low quality firms in the small-cap mix and a higher percentage of small firms fail than do larger established ones, this need not be a risk factor on your small-cap plate. What makes a firm low quality? Are you concerned about a lack of cash flow, low intrinsic value, thin margins or meager growth prospects? Stock screening tools are common nowadays and they allow you to separate the wheat from the chaff. If you purchase low quality firms, the fault usually lies with the lack of due diligence and screening where the investor buys the story but fails to dig into the reality.

In addition to targeting higher quality firms you can reduce your holding period from years to weeks or months. Thus, if you purchase a strong stock today, it is unlikely that it will turn belly up next month without any warning.

But What Is the Story Behind It?

Some investors feel the need analyze the company’s distant future to determine the potential upside. Consider another view. If you purchased Apple in the mid-80s for $3 per share and sold it recently for $600, you have a compound annual growth rate of 23.61%. Not bad, especially since you achieved this by holding a single stock. It is unlikely, however, that you can repeat this success over and over.

Instead of attempting to sift through thousands of companies looking for the one that might make it big, why not trade using a strategy for repeatable results? Small-cap strategy does not depend on discovering the next Microsoft; you buying a certain breed of small-cap stock when a small upside is probable over the next 4 weeks. You re-balance every month for an annual return that rivals the investor who discovered Apple. While past gains do not dictate future ones, the sub-$15 small-cap strategy has averaged robust returns over the past 11 years without the need to read a single story.

Investor Progression

In years past, strategizing with small-caps could only be executed by a market professional. But the investing world has changed putting technology, institutional data and computing power within the reach of everyone. Sophisticated screening software allows the strategist to quickly scan for high-quality small-cap stocks during bull markets when a short-term price rise is most likely. Innovative brokerages allow for low-cost basket-trading which means you can trade multiple portfolios with daily re-balancing, if you so choose, for a flat monthly rate that costs the same as a take-out pizza.

Technology has come a long way in reducing the complexities of investing to a simple point and click interface. You can now build your own custom, dynamic, small-cap hedge fund with market-timing rules for less than buying a traditional under-performing mutual fund.

Back-Testing the Sub-$15 Small-Cap System

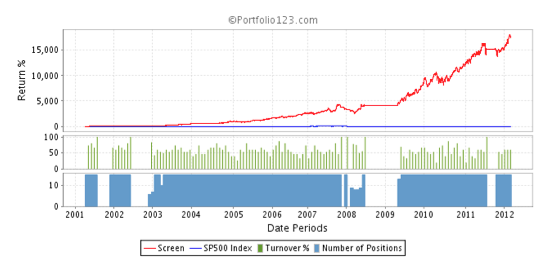

The sub-$15 small-cap system targets liquid stocks on major exchanges that are of high quality with decent price performance. It includes market timing and monthly rebalancing of an optimum 15 stocks. How well has this strategy performed historically?

This back-tested strategy generates a theoretical return of 17,656% in 11 years while the broad market has risen 21% during the same time frame. This translates into a compound annual growth rate of over 60%.

What sorts of stocks are singled out for purchase? Last month (February to March 2012) the strategy picked up 15 companies that included ChipMOs (IMOS) with a 60% profit, Heska Corporation (HSKA) with a 31% gain, CYANOTECH CORP (CYAN) with a 27% rise and ClickSoftware Technologies (CKSW) with a 24% jump. The biggest loser was Richmont Mines Inc. (RIC) with a loss of less than 22.56%. The 4 week return for the model was 7.81% which beat the market by 5.48%.

The New Small-Cap Investor

Sophisticated screening software, discount basket trading, and clever strategy are tools of the new small-cap investor. Instead of looking at small-cap stocks as a long-term speculation where you hope to find the next Facebook, consider buying baskets of small quality firms with methodical rebalancing when the market is not in a downtrend. The rules are slowly changing in the markets where strategy is trumping story and the excess gains of small-cap stocks are on the table for the taking.