Foresight Autonomous (NASDAQ:FRSX)’s Q118 results reveal an R&D-heavy start to the year, leading to an increase in cash burn to $5.1m (Q117: $1.9m). The group ended the quarter with $16.7m cash reserves after outlays of $2.6m on operations, a $2.2m cash injection into Rail Vision (RV) and $160k in capex. Management has reported “tremendous enthusiasm” for its quad-camera systems from the US, Europe and Asia following CES 2018 in January. It has also successfully concluded a multi-user trial of mobile phone-based road safety technology, EyeNet. Our DCF valuation has risen NIS0.07 to NIS5.06 as a result of US dollar strength.

R&D spend pushes up Q1 spend: RV stake revalued

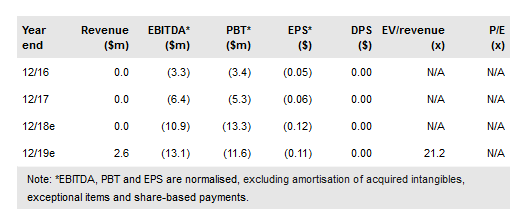

Operating cash flow and normalised EBITDA ($2.8m) in the quarter rose to reach 25% and 26% of our full-year forecasts. This means the group will need to focus on spending at current levels if cash reserves are to last into Q319. First quarter expenses were boosted by a 46% q-o-q increase in R&D costs to $2.1m, which reflected a high level of new hires and subcontractor use. With less rapid growth in M&S and G&A outlays, normalized EBITDA loss increased 25% q-o-q to $2.8m. Equity losses at RV trebled y-o-y to $0.6m in the quarter. In addition to investing $2.2m in RV via warrant conversions, Foresight revalued the group’s stake and warrant holdings in RV by $6.8m during the quarter. We have incorporated this into our model, without any impact on our underlying forecasts.

To read the entire report Please click on the pdf File Below: