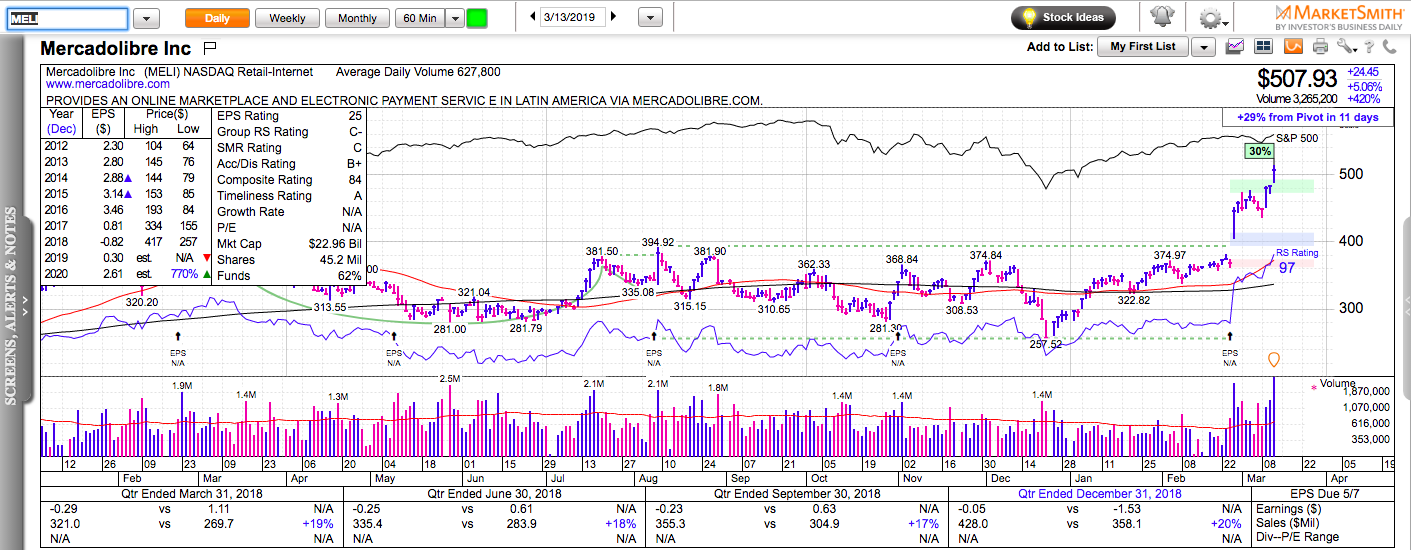

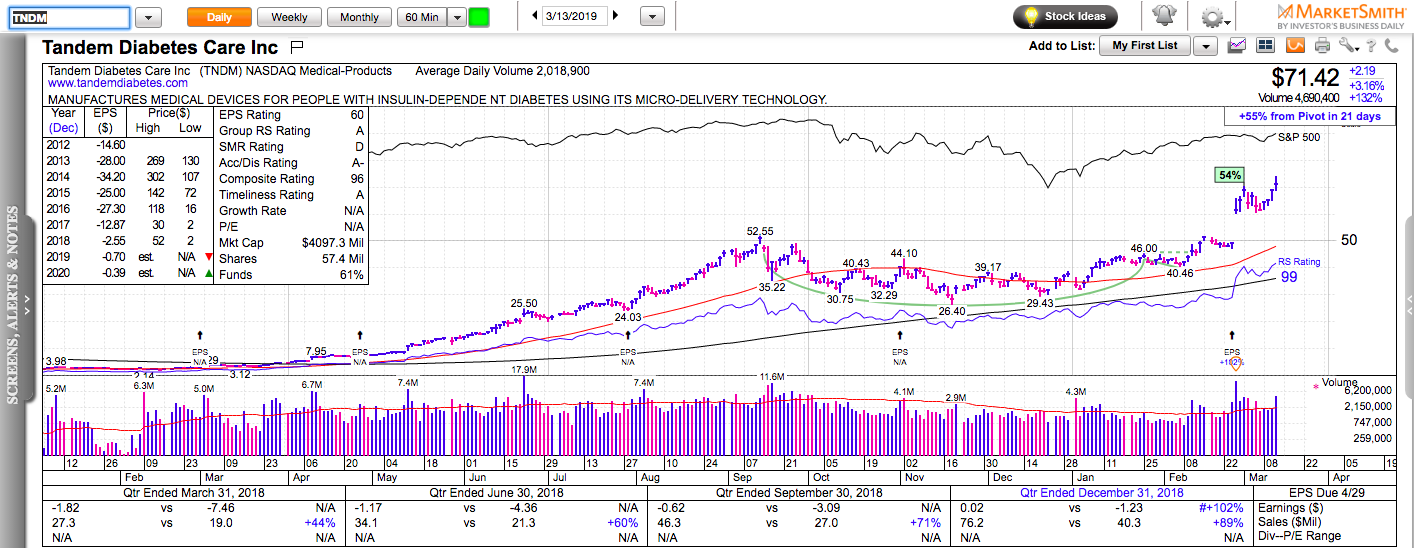

Stocks that receive favorable market reaction after reporting big earnings surprises tend to keep going higher in strong bull markets. Some recent examples include MELI, IONS, ZS, and TNDM.

MercadoLibre Inc (MELI)

Tandem Diabetes Care Inc (TNDM)

A favorable market reaction is a high-volume range expansion to new 50-day high – a gain of at least 5% on at least 2x the average daily volume.

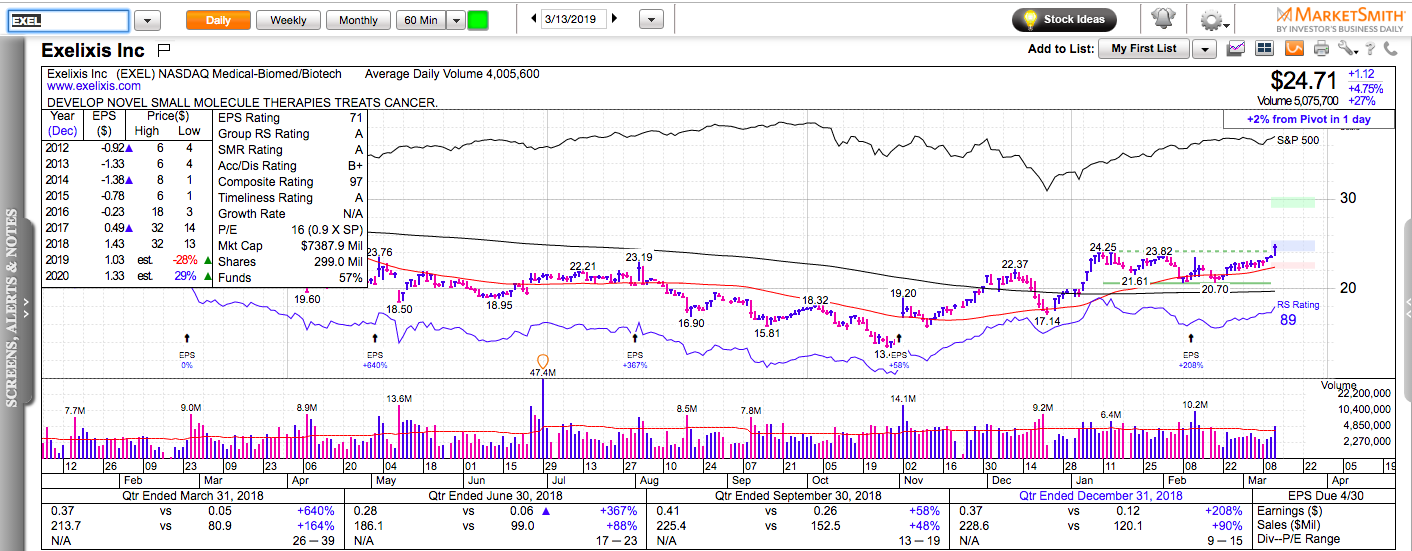

Here are some stocks that went up immediately after their earnings report after beating estimates by a wide margin that might be setting up for another leg higher:

Exelixis Inc (EXEL)

EXEL broke out from an eight-week base.

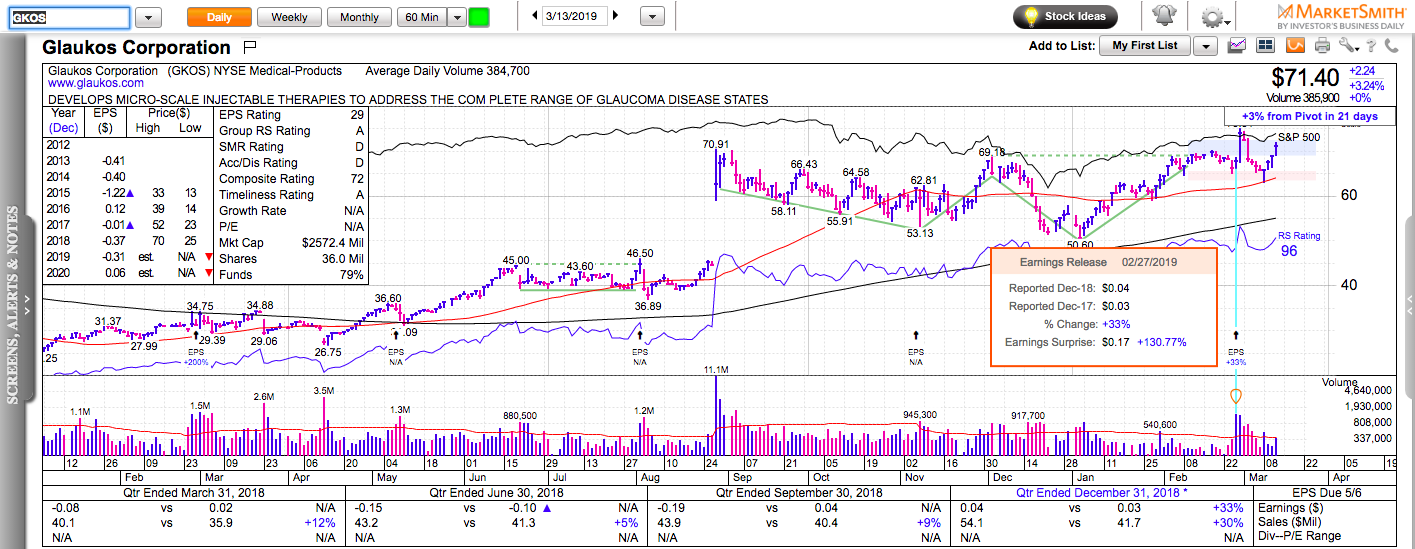

Glaukos Corp (GKOS)

GKOS pulled back all the way to its 50-day moving average where it bounced and now it is setting up again for a potential breakout.

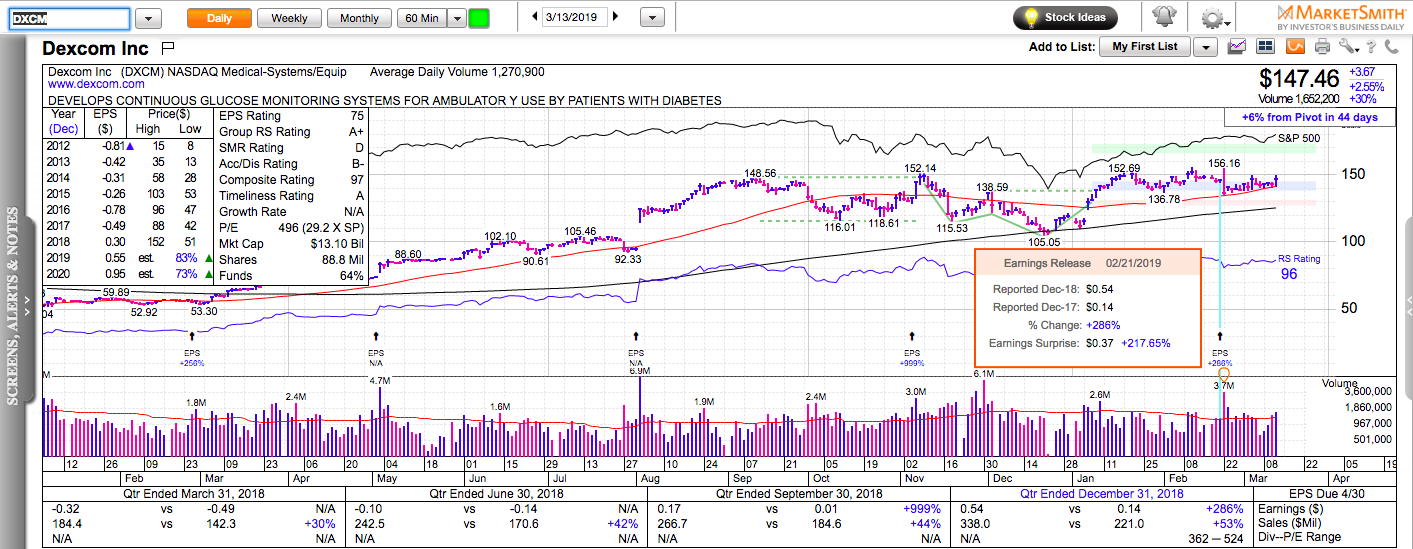

DexCom Inc (DXCM)

DXCM didn’t gap up after their big earnings surprise but managed to consolidate in a tight range near its all-time highs and it is now setting up for a potential breakout.