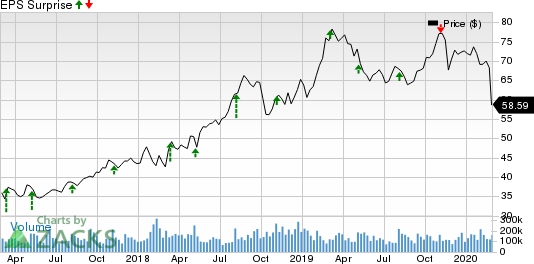

Inter Parfums, Inc. (NASDAQ:IPAR) is scheduled to release fourth-quarter 2019 results on March 2, 2019. The company has trailing four-quarter positive earnings surprise of 10.8%, on average.

The Zacks Consensus Estimate for fourth-quarter 2019 earnings has been stable in the past 30 days at 26 cents per share, which is in line with the year-ago quarter’s reported figure. For 2019, the Zacks Consensus Estimate for earnings is pegged at $1.90 per share that suggests an increase of 11.1% from prior-year period’s reported figure.

Key Factors

Recently, Inter Parfums revealed sales numbers for the fourth quarter and 2019. Sales in 2019 amounted to $713.5 million, up 5.6% (up 7.8% at constant currency or cc) from $675.6 million reported in 2018. Fourth-quarter net sales amounted to $177.8 million, up 0.3% on a year-over-year basis. At cc, net sales inched up 1.5%.

The company has been gaining from robust U.S. -based product sales and gains from popular brands. In U.S. based operations, net sales increased 14.7% to $48.7 million in the fourth quarter. In this category, sturdy performance by GUESS? as well as product launches in Abercrombie & Fitch and Hollister brands is likely to have made a positive impact.

However, net sales in European-based operations amounted to $129.1 million in the fourth quarter, down 4.2% year on year. Softness in Coach and Jimmy Choo brands stemming from unfavorable currency rates is likely to have had a negative impact on the category’s performance in the quarter under review.

Further, rising SG&A expenses, stemming from augmented advertising and promotional activities, is a concern. The company anticipates earnings per share of roughly $1.90 in 2019.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Inter Parfums this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Inter Parfums carries a Zacks Rank #3, it has an Earnings ESP of 0.00%.

Stocks With Favorable Combinations

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Costco Wholesale (NASDAQ:COST) presently has an Earnings ESP of +0.20% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Casey's General Stores (NASDAQ:CASY) has an Earnings ESP of +3.45% and a Zacks Rank #3.

Target Corporation (NYSE:TGT) has an Earnings ESP of +0.78% and a Zacks Rank #3.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Target Corporation (TGT): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Casey's General Stores, Inc. (CASY): Free Stock Analysis Report

Original post

Zacks Investment Research