Citrix Systems, Inc. (NASDAQ:CTXS) is slated to report fourth-quarter 2019 results on Jan 22.

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $1.66 per share, unchanged in the past 30 days. The bottom line indicates a decline of 0.6% from the year-ago quarter’s reported figure.

The Zacks Consensus Estimate for quarterly sales is pegged at nearly $802 million, which is in line with the prior-year quarter’s figure.

Notably, the company has four-quarter positive earnings surprise of 6.8%, on average.

Citrix had reported third-quarter 2019 non-GAAP earnings of $1.52 per share, which beat the Zacks Consensus Estimate by 22.6%. Moreover, the figure improved 8.6% from the year ago-quarter’s tally.

Revenues of $732.9 million surpassed the Zacks Consensus Estimate by 2.6%. However, the figure was flat compared with the year-ago quarter’s tally.

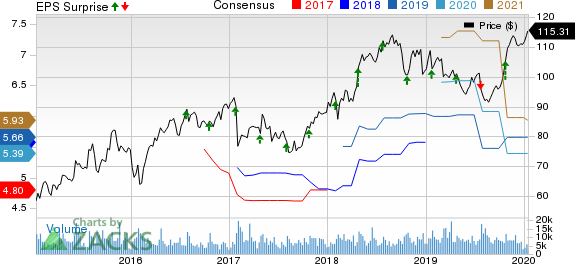

Citrix Systems, Inc. Price, Consensus and EPS Surprise

Factors Likely to Impact in Q4

Citrix’s fourth-quarter performance is expected to have gained from robust adoption of subscription-based services. Transition of services to the cloud has been a fueling factor for subscription revenues. Notably, SaaS revenues form the most significant part of subscription transition.

Moreover, traction witnessed by ShareFile and solid adoption of hybrid cloud offerings are likely to have contributed to fourth-quarter performance. The company has extended the application of ShareFile workflows and connectors to Google (NASDAQ:GOOGL) Drive and G-Suite, as part of its ongoing alliance with Google.

Further, Citrix has left no stone unturned to capitalize on increasing popularity of enterprise workspace productivity solutions. The ongoing workspace trends of Bring Your Own Devices (BYOD) and increasing number of mobile workers is expected to have strengthened its desktop virtualization solutions in the to-be-reported quarter.

Apart from these, the company’s strategic alliances with Oracle (NYSE:ORCL), Microsoft (NASDAQ:MSFT) and Nutanix for deploying cloud-based services have been expanding clientele. This along with synergies from buyouts and addition of innovative capabilities are likely to have driven the company’s fourth-quarter performance.

However, the company has been facing sluggish demand in its hardware-based appliances business. Also, increasing investments on portfolio expansion, product enhancements and strategic acquisitions are anticipated to have been headwinds for the company

These downsides along with adverse impacts from currency rates are likely to get reflected in the to-be-reported quarter's results.

What Our Model Says

Our proven model doesn’t conclusively predict an earnings beat for Citrix this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Citrix has a Zacks Rank #3 and an Earnings ESP of 0.00.

Stocks to Consider

Here are some stocks you may consider as our proven model shows that these have the right mix of elements to beat estimates this time:

Apple (NASDAQ:AAPL) has an Earnings ESP of +4.08% and a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Adobe Systems (NASDAQ:ADBE) has an Earnings ESP of +1.08% and a Zacks Rank of 2.

WESCO International (NYSE:WCC) has an Earnings ESP of +2.96% and a Zacks Rank of 3.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Apple Inc. (AAPL): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Citrix Systems, Inc. (CTXS): Free Stock Analysis Report

WESCO International, Inc. (WCC): Free Stock Analysis Report

Original post