Bristol-Myers Squibb Company (NYSE:BMY) is scheduled to report third-quarter 2019 results on Oct 31, before market open.

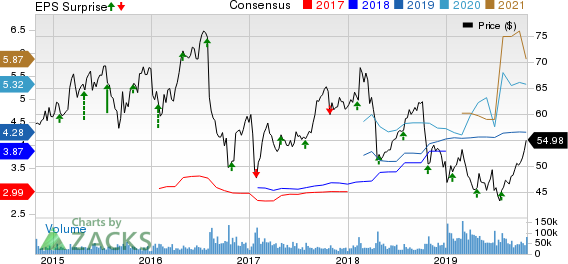

The company’s shares have gained 5.8% in the year so far compared with the industry’s growth of 0.9%.

Bristol-Myers delivered average positive earnings surprise of 10.65% in the trailing four quarters. In the last reported quarter, the company delivered a positive surprise of 11.32%.

Let’s see how things are shaping up for this quarter.

Why a Likely Positive Surprise?

Our proven model predicts an earnings beat for Bristol-Myers this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP for Bristol-Myers is +0.38%.

Zacks Rank: It currently carries a Zacks Rank #3.

Factors Driving Growth

Bristol-Myers’ key immuno-oncology drug, Opdivo, is likely to have maintained its stellar performance in the to-be-reported quarter. The drug, which is approved for multiple indications, generated sales of $1.8 billion in the second quarter, increasing 12% year over year. The momentum is likely to have continued in the third quarter owing to demand resulting from the rapid commercial acceptance of the drug for several indications, including melanoma, renal cell carcinoma, hepatocellular carcinoma and second-line non-small-cell lung cancer (NSCLC).

Blood thinner drug, Eliquis, witnessed strong growth in the second quarter and was the top revenue generator, a trend that most likely continued in the third quarter propelled by market share increases.

Oncology drug, Sprycel, is also likely to have maintained momentum. Further, Orencia and Yervoy might have continued with their stellar performance in the third quarter.

However, the virology business has most likely declined in the third quarter.

Apart from the top and bottom-line numbers, investors will focus on pipeline updates on label expansion of drugs. In August, the European Commission (EC) approved Empliciti plus pomalidomide and low-dose dexamethasone (EPd) for the treatment of adult patients with relapsed and refractory multiple myeloma, who have received at least two prior therapies, including lenalidomide and a proteasome inhibitor (PI), and have demonstrated disease progression on the last therapy.

Earlier this month, the company announced that the pivotal, phase III study — CheckMate-9LA — evaluating a combination regimen of its PD-1 inhibitor, Opdivo, and Yervoy in first-line advanced NSCLC met its primary endpoint of superior overall survival at a prespecified interim analysis. Investors will look forward to more updates on this as the combination regimen targets the lucrative first-line lung cancer indication.

Key Anticipated Updates

Investors will also focus on further updates on the company’s impending acquisition of Celgene Corp (NASDAQ:CELG) . In August, Celgene inked an agreement with Amgen (NASDAQ:AMGN), whereby the latter would acquire the global rights to Otezla for $13.4 billion in cash. The decision to divest Otezla was taken in connection with the ongoing regulatory approval process for Bristol-Myers’ pending merger with Celgene. The EC has granted unconditional approval to this acquisition. The transaction is currently expected to close by the end of 2019 or the beginning of 2020.

Other Stocks to Consider

Here are some other stocks you may want to consider, as our model shows that these too have the right combination of elements to post an earnings beat this quarter.

GlaxoSmithKline plc (NYSE:GSK) has an Earnings ESP of +3.03% and a Zacks Rank #2. It is scheduled to release earnings on Oct 30. You can see the complete list of today’s Zacks #1 Rank stocks here.

Merck & Co (NYSE:MRK) currently carries a Zacks Rank #3 and an Earnings ESP of +0.16%. It is scheduled to release earnings on Oct 29.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

GlaxoSmithKline plc (GSK): Free Stock Analysis Report

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Original post

Zacks Investment Research