Helen of Troy Limited (NASDAQ:HELE) is slated to release third-quarter fiscal 2019 results on Jan 8. This consumer products player has delivered positive earnings surprise for 13 straight quarters. Let’s take a look at the factors that are likely to impact the company’s performance this time.

Focus on Leadership Brands Bodes Well

Helen of Troy focuses on making investments in the “Leadership Brands,” which is essentially a portfolio of market leading brands. Some of the renowned brands in this portfolio including; OXO, Honeywell (NYSE:HON), Braun, Hydro Flask, Vicks and Hot Tools, are set to enhance the company’s market share and revenues. Moreover, this category is among the company’s highest margin providing, volume generating and efficient businesses. Constant investments in these brands are boosting results. Notably, management is on track with investments in product launches, marketing efforts and e-commerce strategies for Leadership Brands.

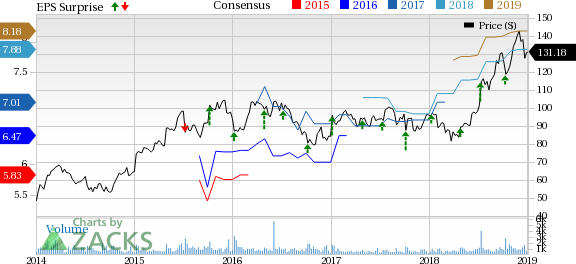

Helen of Troy Limited Price, Consensus and EPS Surprise

Digital & Other Efforts to Aid Growth

The company is likely to keep gaining from consistent online sales and digital marketing efforts. In fact, management plans to make further investments in this arena to maintain pace with evolving consumer environment.

Apart from this, the company is on track with Project Refuel, an initiative designed to improve the performance of the Beauty and Nutritional Supplements units. It also focuses on streamlining supply-chain network. Management expects Project Refuel to lead to annualized profit growth of nearly $8.0-$10.0 million, when it concludes in the first quarter of fiscal 2020.

Sluggish Beauty Unit & High Costs

While the above factors are encouraging, Helen of Troy is exposed to certain headwinds, which can’t be easily ignored. Notably, the Beauty segment has been delivering a weak performance for quite some time. This unit is suffering from softness in personal care category, primarily due to tough competition. Further, Beauty sales are projected to dip in low to mid-single digits in fiscal 2019, which is a concern and likely to weigh on the upcoming quarterly results. Further, sales in the Health & Home segment is exposed to volatility owing to the cold/cough/flu season, which usually extends from November to March.

Apart from this, management expects commodity inflation and impacts of tariff changes to weigh on Helen of Troy’s cost of goods sold in fiscal 2019. This also raises concerns regarding the company’s bottom-line performance in the quarter to be reported.

We note that the Zacks Consensus Estimate for earnings for the impending quarter is currently pegged at $2.40, reflecting 4.8% decline from the year-ago quarter’s tally. Further, the consensus mark for third-quarter sales is pegged at $420.2 million, down nearly 7.3% from the year-ago quarter’s tally.

What Does the Zacks Model Unveils

Our proven model doesn’t show that Helen of Troy is likely to beat bottom-line estimates this quarter. For this to happen, the stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Though Helen of Troy carries a Zacks Rank #3, the company’s Earnings ESP of 0.00% makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post earnings beat:

The Procter & Gamble Company (NYSE:PG) has an Earnings ESP of +0.50% and a Zacks Rank #2.

Inter Parfums, Inc (NASDAQ:IPAR) , carrying a Zacks Rank #3, has an Earnings ESP of +1.59%.

TreeHouse Foods, Inc. (NYSE:THS) , a Zacks #3 Rank stock, has an Earnings ESP of +0.67%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Helen of Troy Limited (HELE): Free Stock Analysis Report

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

TreeHouse Foods, Inc. (THS): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Original post

Zacks Investment Research