Expedia, Inc. (EXPE) is an online travel company. The Company makes available, on a stand-alone and package basis, travel products and services provided by numerous airlines, lodging properties, car rental companies, destination service providers, cruise lines and other travel product and service companies.

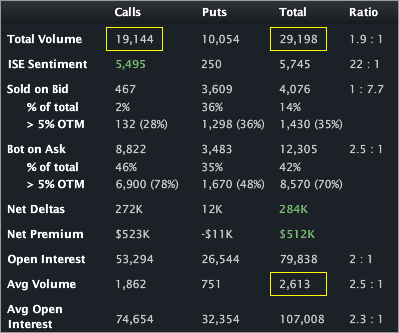

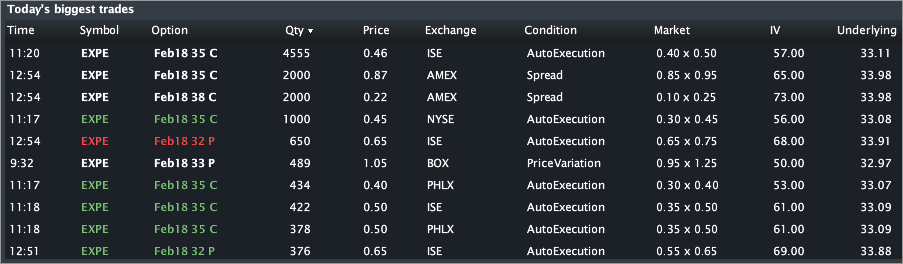

The company has earnings due out today, AMC. This is an order flow note ahead of that call. The company has traded over 29,000 contracts on total daily average option volume of just 2,613. Calls have traded on a 1.9:1 ratio to puts. The action has been in the Feb 35 calls where over 12,800 have traded. The Stats Tab and Day's biggest trades snapshots are included (below).

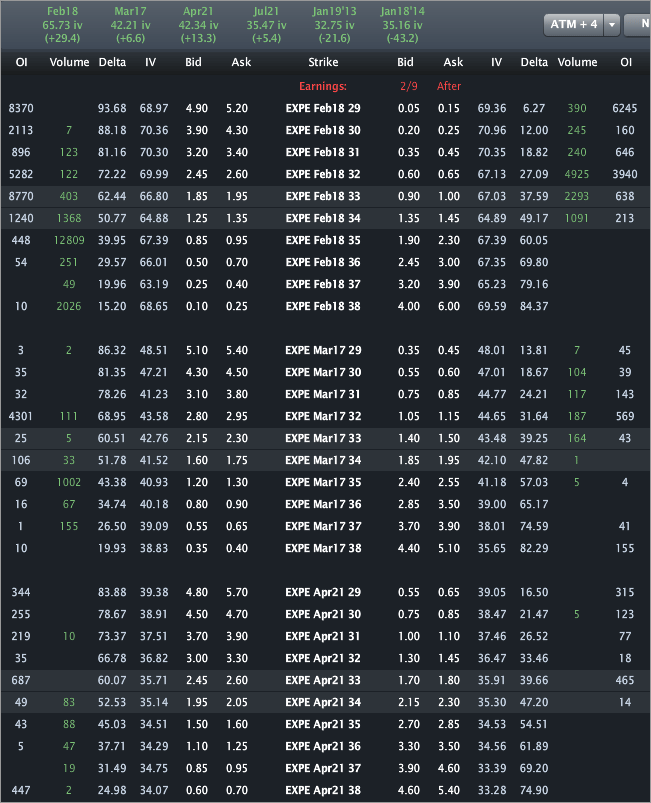

The Options Tab (below) illustrates that the Feb 35 calls are mostly opening (compare OI to trade size). The flow looks like mostly buyers, but there is a touch of ambiguity for sure. On a side note, look at the Feb 38 calls -- over 2,00 have traded and they all look like purchases. It is important to recognize that stock has already surpassed the daily average, so a bunch of these options might be going up tied to stock (so the delta is potentially muted or reversed... maybe).

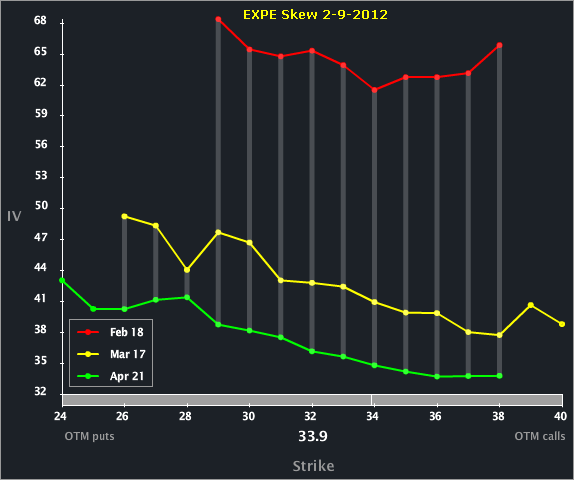

The Skew Tab snap (below) illustrates the vols by strike by month.

We can see the front is elevated to the back -- but that's normal and expected. The Feb options essentially represent the volatility of the earnings reaction as they expire in less than seven trading days.

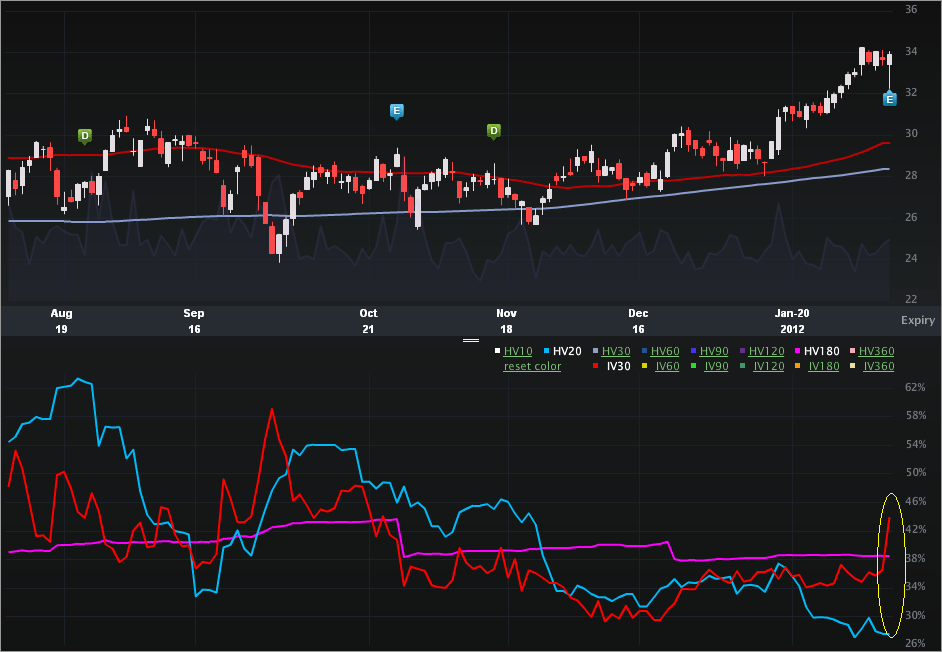

Finally, the Charts Tab (six months) is below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see the upward price evolution of late -- EXPE was in the high 20's a month ago and is now up more than 18% from those levels. It is a bit weird that the vol has reacted so abruptly today. Usually there's an orderly upward trend as earnings approach, but instead we see a ~20% pop right in front of the news.

It'll be interesting to see the results as the order flow reflects premium buyers (bets that the stock will move) and it feels like bullish order flow -- at least in part.

This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Expedia: Earnings Today; Order Flow Bets on a Move -- Possibly Bullish

Published 02/09/2012, 11:18 PM

Updated 07/09/2023, 06:31 AM

Expedia: Earnings Today; Order Flow Bets on a Move -- Possibly Bullish

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.