- Germany, eurozone PMIs revised upwards

- Euro slide continues for a fifth day

- US ISM Services PMI beats forecast

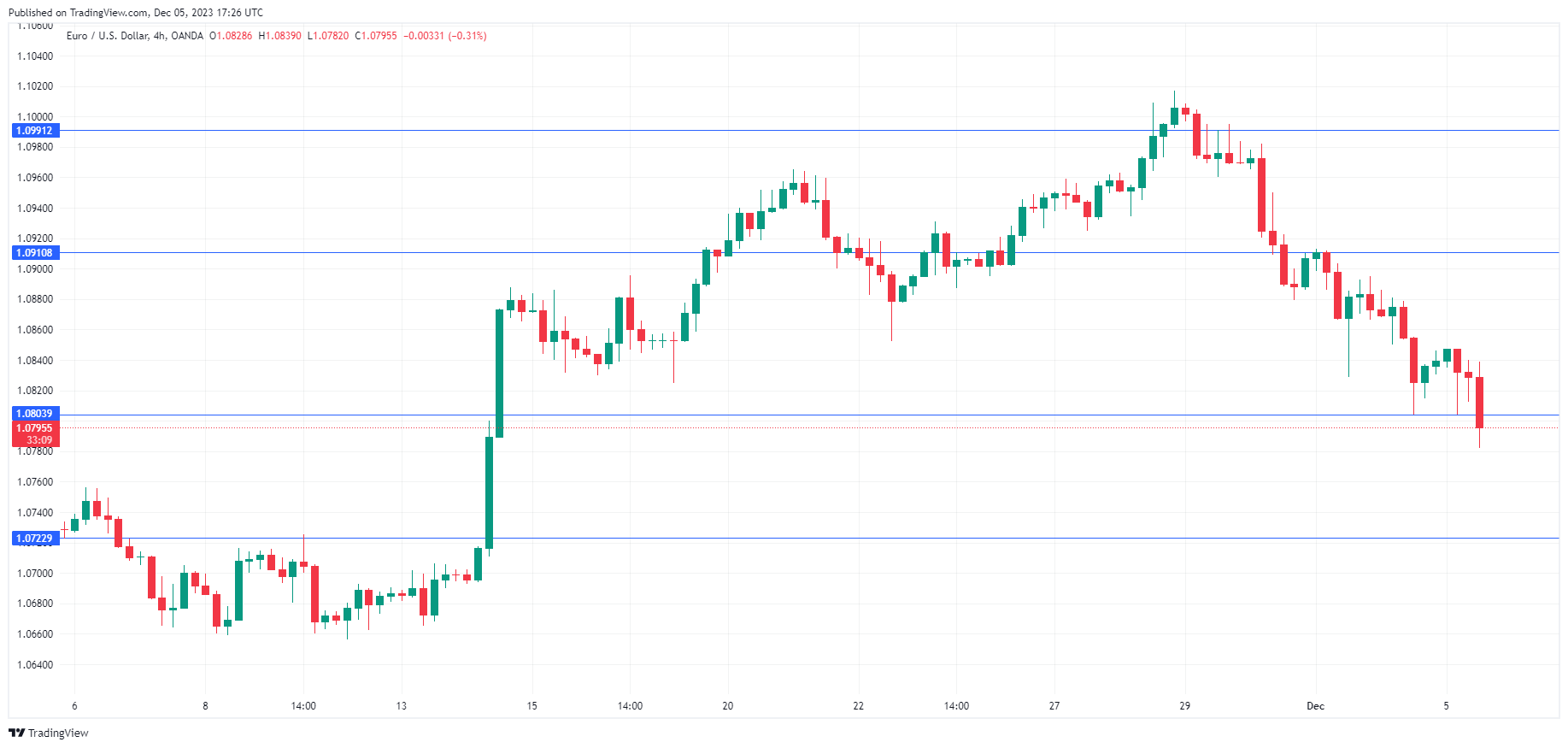

- EUR/USD is testing support at 1.0803. Below, there is support at 1.0722

- 1.0910 and 1.0991 are the next resistance lines

The euro has extended its losses on Tuesday. In the North American session, EUR/USD is trading at 1.0792, down 0.41%. The euro has fallen for a fifth straight day, declining 1.9% during that time.

Germany and eurozone services PMIs were revised upwards in November but that wasn’t enough to stem the euro’s nasty slide. The German PMI was revised sharply to 49.6, up from the preliminary reading of 48.7, following the October reading of 48.2. The eurozone services PMI was also revised higher to 48.7 in November, up from a preliminary release of 48.2 and above 47.8 in October.

The PMI acceleration is welcome news but let’s not forget that the below-50 readings for both PMIs point to contraction. The eurozone services sector has declined for four consecutive months while Germany’s has contracted in three of the past four months. The manufacturing sector is in even worse shape, and the bleak economic landscape could add pressure on the ECB to lower rates and help the economy.

The ECB hasn’t hinted that rate cuts are on the way, although the futures markets have priced in a rate cut in mid-2024, with inflation falling and the economy cooling. On Monday, ECB Vice-President Luis de Guindos said that the drop in the latest inflation report was good news but that future rate decisions would be data-dependent. ECB President Lagarde has repeatedly said that rates will stay in restrictive territory for an extended period and has warned that inflation could pick up in early 2024.

In the US, the ISM Services PMI was stronger than expected for November, climbing to 52.7. This was higher than the October reading of 51.8 and the consensus estimate of 52.0. Business activity and employment both accelerated in November. The index has remained in expansion mode (above the 50 line) for all of this year and has been a key factor behind strong US growth.