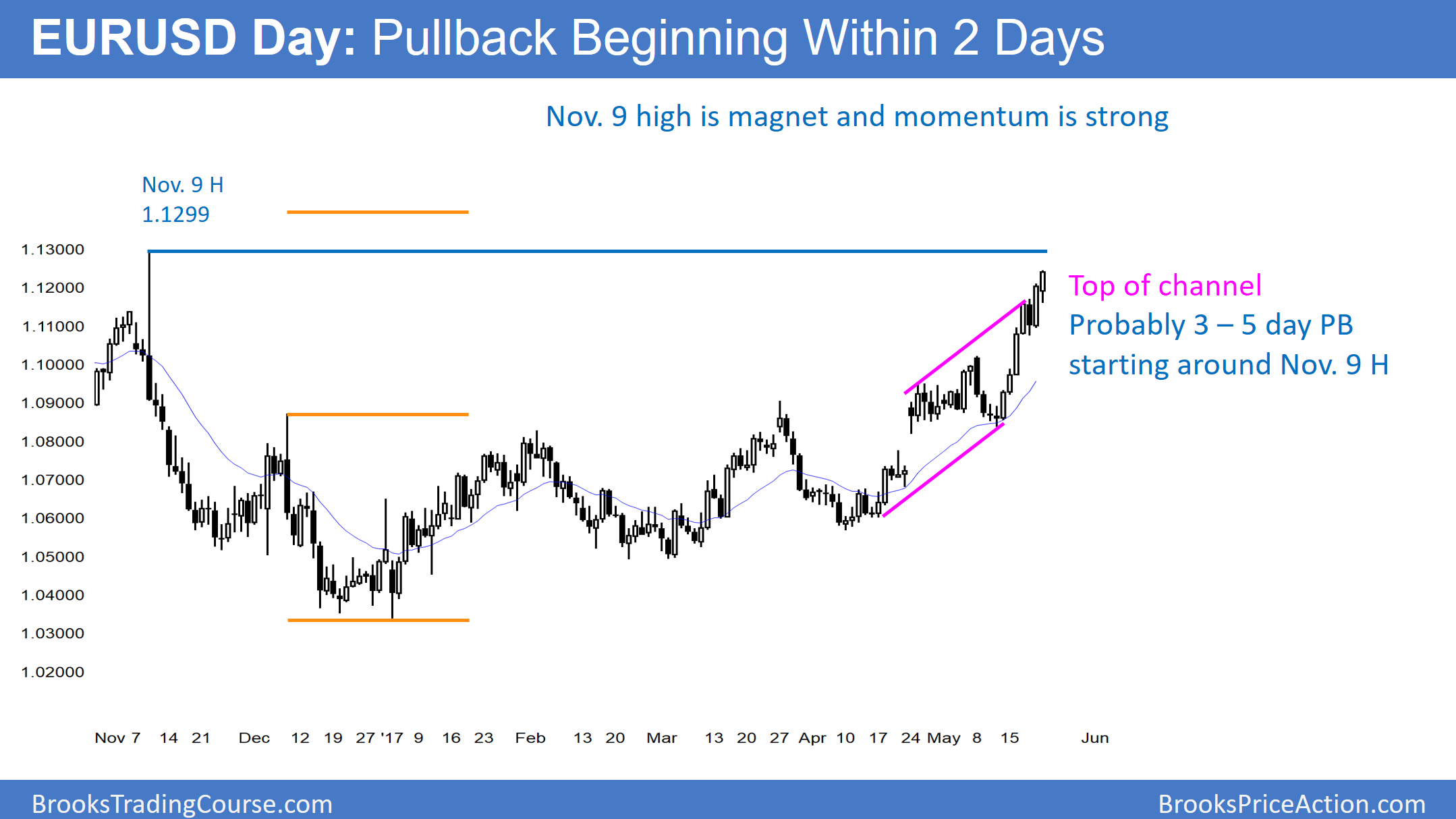

The May rally on the daily chart is within 50 pips of the November 9 top of the bear trend. Since the momentum up is strong, the odds are that the EUR/USD Forex market will closer to it, and possibly slightly above it, this week.

The momentum up on the daily EUR/USD Forex chart is strong. The November 9 high was the start of a dramatic selloff. It is therefore a magnet that is pulling the market up. Since the EUR/USD is now only 50 pips away, and that is close on the daily chart, it might pull back this week before hitting the target.

Even if the bulls break strongly above that high, the EUR/USD is still in the middle of a 2 year trading range. Therefore any strong selloff or rally is still likely to be just another leg in that range. Traders need to see a strong breakout from the range before they will conclude that there is a new trend on the weekly chart.

Likely selling around November 9 high

While it can continue up strongly above the target, it will more likely begin to hesitate. This is partly because the rally is extreme. Hence, the stop for the bulls is far below. Consequently, their risk is now getting unacceptably large. Many will therefore reduce their risk by taking partial profits. This will probably create a pullback that could last several weeks.

Furthermore, there were bulls who bought on November 9 and held through the entire 2 month selloff. They believed that as long as any selloff stayed above par (1.0000), their premise of a bottom around the 2015 low was still reasonable. Since the selloff fell below that 2015 low, many are questioning their premise. They will get out around their entry price of November 9. Consequently, some bulls will be selling here.

Finally, the strong bears want to prevent any strong rally above such an important high. As long as they can prevent that, they can argue that the EUR/USD market will form a double top with that high. They therefore will sell around that high.

Overnight EUR/USD Forex trading

The EUR/USD Forex market rallied again last night. Yet, the overnight pullback fell below Thursday’s high. Since that was a breakout point on the 240 minute chart, the pullback overlapped a breakout point. Consequently, bears are beginning to sell above prior highs and scalp. Hence, some will be selling the rally of the past 4 hours, betting there will be a pullback below the high from 11 o’clock last night.

This is also the 3rd leg up since Wednesday. The bears therefore have a wedge bull channel. Since Friday’s 2nd leg up was strong, it might have reset the count. Yet, a channel where the pullbacks overlap the breakout points is a stairs pattern. It therefore is a lessening of the momentum up. Furthermore, it usually leads to a trading range.

Trading range beginning this week?

Since there will probably be selling around the November 9 high and the 240 minute chart is now having some deeper pullbacks, the odds are that the EUR/USD market will begin to pullback from around the November 9 high.

While it is still easier for day traders to make money buying pullbacks and bull breakouts, the bears will probably begin to make money as well. In addition, the bulls will probably be quicker to take profits now that the rally is near major resistance.

The odds therefore favor a transition into a trading range within a week. Since the rally has been so extreme, the trading range could last a couple of weeks. In addition, it could be 200 pips tall. There is no sign of a top yet and there is still a strong magnet above. Yet, this week will probably bet the start of a trading range.