Increased political risks in the euro area sent EUR/USD down to the lowest level since June, 2017.

When the opponents are pulling each other into a swamp, you don’t have to do anything to win the battle. The markets have at last realized that that the problems around Brexit press down not only the UK, but the entire Eurozone as well. It increased the correlation between the pound and the euro to 0.8 and pushed the USD rate up to 16-month highs. Increased risks of Theresa May’s defeat in the government and in the Parliament, together with the expiring term, given Italy to rewrite the budget draft, suggest that the political environment in the euro area. Amid the slow growth of the currency block’s economy, it discourages the EUR/USD bulls.

It is said in the market that the euro-area weakness and the necessity of the assistance to the European banks will make the ECB not only cut down the forecasts for the key economic indices at the Governing Council’s meeting in December, but also resume the Long-Term Refinancing Operations (LTROs). The growth gap widens the spread between the U.S. and German government bonds up to 3.5%, which is quite sufficient for carry traders. Active speculating on the difference between the rates, according to Nomura, will lay a solid foundation for the further EUR/USD decline.

Dynamics of the spread between U.S. and German government bonds

Source: Bloomberg

However, the bank hopes that the Italian turmoil won’t spread over the other European countries, and a slowdown in the U.S. GDP growth will support the major currency pair. Nomura believes that is the EUR/USD pair will be consolidating in the range of 1.1-1.135, where it was trading during most of the 2015-2016 period. I believe it to be quite a realistic scenario, including the euro potential drawdown, due to the escalation between Rome and Brussels. Another matter is messy Brexit. According to NAB, the euro won’t go back in the range of 1.15-1.1875 unless the EU and the UK strike a deal that will be ratified by the UK government and the parliament. If they fail, and the pound drops to $1.2, it will suggest the euro future outlook to be rather gloomy.

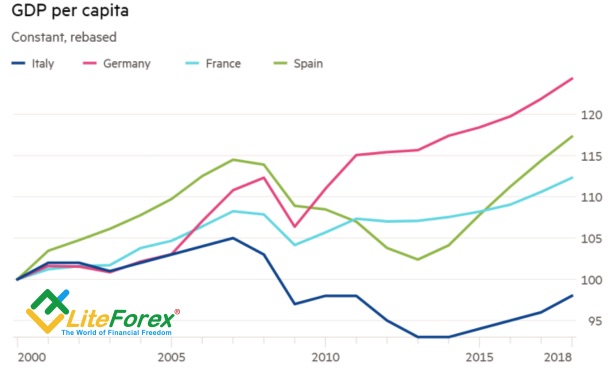

Someone may consider that the budget deficit of 2.4% of the GDP, proposed by the Italian government, is the universal recipe. Only Italy and Greece failed to restore the before the crisis economy growth pace in the euro area; besides, Italy, according to the per capita GDP, lives in the last century.

Dynamics of GDP per capita

Source: Financial Times

Alas, but Italy will hardly solve its problems by means of boosted public spending and the tax reduction. The problems are of a structural nature and result from both the local companies’ unwillingness to apply technological innovations and a low higher education level among the population. I don’t think that Italy’s economy will expand by 1.5% in 2019, as the euroskeptics announced; so the EU position looks quite reasonable. Rome and Brussels may start an open confrontation; and it makes the major currency pair more likely to be falling down to at least 1.118.