The ECB meeting, as well as the reports on the US CPI and the Euro-area PMI, will clarify the EUR/USD prospects.

If anyone has been still puzzled over what is more important for the market, the U.S. president’s comments or the Fed monetary policy stance, their headache should end in the mid-December. Investors ignored new Donald Trump’s attacks on the Fed policy; and the U.S. strong producer price index pushed the dollar up. Jerome Powell was right saying that the Fed further policy would depend on the incoming data. Strong PPI reassured the markets that the Fed will go on normalizing its policy in 2019.

The U.S. president is restless continuing his criticism of the Fed. According to him, it is not wise to raise the interest rate in December, and the Fed chairman, though he is a good man, is being aggressive. Too aggressive. The U.S. president have repeated this phrase three times, clearly suggesting that the Fed should take a pause in tightening its monetary policy. The markets showed no reaction to his passionate speech.

The FOMC members are not foolish. Yes, they can only assume what the neutral level is, so will be acting very cautiously. According to the incoming data. In this regard, the increase in the core producer price index up to 0.3% MoM and to 2.7% YoY is a strong argument for more rate hikes. Strong statistics increased the probability of one federal funds rate increase in 2019 to 57%, from 49%, pushed the U.S. Treasury yield up and pressed the EUR/USD down to figure 13 base.

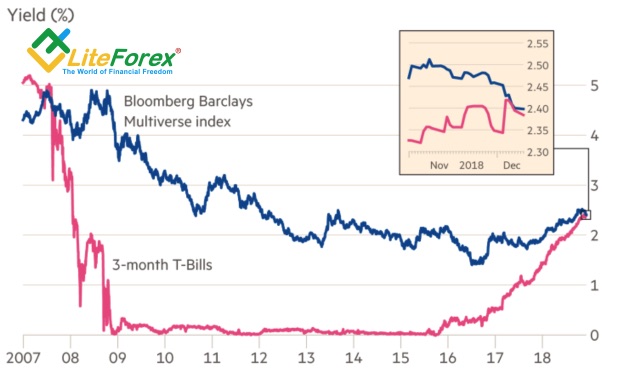

Furthermore, many investors prefer to stay aside amid the start of U.S.-China negotiations, ahead the ECB meeting and reports on on the important data, concerning the U.S. inflation rate and the euro-area PMI. It is remarkable that the yield on 3-month Treasury Bills has exceeded $52-trillion global debt market for the first time since global financial crisis. It suggests that the strategy of cashing out a growing more popular.

Dynamics of yield on short-term Treasury bills and global debt market

Source: Financial Times.

Euro should be supported if the ECB retains its confidence in the euro-area prosperous future. However, if Mario Draghi and his colleagues decide to extend QE or speak about LTRO, it will be a real disaster for the EUR/USD bulls. Their positions will also be shaken by the European weak PMI in December or the growth of the U.S. core inflation rate in November up to 2.3 YoY or higher. In fact, there are back the times when all important decisions depend on the incoming data. And it is about not only the central banks, but about investors as well.

With this respect, it is clear why the market ignores the information about the U.S.-China trade talks, and the resumed unrest in Catalonia. The local authorities announced their inability to manage the demonstrations by means of regional policy forces and asked assistance form Madrid. Euroskeptics are at work, making the EUR/USD bulls worry. The pair still tends to consolidation in the range of 1.1265-1.1445 ahead the important events.