STOCKS:

The European debt contagion remains front and center. Spanish and Italian short-and-long term bond yields have moderated recently given the ECB looks to step in to buy’em. This shall support stocks in the short-term, but won’t solve the overriding debt and fiscal problems...kicking the can down the road so to speak. So enjoy it while it lasts; after the euphoria will come the days of reckoning. How long? Good question.

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1215; which delineates bull/bear markets. However, the 200-dma support level at 1334 remains the bulls “Maginot Line,” while overhead resistance at 1340-to-1360 was extended above and now becomes support. This, coupled with the recent S&P 500 bullish weekly key reversal higher has suggested the 1450-to-1500 zone would be tested; but gosh darn it...this rally is one of the “weirdest” we’ve seen, and this obviously causes us some degree of trepidation. Melt-up or melt-down?

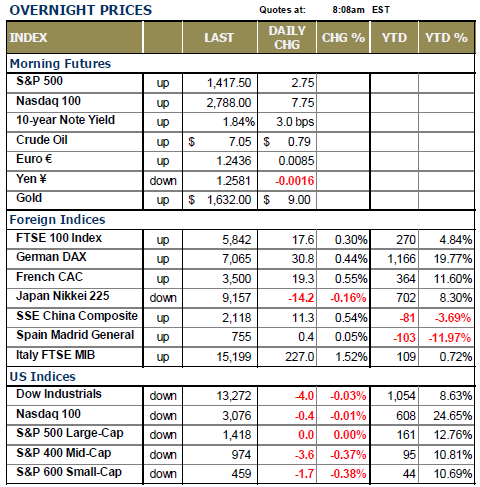

EUROPEAN SHARE MARKETS ARE HIGHER THIS MORNING as borrowing costs in Spain and Italy continue to move lower after the comments several weeks ago by ECB President Draghi that he will do “everything that is necessary” to save the eurozone and the euro. Today, Spain’s 10-year yield is at 6.22%, while Italy’s stands at 5.70%; and while these remain elevated – they are far off their highs.

The “Draghi Put” is in place; and we see the German DAX moving higher as a result. We still find it more than a passing interest that the DAX is higher by nearly +20% on the year, while Italy is higher by nearly +1%. If there was to be a surprise this year, then it would be that Germany – while on the doorstop of declining growth…would show such a larger gain for the year. Italy can be lumped into this category as well, for while it will need a bailout…her stock market is higher. We stand scratching our heads really.

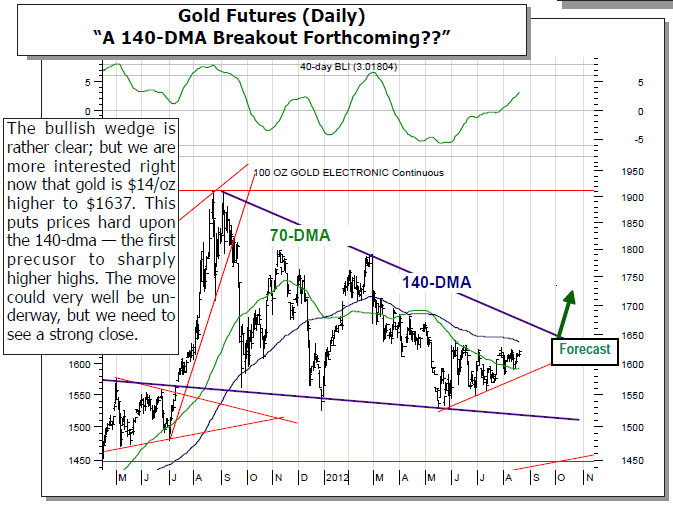

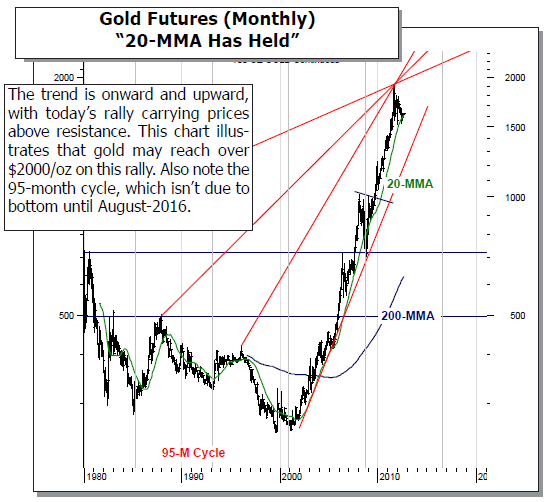

We should note this morning that gold prices are once again rising sharply, and indeed they are $14/oz higher to $1637. This is important, for this level is major resistance, with a breakout above it for three days running would suggest that gold prices are headed to above the $2000/oz. We’ve included both daily and monthly charts, and indeed the technicals support just such a move. And, it could be rather breathtaking as all tops in the commodity markets are made in “violence” as the last one throws in the towel – and garnering the all-time high tick. This is some while off, but get in your comfy chair, grab the popcorn – and watch the fireworks. For now, we are long NEM and GG.

We’ll look at adding silver via the 2x long ETF (AGQ) soon.

THE AUGUST DOLDRUMS ARE ONCE AGAIN UPON US as the major bourses around the world are moving in very narrow ranges this morning. And, there is no rhyme of reason for the movements we see; although there are a number of press reports out regarding the ECB bond purchases. One note states that the ECB will use a “target rate” on European bounds to become a buyer – ostensibly somewhere in the 5.0% range we would think if indeed this were going to be the case.

Anything higher would simply just be too much to bear. Too, we find Merkel warming to the ECB plan to do so; while her Bundestag remains opposed to the idea of buying bonds on the secondary market. In other words, there is confusion coming out of Europe this morning…and it is breeding contempt.

And it is from just such contempt that we are likely to see volumes dry up even further in the US from last week’s slow option expiration week volume figures. What we will make out of this the rally is predicated first and foremost on a withdrawal of selling pressure; and it is not a demand led rally that we all consider necessary for a rally to be “strong and impressive.” We’ll state this rally is impressive in its ability to climb the “wall or worry,” but we remain concerned about the internals and a host of other technical indicators. Finally, it’s important in our mind that our models models are now at overbought levels – urging caution, for if they turn lower – then the probabilities will have changed from that of a rally to that of a decline.

To Read the Entire Report Please Click on the pdf File Below.