The fun and games of a Eurogroup meeting in Dublin today looks set to dominate markets today, with Portugal, Cyprus and Slovenia on the agenda. A delay in the payment schedule of up to 7 years for Portugal’s existing payment plan is set to be discussed. However, typically, the Germans are not particularly happy with this development. It is also more than likely that we will see Portugal need to take another bailout before 2014 given the expected funding difficulties that Portugal will be battling with. We have to remember of course that 20% of the most recent bailout plan was deemed as unconstitutional by the country’s highest court.

We should also see a sign-off of the latest plan to bailout the Cypriot economy which, seemingly overnight, has increased from EUR17bn to EUR23bn. The main issue around this, however, is that Cyprus will have to find the additional EUR6bn itself – with bank depositors once again the likely target.

Funds will also be raised by Cyprus selling its USD400mio of gold reserves while also imposing losses on Bank of Cyprus bondholders. It has been clear since the beginning of the issues around Cyprus that the medicine is more of a penalty than a cure for the economy.

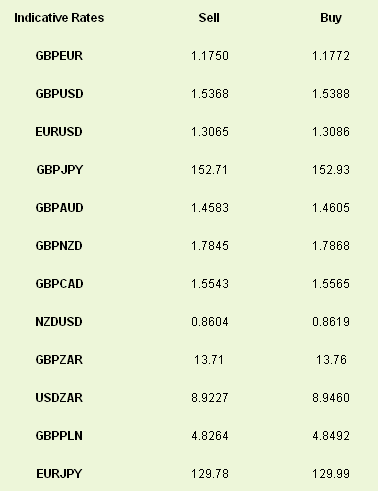

Despite all this euro hit a 7 week high against the USD during yesterday’s session with particular solace found in an Italian bond auction. Peripheral bonds have been doing well in both primary and secondary markets in recent weeks, with traders eager for yield as they continue to bet on further, looser monetary policy from the world’s central banks. GBPUSD also moved to a 7 week high yesterday with price peaking at 1.5412.

Most eyes remain on USDJPY this morning, with the market taking a run at the psychologically important 100.00 level. We got within 5 pips last night before moving lower through the Asian session. This morning the Bank of Japan are apparently mulling upgrading its inflation forecast for the Japanese economy to 1.5% for 2014. This is a confidence trick more than anything. We know in the UK better than most that relationship between inflation and an inflation target is a very loose one.

Overall EZ industrial production is due later this morning and comes following a really mixed picture from those individual countries that have reported already. Italy, Spain and other peripheral nations have disappointed, unsurprisingly, while both Germany and France managed to beat market estimates. The region-wide measure is expected to see a 0.2% increase.

Across the pond, advance retail sales and consumer confidence will be able to tell us more closely whether the recent dips in US data, particularly that of the jobs market, has bled through to other parts of the economy. Pain from the payroll tax credit expiry and sequestration spending cuts will be felt in these numbers we believe and, should retail sales show contraction, further delays to the proposed cessation of asset purchases by the Federal Reserve will be priced into the USD and further losses could easily be seen.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Eurogroup Meet In Dublin To Discuss Cypriot Bailout

Published 04/12/2013, 06:21 AM

Updated 07/09/2023, 06:31 AM

Eurogroup Meet In Dublin To Discuss Cypriot Bailout

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.